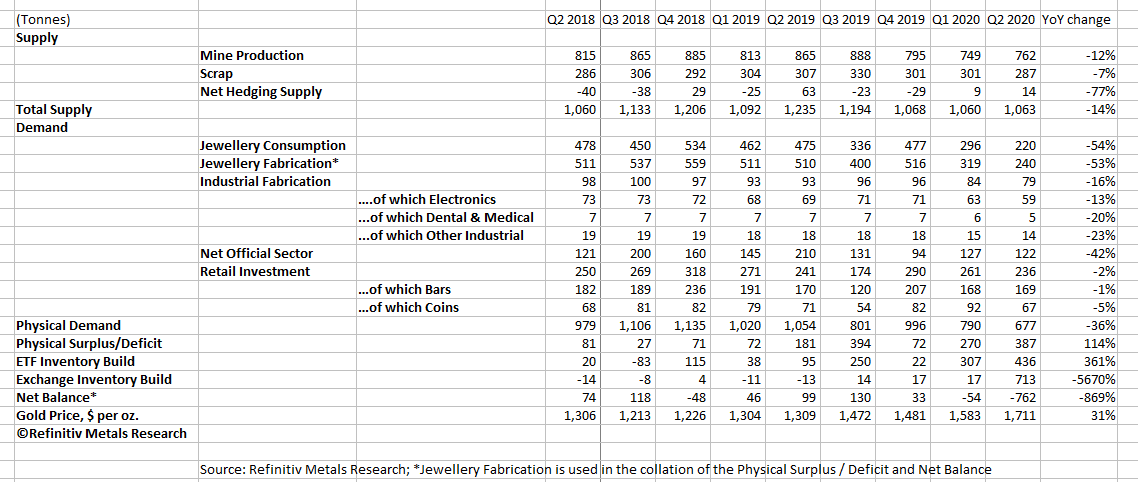

· All the major sectors recorded double-digit percentage declines, with jewellery demand remaining the worst affected segment

· Gold recorded a spectacular performance during the second quarter, soaring to an eight-year high of $1,772/oz by the end of June

· ETP holdings surged by another 436 tonnes in the April to June period to a fresh high of over 3,000 tonnes, with year-to-date inflows on track to exceed previous full-year record

Physical gold demand fell to 677 tonnes in Q2 – its lowest levels since Q1 2009 as record high gold prices, in light of COVID-19, led to a drop in consumption.

Jewellery fabrication volumes, which typically account for around 55% of total physical demand, was once again the worst hit segment by the pandemic, with global offtake contracting by 53% in the second quarter, to a total of 240 tonnes, the lowest quarterly level seen over the past two decades. All the key regions witnessed severe losses as demand was paralysed due to the virus outbreak and lockdowns in many markets.

Gold recorded a spectacular performance during the second quarter, soaring to an eight-year high of $1,772/oz by the end of June, driven by escalating fears over the global economic downturn caused by the COVID-19 pandemic and massive stimulus measures introduced by central banks around the globe in an attempt to lessen the impact. Gold averaged $1,711/oz in the second quarter, up by 8% from the previous three months and 31% above the level seen over the same period of last year.

Notably higher gold prices, reaching record levels in many local currencies, put further pressure on demand. Likewise, demand for gold used in industrial applications recorded a year-on-year decline of 16%, with losses across all the major segments. Official sector purchases dropped by 42% to an estimated 122 tonnes in the April to June period, largely caused by an absence of purchases by Russia and China.

While ETP demand surged, long speculative positions on COMEX jumped by 18% or 100 tonnes over the three-month period, although still below a record level of nearly 1,000 tonnes witnessed in mid-February. Turning to retail investment, which is the sum of bars and all coins, demand is estimated to have retreated by 2% year-on-year to a total of 236 tonnes in the second quarter. Physical bar investment was down by less than 1%, estimated at 169 tonnes, as poor performance in Asia was largely offset by a stellar demand in Europe and, to a lesser extent, North America. Gold bar demand in Asia slumped by 58% year-on-year, led by a sharp fall in India as a result of record high gold prices and a national lockdown. Demand in China dropped by 2% year-on-year, hit by the economic slowdown and high gold prices.

On the contrary, gold bar demand exploded in Europe, led by its largest market Germany, driven by growing worries over the COVID-19 outbreak and its economic impact, renewed fears over the credibility of fiat money amidst unprecedented stimulus measures as well as the availability of physical gold due to limited refinery operations and logistical disruptions caused by the pandemic. Similarly, investment demand in North America jumped by 25% year-on-year. Coin demand, which is the sum of official coin fabrication and medals & imitation coins (MIC), slipped by 5% in the second quarter. This was led by a sharp fall in medals demand in India, which usually accounts for the bulk of gold demand from this sector, largely offset by a 27% rise in official coin fabrication.

Turning to supply, following a strong first quarter, mine production is estimated to have dropped by 12% to 762 tonnes in the second quarter, with operations being affected by the COVID-19 outbreak. The most impacted regions include Latin America and Africa, which after strict lockdowns were placed on a non-essential activity, including mining in most cases. South Africa, Indonesia, Peru and Argentina suffered heavy losses, while moderate gains were reported in Russia and Australia, mainly emphasising governments’ different approaches to the pandemic. Not only primary gold production dropped considerably during this period, but also gold as a by-product, especially from copper, silver and PGM mines were also dramatically affected. According to our records, nearly 130 mines had to be put under care and maintenance or continued to operate under reduced capacity. While restrictions in several countries have been easing during the last few weeks, with mines starting to ramp up production, due to heightened uncertainty many companies remain cautious, and have already withdrawn their guidance production.

What perhaps comes a bit surprising is a 7% year-on-year drop in scrap supply given gold’s strong price performance. However, the drop was driven by reduced flows in the three largest markets, Asia, Europe and North America, which together account for nearly 90% of global scrap supply. Lower scrap volumes were due to disruptions and shutdowns caused by the COVID-19 outbreak, which saw scrap collecting agencies as well as refineries in many markets shut down for a few weeks, and thereafter operate at reduced capacities after re-opening.

Cameron Alexander, Director of Precious Metals Research at Refinitiv, comments: “Looking ahead, the overall macroeconomic backdrop remains very supportive for gold. We believe that gold will continue its uptrend, driven by growing concerns over the global economic recession, fears of a second wave of COVID-19, heightened geopolitical tensions, historically low and negative interest rates as well as rising inflationary expectation amidst unprecedented levels of stimulus measures launched by central banks around the globe.

“Having said that, gold remains vulnerable to liquidation in the short term as a move closer to its previous record high level or beyond that may well trigger a wave of profit taking.

“Furthermore, should the global economic downturn turn out to be less pronounced or should we see early signs of a faster recovery, gold may come under renewed pressure. We forecast gold to average $1,715/oz in 2020, with a possibility to touch fresh highs later in the year.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading