“Unfortunately, fraud in ICOs remains a very real problem, so I am not surprised by the number of “dead” tokens.” This is how Daria Generalova, ICOBox co-founder, started an open comment about the figures revealed a few days ago about fraudulent ICOs. In that study, conducted by specialised sites Coinopsy and DeadCoins, they concluded that more than 1000 of this capital-raising venture were either scam or “true abandonware.”

ICOs represent the last method for entrepreneurs and start-ups to fund their companies by creating new cryptocurrency. These “tokens”, as they are called, can be sold to investors, out in the digital and worldwide, as if they were stakes of that company. For when the company is finally released, these anonymous investors would have a share or even rewards within the company.

Although ICOs have many pros – they allow entrepreneur to get crowdfunded avoiding banks and other middle-men and their excessive fees – it also carries along great risk for minor investors as they run their funding within the cryptocurrency exchanges. Highly unregulated and volatile, many new tokens listed in them haven’t passed any requirement or ethical mandate.

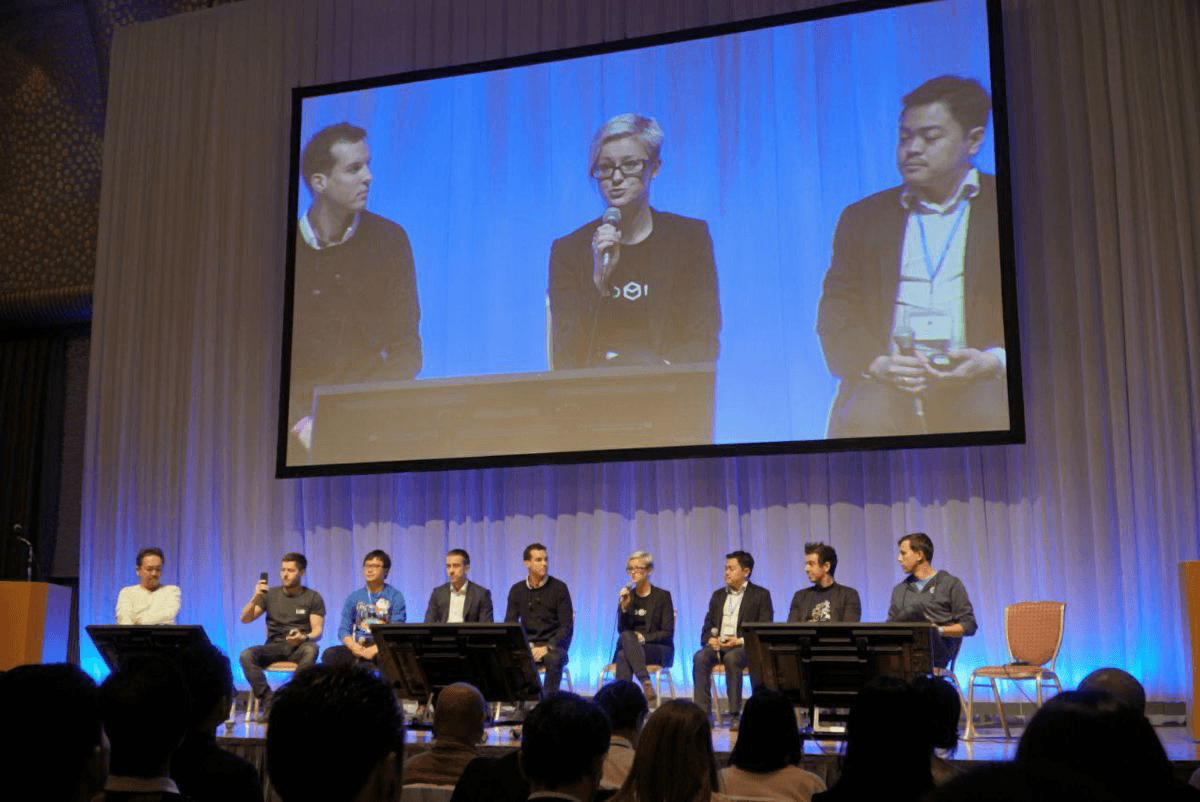

For that, companies the likes of ICOBox Box provide great resources for both authorities and potential investors as they regularly check the exchanges looking for anomalies in the sense of possible fraud.

And as of that, Daria Generalova and her team regularly examine the market together with analysts from the IBRC (ICOBox Blockchain Research Center), and have identified a number of criteria that enable us to look at any ICO and figure out whether a token is not long for this world, as she recently said in the mentioned open comment.

They put them under strict tests to find out potential scam. “First, the project stops showing up in industry media. Second, its official website and social media accounts stop being updated. Third, its community activity drops off sharply, or there’s a mass exodus of its developers and advisors that starts immediately after its ICO. Fourth, the project founders are in no hurry to release their tokens on exchanges. Fifth, the deadline for completing the next stage mentioned on its website or in the White Paper is constantly being pushed back, despite the fact that market rules state that all startups must follow their roadmap very closely and report any changes or delays through the media and or social networks,” she added.

All of these actions, separately or in combination, are capable of eroding the value of even the strongest coins. Naturally, all of this has a very negative effect on the market, scares off possible token holders, leads to litigation, market panic, and to perfectly reasonable responses on the part of governments and regulators.

Nonetheless, she thinks that those tokens that haven’t been completely honest with their investors are the real issue behind a vibrant and growing market as in many ways, [she] believes that the current outflow of funds from the cryptocurrency market and the fall in value of cryptocurrencies is largely the result of such ill-conceived, indefensible, and irresponsible actions of certain market participants.

“The only heartening thing that can be taken from this is that more market players are starting to understand this problem, to study projects and the biographies of their founders carefully before funding them, or to turn to large, established providers of SaaS solutions. The days when you could collect funds based on a white paper alone are over. Now you need to prove to everyone that you really have something special.” she ended up with.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading