Yesterday, we looked at how futures contracts tend to work across a variety of asset classes. Today, we’re going to zone in on forex futures, and look at the differences between these and futures that cover other asset classes.

Forex Futures Vs. Traditional Futures

Essentially, forex futures operate in the same basic way – a contract is bought that agrees to buy or sell a specific amount of an asset (in the case of FX futures, a currency pair) at a specific price on an agreed date. The main difference is that forex futures are not traded on a centralised exchange, unlike traditional futures. Instead, the deal flow is made available via several different exchanges throughout the world, although most of them are based in the USA. The reason for this is that most forex futures are traded through the Chicago Mercantile Exchange (CME) and its partners, known as ‘introducing brokers’.

That said, forex futures are not strictly speaking over-the-counter (OTC) derivatives, in that they are still bound to a designated ‘size per contract’, and unlike forward contracts, they are only offered in whole numbers. Also, unlike the spot forex market, all currency futures are quoted against the US dollar.

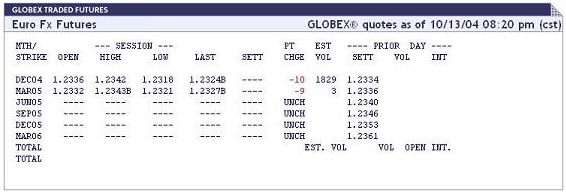

A forex futures quote might look a bit like this:

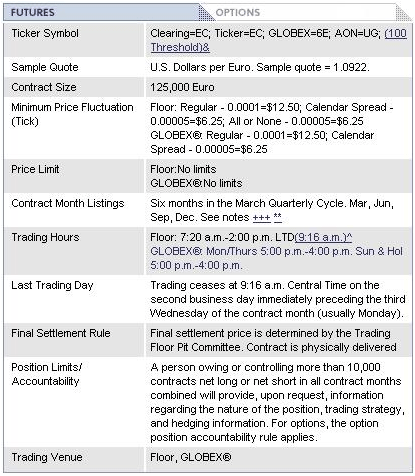

When you enter into a futures contract, the broker you are dealing with should provide you with its specifications, which includes information such as contract sizes, trading hours, pricing limits, and time increments. Here is an example of a forex futures specification sheet from the Chicago Mercantile Exchange:

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading