GBP Crashes to a Seven-year Low Against the USD, now what?

GBP Worst Day Since Banking Crisis! `Brexit’ Fears Start its Self Destructing Mode and send Pound to critical seven-year low against the dollar.

The pound fell the most since the U.K.’s 2009 banking crisis after London Mayor Boris Johnson, stated he’ll campaign for Britain to leave the European Union in a June referendum.

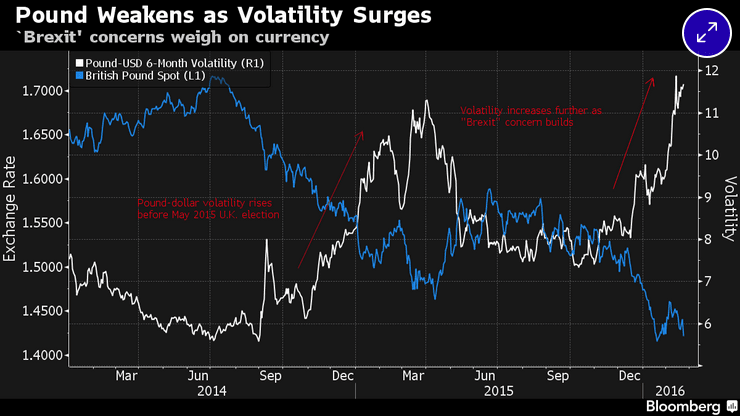

GBP has dropped to it lowest level in almost seven years against the USD, and weakened at least 1.2 percent against all its 16 major related currencies. The move shows the complexity of the “Brexit” and its potential negative impact as it reversed a gain made on Friday when Prime Minister David Cameron secured a deal on membership terms with EU leaders in Brussels.

The gauges of British pound volatility versus both the American dollar and the euro surged to the highest levels since 2011 as the endorsement of Conservative MP Johnson’s backing to the so-called ’Brexit’ pitted him against the prime minister, and expands the divisions in the Tories, the conservative party in power, who said he would fight to keep Britain in the bloc at the June 23 vote just in the follow up of the Prime Minister victory in Brussels.

In reaction to this news, Sanjiv Shah, Chief Investment Officer at Sun Global Investments, said:

“Boris Johnson’s announcement that he is going campaign on behalf of the Brexit campaign has triggered a drop in the value of the Pound against the Euro, prompting concerns that it will continue to weaken as doubt over the outcome of the referendum increases.”

“We believe that, as the debate unfolds, there could a material increase in support for Brexit, which will add further pressure to the Pound, stock and gilt prices.”

“The final result maybe close depending on how the debate progresses. At any rate, we are in for some interesting times.”

Sanjiv has over 25 years of experience in the financial services sector and previously worked for the Bank of England, FSA, Paribas Capital Markets Group and Lazard Brothers.

On the same subject most analysts and thought leader have very strong opinions and this shows how bad prepared the UK is for the eventuality of a “Brexit” scenario. Moreover how the subject of the EU is dividing the conservative party, to a scenario of civil war, and creating a situation that can break the government.

The fin-tech entrepreneur Rajesh Agrawal, Founder and CEO of RationalFX – UK’s first online FX brokering company – and Xendpay – an online money transfer company – two leading international financial services companies headquartered in London.

Rajesh is also business advisor to Sadiq Khan MP, the Labour Party’s candidate for the upcoming London Mayoral Election. Speaking about Boris’ announcement, Rajesh Agrawal said:

“In opting to support the campaign to leave the EU, Boris has clearly put his own ambitions before the national interest and that of the city he represents.”

“Leaving the EU would bring considerable risk and uncertainty for British business and would put London’s position as the world’s top-ranking financial centre at risk.”

“The free movement of goods and services across the EU and the unbridled access to 500 million potential customers it brings is crucial to the growth of businesses large and small. Outside the EU, British firms would face years of turmoil while market access and existing trade deals are re-negotiated. This will mean slower growth, less investment and fewer jobs.”

“The suggestion that British businesses will not suffer if Britain follows Boris’s path to exit is a fantastical delusion worthy of only our most eccentric politicians.”

Read More:

What is the best definition of economic data?

plataforma iphone de trading en forex

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading