How the Euro surprises the Forex Industry Trading at 1.2640?

What are the technical facts regarding the Euro value? Mario Draghi has been playing an exciting, and maybe a dangerous game, by creating a unique false idea; the Euro has to trade at parity with the US dollar. It is time to face the technical facts.

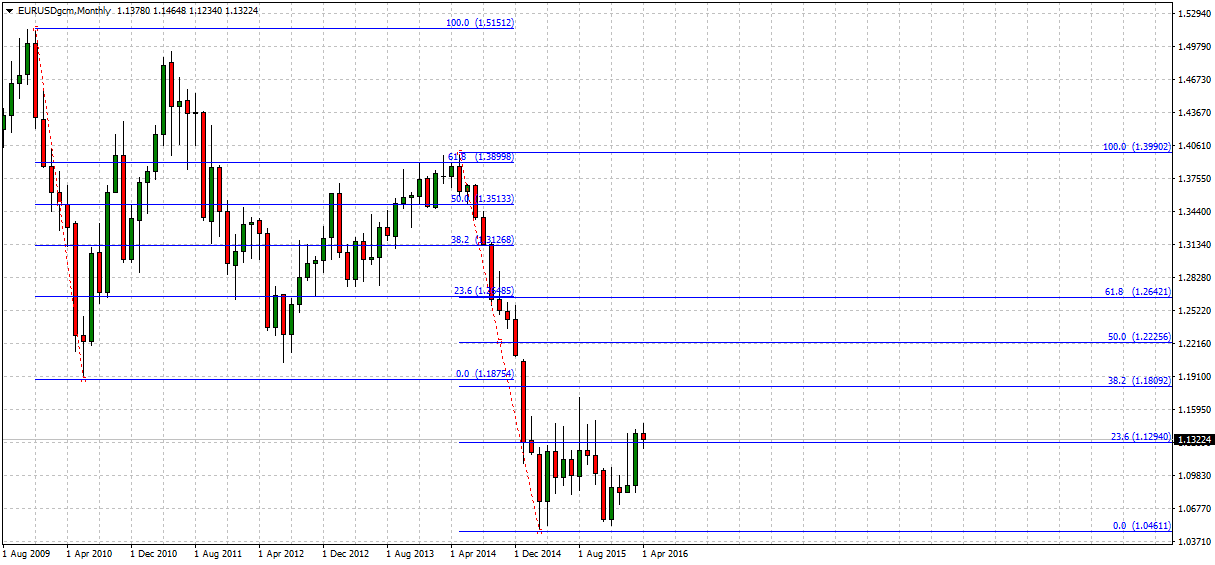

- December 01, 2009: trading lower from its previous high around 1.6000, EUR/USD established a lower high 1.5140 and will drop for seven consecutive months. Total pip count at that time +-3200 pips.

- June 01, 2010: Finally, it finds support and its bottom for the next two years; EUR/USD makes a “U” turn recover. Total pip count at that time +-3060 pips.

- May 01, 2011: calm will not last for too long. From a lower high 1.4940, EUR/USD drops for 15 consecutive months to trade close to its two-year low.

- May 01, 2014: finds resistance against the Fibonacci level 61.8, not the first time, and then it drops breaking previous four-year support levels.

Avoiding peer-to-peer pressure, we live in a time where we have to go with more of the same, and then we experience our spectacular now when pragmatic energy and dedicated bravery are enough to illustrate words and ideas. Not much to be excited, but sufficient to embrace real out of the box behavior.

It has to look to many readers as some technical analysis research, more and less, what it has is nothing more than observation and common sense. Just think about it for a minute, Wall Street survives (sometimes) playing its part, pretending they know something you do not know, and yet, the fact is, no one knows. There is a few clues and evidence to support views or to count down all the Whys and why is so logical do it right now.

Now, let’s organize the background story behind this parity concept idea where everyone talks about EUR/USD below 1.0110 and finally trading at 0.97 cents one wonders: What is the prize for many if it goes there? Probably, Mario Draghi had the opportunity to organize a secret raffle where all the “parity forecasters” are going to celebrate dancing and drinking whiskey while we all witness the euro and Eurozone last chapter.

In the beginning, we had time to think about the massive debts accumulated by a few players, nothing fancy or enough to worry about it. Not yet, but soon it can turn things upside down. Still, with all that nuclear debt the Eurozone carries, we have to believe that governments are adjusting to improve their finances, and there is no time or need to waste taxpayers’ hard-earned funds. Think twice; the joke is just about to begin.

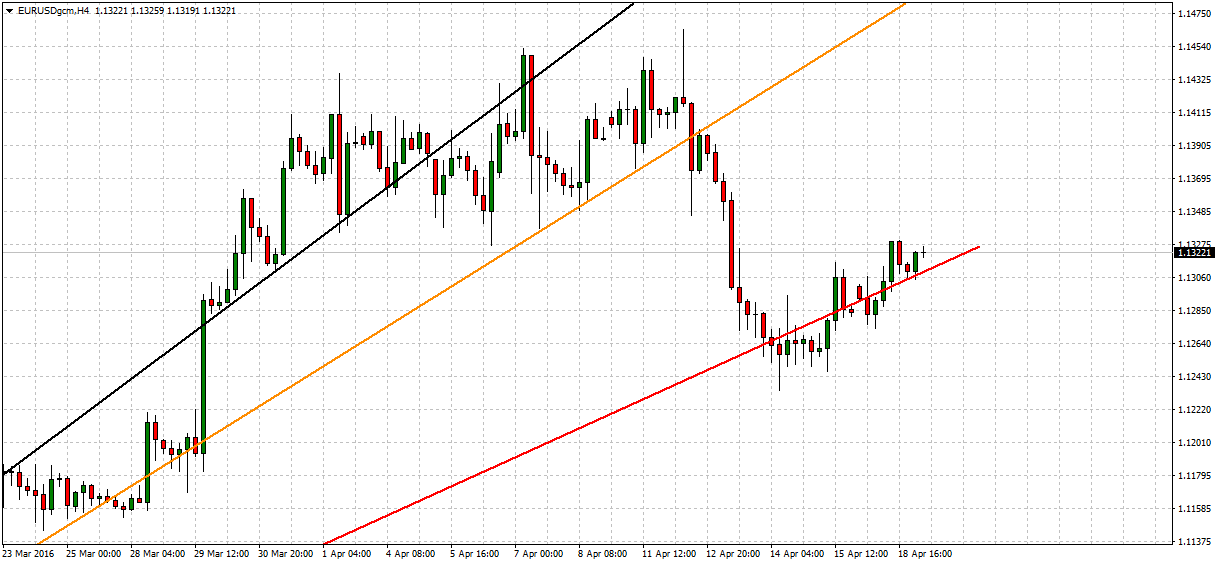

Technical View: Just another perspective without too many “if”

First-off, we may find clues and evidence to support our technical and long-term forecast by applying Fibonacci levels on a monthly chart. This serves our purpose well because it provides expected zones where the euro price should find resistance and support.

We cannot deny how funny it was to realize something particular about the price past behavior from 2009 to 2014. It is more than, an expected surprise, it delivers a complete view and trading map without paying a premium to a hedge fund or money manager; just like that.

Our findings demonstrated a massive recovery towards 61.8%, however, it is not set in stone and on its third attempt the euro breakdown a critical support established around 1.1875 finding a new trading range.

We were hunting to gather enough evidence to support our previous bullish view, but keep in mind; the market is the one sharing this information with everyone not only with us.

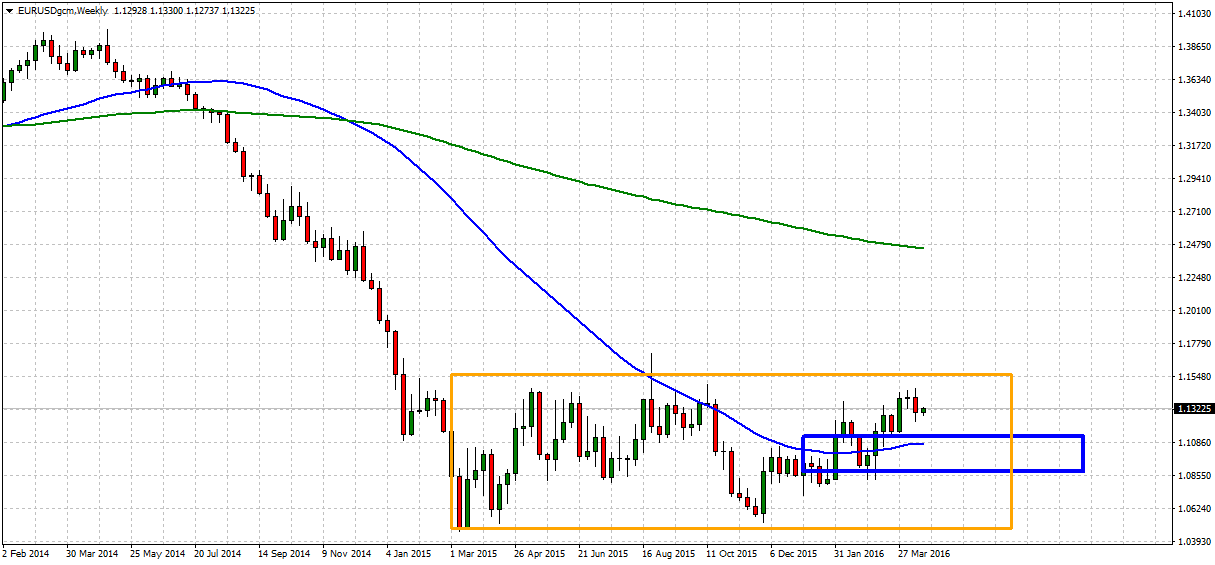

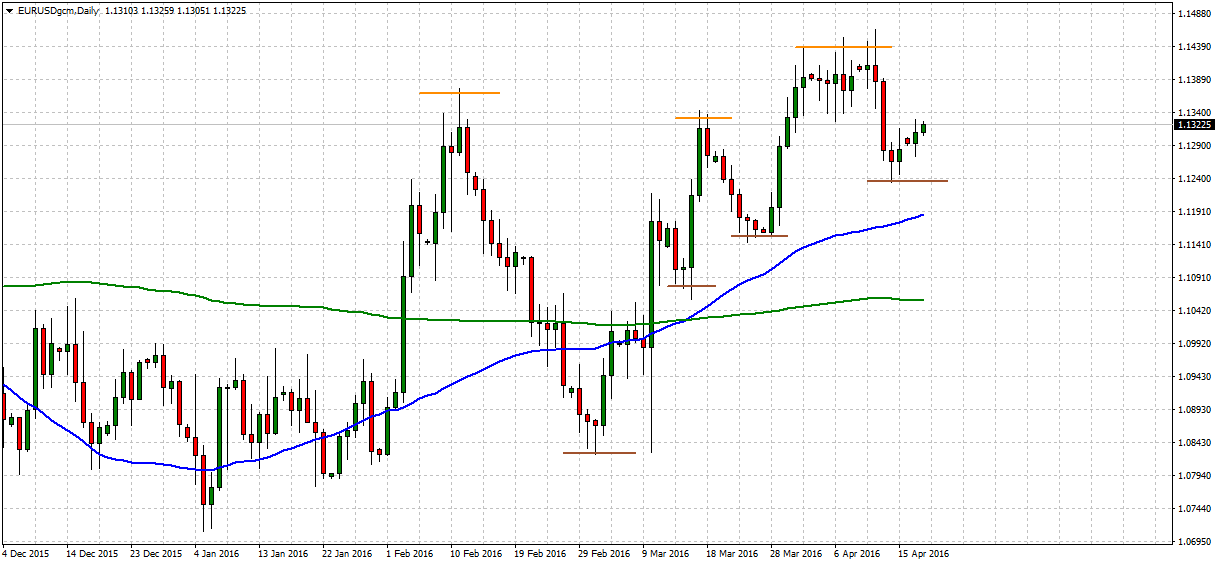

- +60 weeks the euro has been trading inside an 800 pip range from highs to lows.

- +10 weeks the euro has been breaking to the upside its 50 SMA (blue SMA).

- +6 weeks the euro has been trading above its 50 SMA (blue SMA).

To make a better statement, Where do you think is the buying zone? Yes, we drew a blue rectangle to mark it. It does add value to review 1.1085 to 1.0855.

Perhaps we are asking the wrong questions. Maybe nobody cares about making money anymore, and it is just about having an idea to squeeze until there is no more juice in it. It does not matter to be thirsty when you know a glass half full is in front of you. No! Definitely is ten times better to follow another voice because it sounds smarter than yours?

- On Daily Chart, we can recognize since January 2016 a set of higher lows. We marked those with short horizontal lines.

- On Daily Chart, we can recognize the same pattern, but this time to the upside with higher highs.

- On Daily Chart, we can recognize a moving average crossover. The 50 SMA (blue line) breaks to the upside the 200 SMA (green line) Is not that multiple bullish confirmations?

Once again, Central Banks used to be powerful and somehow even “Godlike” However that scenario is different as we face deflationary challenges. Our expectations must change to give us the opportunity to adapt and embrace every single development in the markets.

Remember “the market has memory” do not get caught in the media and ten thousand reasons to see a weaker euro because it is just not happening.

What is next? Well, there is one question that answers all our doubts.

If you were Mario Draghi and it is your job to kill the euro: Where would you like to do that from 1.0500 or 1.2640? We both know the answer to that question, and that is exactly why the euro will run one more time above 1.2000s

José Ricaurte Jaén is a professional trader and Guest Editor / community manager for tradersdna and its forum. With a Project Management Certification from FSU – Panama, José develops regularly in-house automated strategies for active traders and “know how” practices to maximize algo-trading opportunities. José’s background experience is in trading and investing, international management, marketing / communications, web, publishing and content working in initiatives with financial companies and non-profit organizations.

He has been working as senior Sales Trader of Guardian Trust FX, where he creates and manages multiple trading strategies for private and institutional investors. He worked also with FXStreet, FXDD Malta, ILQ, Saxo Bank, Markets.com and AVA FX as money manager and introducing broker.

Recently José Ricaurte has been creating, and co-managing a new trading academy in #LATAM.

During 2008 and 2012, he managed web / online marketing global plan of action for broker dealers in Panama. He created unique content and trading ideas for regional newspaper like Capital Financiero (Panamá), La República (Costa Rica), Sala de Inversión América (Latinoamérica) and co-developed financial TV segments with Capital TV.

He is a guest lecturer at Universidad Latina and Universidad Interamericana de Panamá an active speaker in conferences and other educational events and workshops in the region. José Ricaurte worked and collaborated with people such as Dustin Pass, Tom Flora, Orion Trust Services (Belize) and Principia Financial Group.