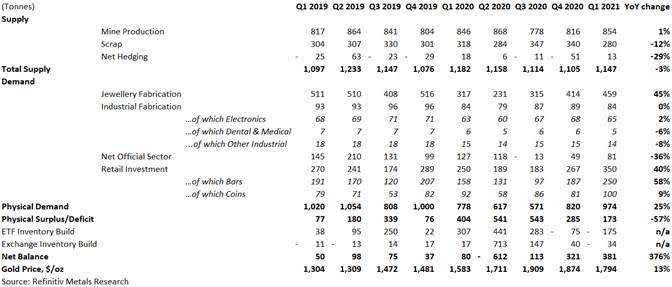

Gold ETF investors liquidated 175 tonnes in the first quarter of the year representing the largest level of net quarterly outflows since Q4 2013 according to Refinitiv Metals Research.

- Gold prices came under significant pressure since the start of the year, correcting by 13% during the first three months, and trading at near nine-month low at end-March..

- Investment demand for bars and coins jumped by 40% driven by bargain hunting and growing concerns about rising inflationary pressures and currency stability

- Sentiment shift towards gold among the professional investor community, as evidenced by strong outflows from gold ETFs.

It was also the second consecutive quarter of net outflows (with net selling of 75 tonnes being reported in Q4 2020). This compares to net inflows of over 300 tonnes seen in the first quarter of last year.

This was largely a reflection of a shift in investor sentiment towards gold since the beginning of the year, with gold being pressured by firm US dollar, rising US Treasury yields and growing enthusiasm around economic recovery amidst the ongoing rollout of vaccination programmes.

Gold Prices Have Reversed Since The Beginning of 2021

Following a spectacular performance in 2020, when we saw gold appreciate by 27%, touching a fresh all-time high in early August, the beginning of this year hasn’t been as rosy as some may have expected. With the growing optimism around economic recovery in light of the ongoing rollout of vaccination programmes and stimulus measures introduced by central banks and governments, gold came under significant pressure, correcting by 13% during the first three months of the year, and trading at near nine-month low at the end of March.

Gold averaged $1,794/oz in the first quarter, down by 4% from the previous three months, but still some 13% above the level seen over the same period of last year.

Gold Demand Has Recovered At a Low Level

Gold demand from the jewellery sector, which was the worst hit segment by the pandemic last year, rebounded by 45% in the first quarter of 2021, to a total of 459 tonnes. The recovery was largely driven by strong gains in key Asian markets, including China and India, where demand revived from the lockdown hit Q1 2020, as the economies continued to re-emerge from the pandemic, helped by the festival period and lower gold prices in many local currencies. Despite strong year-on-year growth, demand remained relatively subdued on a historic basis, and down by 10% from the Q1 2019 level. Meanwhile, demand for gold used in industrial applications was broadly flat during the first quarter, following a double-digit decline in 2020, as gains in the electronics offtake were offset by the ongoing weakness in some other areas.

Turning to retail investment, which is the sum of bars and all coins, demand is estimated to have rebounded by 40% year-on-year, to a total of 350 tonnes in the first quarter. Physical bar investment soared by 58%, to an estimated 250 tonnes, led by a resurgence of demand in Asia as the economies continued to re-emerge from lockdown, further helped by lower prices in local terms, pushing the offtake closer to pre-pandemic levels. In addition, gold bar demand remained strong in Europe, driven by ongoing concerns over the economic uncertainty, currency stability and inflationary pressures amidst massive stimulus measures adopted by central banks and national governments to pull economies out of the deep economic recession caused the pandemic. Coin demand rose by 9% during the first quarter, led by higher official coin fabrication and a rebound in Indian demand for medals & imitation coins.

Hungary Leads Net Gold Purchases In Official Sector

Official sector net gold purchases were estimated at 81 tonnes in the first quarter of the year, down by 36% year-on-year. The first three months witnessed a steep rise in gross sales, led by Turkey and the Philippines, while gross purchases declined by 11%, although a year-on-year drop was far less pronounced than in the previous three quarters. Gold purchases were led by Hungary, who added 63 tonnes to its official gold reserves in March, for the first time since October 2018, with further additions from India, Uzbekistan, and Kazakhstan.

Gold Supply Was Disrupted By Covid-19 Pandemic

Turning to supply, the impact of COVID-19 on the mining industry seems to have started dissipating, as we are past the peak of disrupted mines. It is estimated that over 140 mines had been affected by the pandemic since March 2020, in the form of either a complete suspension of their operations or a partial setback. We estimate that total gold production loss caused by the pandemic surpassed 150 tonnes. While some mines in the important producing countries such as Mexico, Peru and South Africa remain affected, global output has started to recover during the last few months. Preliminary results indicate that mine production during the first quarter of 2021 increased by around 1% year-on-year, to a total of 854 tonnes, with the largest gains being realized in Canada and Indonesia, which were partially offset by losses in Mali and the Democratic Republic of Congo. Meanwhile, preliminary results indicate that gold hedging represented a net 12.7 tonnes during the first quarter, as most Australian companies (which account for more than a half of the total hedge book) renewed or even increased their contracts, locking favourable gold prices in Australian dollars.

Scrap supply is estimated to have fallen by 12% in the first three months of the year, to a total of 280 tonnes, driven by reduced flows in Asia amidst lower gold prices in many local currencies, while a resurgence of new COVID-19 cases and the introduction of lockdown measures weighed on scrap flows in Europe.

Saida Litosh, Lead Analyst at Refinitiv Metals Research, comments:

“Looking ahead the broader macroeconomic backdrop remains favourable for gold. We believe that gold will continue to benefit from ongoing concerns around the economic uncertainty, increased debt levels, negative interest rates, and currency stability amidst unprecedented levels of stimulus measures launched by central banks and governments around the globe.

“Moreover, the ongoing battle against the virus and the risks associated with the development of new variants, vaccines production and distribution will continue to support gold investment demand this year.

“Having said that, gold could remain vulnerable to further liquidation and sideways trading in the short term, particularly should we see faster-than-expected economic recovery, further rise in US treasury yields and a stronger dollar. We forecast gold to average $1,764/oz in 2021.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading