From a trader’s point of view, there is one commodity that is worth infinitesimally more than any other. And it’s not cutting-edge technology, advanced technical analysis, or profound macroeconomic insight – although these are undoubtedly hugely valuable – it’s information.

Not just any information – after all, the world is filled with more information than even the most powerful computers could hope to store, and the most intelligent brains could hope to begin to comprehend. No, there’s one type of information that has the potential to give traders a bigger edge than any other, and that’s the latest information. Information that the rest of the market has yet to factor into their equations.

If you know something before the rest of the market does, you can act on it before the chasing pack has a chance to react to it. That’s why unscrupulous traders will go to great lengths to obtain this type of information, even sometimes risking lengthy jail terms in order to do so. That’s why major institutional investors spend millions building optic-fibre connections to exchanges that give them data a few microseconds before everyone else.

And it’s also why most of them spend small fortunes to obtain premium news feed services – such as the $20,000-odd annual cost of a single Bloomberg terminal. Why do they do this? Well, it’s because knowing the latest market-moving data even a fraction of a second before the rest of the market receives it means that they can get in on a big price shift a little bit before everyone else realises it’s going to happen – and in a fast-moving, highly competitive market such as foreign exchange, that can make all the difference between a trade that nets them hundreds of thousands of dollars and a trade that makes them millions. Basically, the huge investments involved in obtaining data swiftly are worth much more than the cost of obtaining it – otherwise, they wouldn’t do it.

The Machines Take Over

In the modern trading environment, where the major players are making increasing use of so-called “black box” algorithmic trading techniques, speed is now a hugely valuable – and quantifiable – asset. Today’s financial markets are increasingly driven not by the activities of human traders, but of computer algorithms.

In the following clip, MIT professor and algorithmic trading guru Kevin Slavin gives a TedX talk explaining the increasing power that such systems are having over our world, and the financial markets in particular.

And here is another video, produced by Lucy Leigh-Pemberton and Isobel Lawrence at Imperial College in London, that demonstrates just how far algorithms have infiltrated the world around us, and what this could mean in the future.

Mining News from Social Media Data

For many years, top-level data providers such as Bloomberg and Dow Jones have been able to capitalize on the demand for timely news and data. However, in recent years, the emergence of social media – in particular Twitter – has started to threaten this hegemony. In order for one of the major newswire services to issue a piece of news or data, they have to be able to verify that it is true. And in real life, truth often comes out first in the form of an unsubstantiated rumour, which is just the kind of thing that will appear on Twitter long before it coalesces into news.

Of course, you can’t believe everything that you hear, especially on a largely unregulated social platform such as Twitter. Things don’t have to be verified facts to appear there, which means that this information can never be regarded as truly reliable. But while it may not be reliable, it’s fast – and in many cases, speed is more important than accuracy.

If you were to catch a market-moving rumour on Twitter that turned out to be true, and traded on it before the information was verified and broadcast by a responsible data provider, you would get the jump on the market, and reap the rewards. While there is always going to be a high risk that this information will turn out to be false, the potential gains may outweigh the risks.

Naturally, with such a potentially rich source of timely information available to the general public, there have been attempts to leverage this type of information, and reduce the risk (and hassle) involved to levels that are acceptable to traders. The biggest stumbling block is the sheer amount of data produced by social media, the vast majority of which can be considered ‘noise’. The trick is to find a way to block out this noise in order to obtain tradeable signals, and this is where data mining comes in.

Companies, such as New York-based Dataminr, claim to be able to offer their clients market-moving information minutes ahead of the newswires, by accessing and analyzing social media for tradeable information. One of the biggest feathers in its cap to date has been to inform its clients that the so-called “hack crash”, in which billions were wiped off the value of stocks after a tweet from the AP Twitter account claiming there had been an explosion at the White House, was a hoax a full two minutes before the official announcement.

Companies, such as New York-based Dataminr, claim to be able to offer their clients market-moving information minutes ahead of the newswires, by accessing and analyzing social media for tradeable information. One of the biggest feathers in its cap to date has been to inform its clients that the so-called “hack crash”, in which billions were wiped off the value of stocks after a tweet from the AP Twitter account claiming there had been an explosion at the White House, was a hoax a full two minutes before the official announcement.

Dataminr employs event detection software to trawl the entire output of Twitter – more than 400 million tweets daily – to identify emerging trends or hot-spots of activity that match up with the client’s stated interests. Another notable success for the firm was being among the first entities to report the death of Osama Bin Laden after identifying a tweet from a former official from the US Defense Department. After 19 more tweets about the subject, the firm sent out an alert to its clients – a full 20 minutes before the news broke via mainstream news channels.

Sentiment Analysis

Sentiment Analysis

While data mining social media data has huge potential for short-term intraday trading strategies where speed is of the essence, it can also have benefits for longer-term swing traders in the form of sentiment analysis. This is the process of analysing huge amounts of data to gauge the mood of consumers, as well as their reactions to marketing activities such as product introductions, ad campaigns, and celebrity endorsements.

A study, published in 2010 by Indiana University informatics professor Johan Bollen demonstrated that social sentiment data mined from Twitter could predict stock market swings with an accuracy of 87%. In this sense, Twitter users are acting as what Bollen describes as being “human sensors”, allowing the analyst to tap into “the wisdom of the crowd”.

What About the Little Guy?

As you can imagine, this type of technology is far from cheap. Sifting through millions of Tweets to find actionable information in a timely fashion requires some serious computing power, not to mention some pretty high-end software. Also, there is the issue of accessing the data in the first place, as only a very small proportion of Twitter data is made available via the standard interface.

At present, there are only two known methods for accessing the full “firehose” of global Twitter data: either via Twitter’s own developers’ API, which places strict limits on the amount of data that can be extracted and the terms that can be tracked, or through an authorised data reseller such as Datasift, Topsy, or Gnip. And neither is particularly cheap. This, coupled with the cost of using professional-level data mining services such as Dataminr, prices this process out of the reach of the vast majority of independent traders and investors.

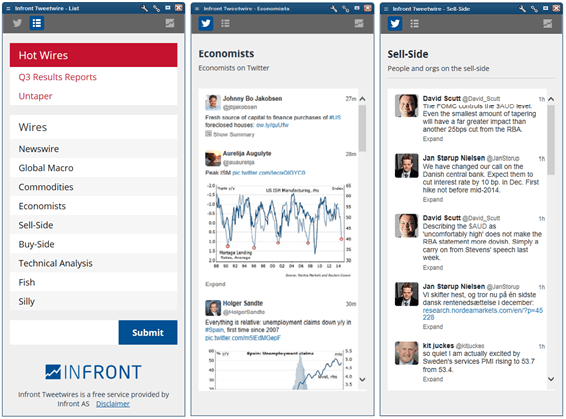

There is, however, a halfway house for those who want to gain more useful insights from Twitter but aren’t trading on a scale that would justify the investment in true data-mining technology. Last week, a Norwegian firm called Infront launched Tweetwires, a cost-effective system for curating and filtering Twitter data that is relevant for traders into a useable news stream consisting of market-moving events and sentiment. Basically, it claims to be offering much the same thing as high-end services such as Dataminr, but at a fraction of the cost.

So how can this be achieved, given the (costly) difficulties outlined above? Well, Tweetwires doesn’t analyze the full stream of global Twitter data, and gets the information it needs from Twitter lists using standard widgets. This cuts the cost of obtaining the data down to zero, and significantly reduces the amount of computing power that is required to sift through it for useful information. So while it might not see everything, it could still reveal a sufficient sample of what might be occurring on a bigger scale.

Can Traditional Newswires Compete?

With Twitter data proving, in many cases, to reveal news stories much quicker than even institutional-level newswires, such as that provided by the Bloomberg terminal, is the writing on the wall for these services? Certainly, the relative unreliability of Twitter as a news source – ironically highlighted by the “hack crash” incident – means that there will always be a requirement for verified, accountable news as opposed to the aggregated “Chinese whispers” that a curated Twitter feed represents.

Source: q4blog.com

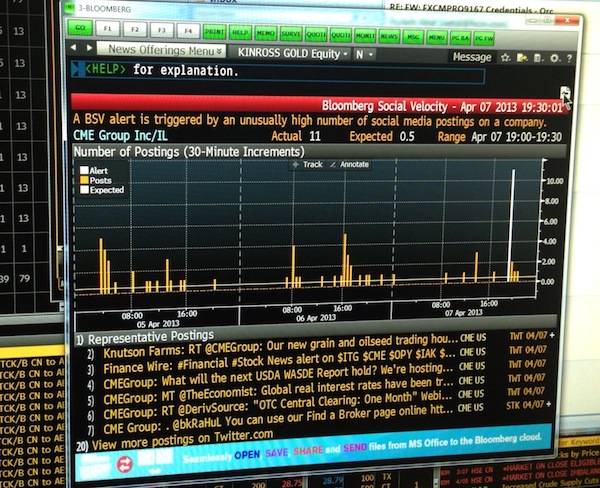

However, the newswire services are not oblivious to the potential of social media as a source of tradeable information, and have begun to incorporate it into their services. Earlier this year, Bloomberg introduced a curated social media feed consisting of tweets from the Twitter accounts of relevant sources such as corporations, government officials, economists, executives, and commentators. Although these are chosen by the Bloomberg staff, they can be filtered by the user to show only the information that is relevant to the market(s) they are operating in. It also provides a sentiment analysis tool called “Bloomberg Social Velocity”(pictured above), which alerts users to unusual spikes in social chatter about specific companies and topics.

So while Twitter might not replace the traditional newswire service entirely, it has certainly earned a place alongside it in the trading consoles of institutional and retail traders alike. This means that social media is set to play an increasingly important role in the financial markets, and that traders who do not keep on top of the latest developments in the Twitterspher may find themselves at an increasing disadvantage as time goes on.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading