By Magdalena Golebiewska – Country Manager at Luno

You can’t spend five minutes reading about cryptocurrencies without stumbling across at least one prediction for the future price of Bitcoin. Across forums, social media, newsletters, blogs, news sites and every other corner of the internet — financial analysts, expert investors, bankers, tech icons, and new enthusiasts offer up their views. Some cite careful analysis, some base it on past trends. While others are guessing or acting on their ‘intuition.’ Their predictions are varied, ranging from a plummet to zero, to millions.

With all this noise surrounding the Bitcoin price, you might be wondering whom to believe. Or if you should believe anyone at all. Is it possible to predict the future Investing begins with education, not buying. So it’s important to think about the information you base your buying decisions on.

How do people make price predictions?

There are two types of analysis used for predictions: fundamental and technical.

They’re used for everything from the stock market to Bitcoin. While other types of analysis do exist, these are the main ones.

Fundamental analysis

Fundamental analysis is all about intrinsic value. You look at the factors that give something value, then decide if it’s under or overvalued. Publicly traded companies release lots of information to help with this. So, for a stock you might look at a company’s:

- Revenue (how much money it’s making)

- Profit margins (how much of the revenue is profit)

- Growth potential (how much money it could make in the future)

- Management (how competent the people in charge are)

Some of these factors can be defined in numbers. Others come down to the judgement of the analyst.

For a cryptocurrency, you might look at its:

- Price growth (how the price has grown over time)

- Scalability (if it has the potential to keep growing)

- Security (if the network is secure and safe from attacks

Technical analysis

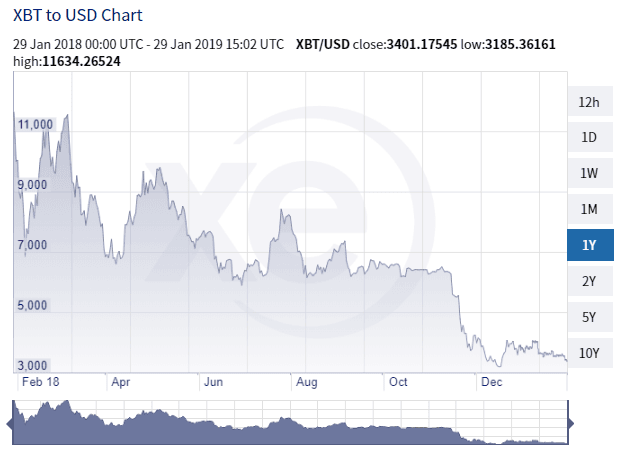

Technical analysis is different as it focuses on an asset’s price, not the asset itself. Maybe you’ve heard the phrase ‘past performance is not an indicator of future performance.’ But technical analysis bases future predictions on the past. This can be based on a short time frame (hours or even minutes) or long (months or years.)

To do this, you look for patterns and trends in price charts, such as:

- The average price over a chosen time span

- The price at which a lot of investors start buying

- The price at which a lot of investors start selling

- The overall price trend

Do fundamental and technical analyses work?

There’s no straightforward answer to that question. Both techniques can be useful, but they also have their limitations for cryptocurrencies.

Fundamental analysis works when investors base their decisions on fundamentals. This isn’t always the case for Bitcoin. Many investors base their decisions on the decisions they expect others to make.

Technical analysis assumes that a market follows rational rules and patterns. It’s less useful for cryptocurrencies because the market is still young. There isn’t as much past data to analyse. Cryptocurrencies also have less liquidity than something like stocks.

Self-defeating and self-fulfilling prophecies

When we talk about price predictions, we run into an important concept: self-defeating and self-fulfilling prophecies. Making a prediction about the future can end up changing what actually happens as the prediction about the future creates the future.

This isn’t the case when we talk about a system like the weather because we can’t change it. But when you make predictions for a system involving people, it’s different. Hearing predictions can cause people to change their behaviour.

Sometimes this happens in a way that prevents the prediction from coming true — a self-defeating prophecy — or it can cause the prediction to come true — a self-fulfilling prophecy. Predictions about cryptocurrency prices have the power to influence how investors act. If it’s predicted the Bitcoin price will increase, this encourages more people to buy. This can drive up the price, and vice versa.

That brings us to incentives.

The issue of intentions

Incentives are what motivate people to do what they do. It’s an important concept in investing. Financial gain is a powerful driving force.

Most investors understandably want to do whatever will make them the most money. This can include making predictions that benefit them.

Let’s say you come across an article where the author claims Bitcoin will be worth $100,000 by December 1st 2019. Rather than taking that at face value, it’s important to ask: why are they saying this? If they know for certain, why don’t they put all their money into Bitcoin, and make a huge profit? Why are they sharing that information?

Likewise, if someone claims Bitcoin will drop, you might wonder why they’re saying that. If they know for certain, why don’t they keep quiet, short it, and make a big profit?

In both cases, we need to consider the underlying incentives.

If someone stands to profit from the Bitcoin price increasing, it’s natural they’ll predict it’s going to do that. They’re hoping this will turn into a self-fulfilling prophecy. If someone stands to benefit from it decreasing or to suffer if it increases, it’s not unexpected that they’ll predict it’s going to decrease.

Luck and probability

But if no one can predict the future, how come some people do make correct predictions?

Maybe you heard that your brother’s roommate’s cousin’s coworker’s uncle correctly predicted the price of Bitcoin. Or you’ve seen someone on Youtube who seems to always get it right. The fact that no one can predict the future doesn’t mean no one can make correct predictions. It comes down to luck, probabilities, and information asymmetries.

First, luck. Every day, thousands of people make predictions about Bitcoin prices. It’s inevitable that some of them will be correct by luck. As they say, even a stopped clock is right twice a day. With so many people making predictions, it’s likely a percentage of them will be correct.

When professional forecasters make predictions, they usually base them on probabilities. What’s the most likely outcome? A weather forecaster might say it’s going to rain tomorrow because there’s a 62% probability. They don’t know it for sure. It’s just more likely than not.

Then there’s insider information. If you know something most investors don’t, you have a big advantage. For example, if you have insider information that Apple is about to release a new product, it’s reasonable to expect the stock will go up. But other investors buying Apple stock aren’t aware of that information, so they can’t predict it.

Insider information is less meaningful for cryptocurrencies. There’s a less direct link between fundamentals and prices. Events that seem like they should cause an increase or decrease can do the opposite or nothing.

Conclusion

The next time you look at a cryptocurrency price chart, imagine a crowd of people in a stadium, all moving at different times but appearing to create an organised rippling motion. Because that’s what you’re seeing: the combined actions of many people.

There’s no mystical, secret order to it. There’s just lots of people making decisions based on the information they receive.

Read More:

how to get personal loans with income verification?

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading