Hawkish pause from the FOMC not doing much for the US dollar, although watching the long end of the yield curve in coming days. The JPY nosedived as the Fed is the latest central bank to tilt more hawkish, which pressurizes the Bank of Japan to move if it wants to avoid disorderly further yen weakness. Today’s ECB meeting and US data are in the spotlight as the Powell presser emphasized data dependency.

By John Hardy, Head of FX Strategy

FX Trading focus:

– FOMC delivers a hawkish hold, with a knee-jerk USD rally not sustaining as Powell emphasized data dependency in the press conference. A flurry of data in the US session ahead.

– ECB anticipation is low as in-line to slightly dovish guidance are more likely than a hawkish surprise, and staff economic projections are in focus.

FOMC: a hawkish hold delivers little for the USD.

The FOMC delivered no hike as most expected and a very slightly altered statement. The hawkish surprise was in the economic- and Fed funds projections in the accompanying materials. The dot plots for the Fed funds rate were adjusted 50 bps higher to 5.6% for the end of this year and 0.3% higher for next year (to 4.6%) and even for 2025 (also +0.3% to 3.4%, suggesting the Fed wants to maintain a higher-for-longer message. Supporting that adjustment were upgrades to the PCE core inflation projection for this year to 3.9% from 3.6% in March, although the 2024 and 2025 inflation projections were kept unchanged. Unemployment rate projections were revised sharply lower for this year to 4.1% and growth projections adjusted higher. Fed Chair Powell softened the hawkishness quickly in the press conference by indicating strong data-dependency (again highlighting that the data is always going to tell us what the Fed will do.) As well, he did a poor job of explaining why the Fed should pause here only to resume hiking again later this year – but data dependency does most of the explaining (at the margin, possible as well that the Fed wants to see how the market absorbs the heavy Treasury issuance incoming after the lifting of the debt ceiling.)

We do have to remember that the March economic and policy projections were in the week just after the sudden advent of the banking turmoil on March 8-9, which forced the Fed to wax a bit more cautious at the time on the possible impact of the impending credit crunch. Looking at the December SOFR future, the rate expectations from the Fed have now almost come full circle, with the market allowing the Fed’s new dot plot to price in about half a rate hike of further tightening for that meeting relative to before yesterday’s announcement and taking the rate to about that much above the current Fed Funds rate.

The most interesting development to watch from here is whether the US yield curve stops deepening its inversion as it did yesterday (2-10 spread to -91 basis points) and if stronger than expected incoming US data, if that’s what we get, begins to pressure longer US yields higher. The 10-year is perched close to the cycle highs near 3.86%. The only path to USD strength may lie via longer yields lifting more aggressively and impacting risk sentiment.

ECB: watching staff economic projections

The European Central Bank will almost certainly hike 25 bps today to take the deposit rate to 3.50%, the second hike in a row at smaller increments after the multiple 50 bp hikes. As discussed in my update yesterday, the range of outcomes from the ECB are either in-line with expectations for marginal further tightening to tilting slightly dovish and not wanting to provide forward guidance. The bar looks high for a hawkish surprise. Since the last meeting headline Eurozone CPI has cooled to 6.1% from 7.0%, and the “super-core” measure fell to 5.3% from 5.6%. Furthermore, the ECB’s Consumer Expectations survey for April saw the 1yr ahead inflation expectation declines to 4.1% from 5.0% and 3yr view fall to 2.5% from 2.9%.The growth trajectory is also worrisome with Germany and Eurozone in a technical recession, and if the ECB decides to (like Bank of Canada) remove all forward guidance, it could weigh on the euro, depending on what risk sentiment and long US treasury yields are doing. (Most negative for euro: concern on growth weighing on guidance, risk sentiment weakens as US long end comes unmoored and heads to 4.00%). Staff projections for economic growth and inflation will also affect how the market reacts to the ECB’s guidance and incoming data.

Urgency rising for Bank of Japan to signal willingness to make policy shift.

The bottom is dropping out of the Japanese yen ahead of Friday’s Bank of Japan meeting, in part as a number of central banks have adjusted their policy expectations higher recently and yields at the long end of the US yield curve are perched near the highs since the March US banking turmoil pushed them lower. At his first meeting as Bank of Japan Governor back in April, Kazuo Ueda stated that the bank would take up to eighteen months to conduct a policy review (likely wanting to incorporate one more year of wage talks next March to see if inflation will prove sustained before moving with any notable tightening). But with the most recent collapse in the Japanese yen, the market could yet force the BoJ’s hand and require that the bank make at least a few tweaks to indicate it won’t allow the JPY to absorb intensifying pressure. The market is pricing the BoJ to deliver perhaps a hike of the policy rate from –0.10% to 0.0% through its December meeting.

Chart: EURJPY

EURJPY has lurched higher post-FOMC as the JPY was lower across the board, pressurizing the Bank of Japan . Not since the very strong EUR days leading into the global financial crisis has the pair traded at this elevated a level. For any hope of a turnaround, either the economic outlook will need to deteriorate globally and punch yields back lower or the Bank of Japan is going to have to signal a willingness to shift policy notably before the end of its policy review that could theoretically last well into late 2024.Support now stiches to the 151.00-151.50 area with no ceiling for now if long global yields come unmoored and the Bank of Japan continues to sit on its hands on Friday.

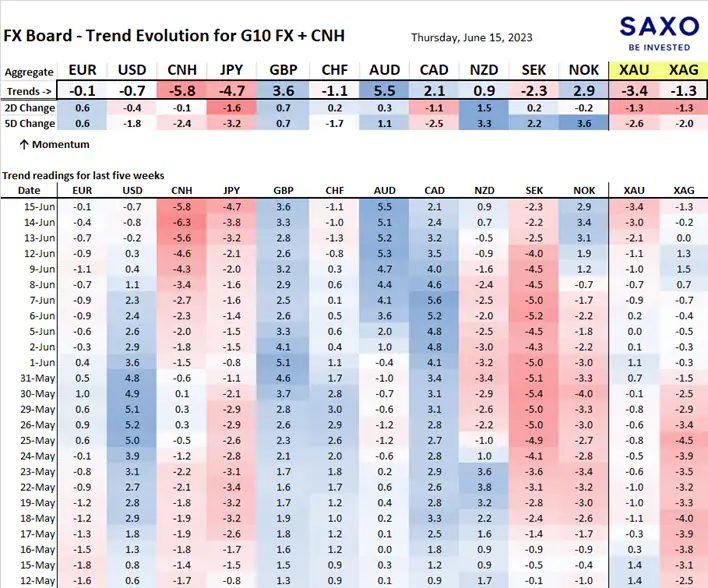

Table: FX Board of G10 and CNH trend evolution and strength.

Status on currencies should be clear on the Friday close after the ECB and BoJ have weighed in and we have a look at today’s US data. The AUD got further support on strong jobs data and key commodities are supporting as well (copper above recent resistance). Gold looks very weak – watching yields there for risk of further pressure.

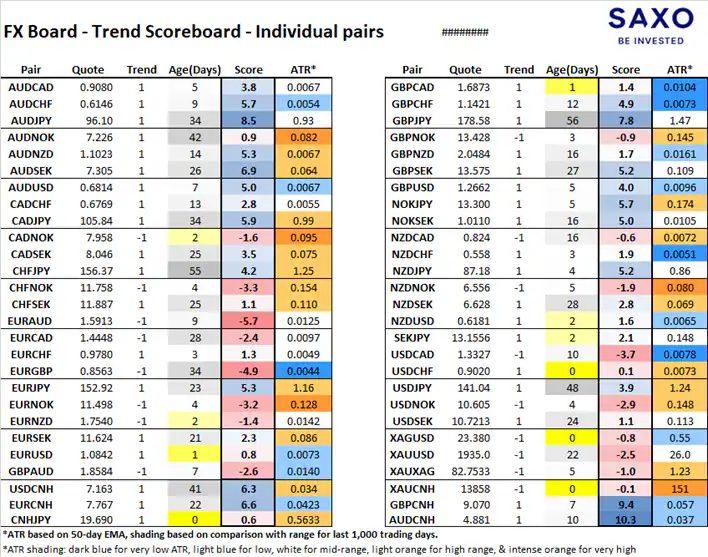

Table: FX Board Trend Scoreboard for individual pairs.

Will look at status on other side of event risks through tomorrow’s BoJ. USD pairs in many places on their back-foot again very quickly here after the FOMC even after the USD was weaker ahead of the meeting and FOMC supposedly delivered hawkishness. USDJPY the key exception, of course.

Upcoming Economic Calendar Highlights (all times GMT)

1215 – ECB Rate Decision

1215 – Canada May Housing Starts

1230 – US May Retail Sales

1230 – US Weekly Initial Jobless Claims

1230 – US Jun. Empire Manufacturing

1230 – US Jun. Philly Fed survey

1245 – ECB President Lagarde Press Conference

1315 – US May Industrial Production

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading