I’ve always been a fan of Disney, both as a consumer and as an investor. So the widespread bearishness over Disney’s ESPN situation has been troubling. I was surprised, then, to see the reason for the latest bullish sentiment from investment firm Piper Jaffray: Zootopia.

The firm’s analyst Stan Meyers points out that the animated film not only broke a record for Disney, shattering Frozen’s opening day weekend with about $75 million in ticket sales, but the film is “outperforming expectations by 50-60% and supporting our thesis that Disney’s film slate (combined with consumer products and theme parks) will drive the overall performance at an accelerated pace over the next three years.”

And if the trend continues, Zootopia could be the next Frozen in terms of film sequels, consumer products, merchandising and theme parks.

Meyers concludes with an Overweight rating for Disney, along with a price target of $120, signaling value growth of 22.2% above the stock’s current price.

More on the film front

With major successes on virtually all fronts in its studios, Disney continues to ramp up its production with new films.

On Monday, the company announced that it would bring back the Indiana Jones franchise with a fifth film starring Harrison Ford. Having acquired the rights to the franchise in the company’s 2012 acquisition of Lucasfilm, Disney has some work ahead of it to make up for the disappointing fourth installment, “Indiana Jones and the Kingdom of the Crystal Skull.”

That said, Disney knocked the latest Star Wars installment out of the park and has done a bang-up job with the Marvel Universe, so it’s more than likely we’ll see an improvement.

Another recent development is that narrowing of the search for a young Han Solo for Lucasfilm’s upcoming spinoff film depicting the galactic smuggler’s roots and how he came to be. And if Disney has its way, you likely won’t live to see the last Star Wars film — it’s a forever franchise. In other words, that cash cow is going to produce for decades to come.

But what about ESPN?

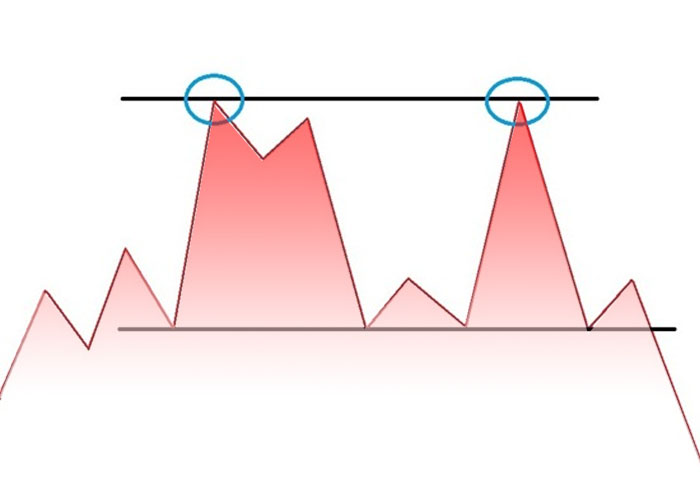

The interesting thing to consider in all of this is that Piper Jaffray made no mention of ESPN in its statement. Having been a catalyst for Disney’s recent slump, it’s curious to see it be completely ignored, especially when it was the main focus in December despite the massive success of “Star Wars: The Force Awakens.”

Believe me, the ESPN problem won’t be going away anytime soon. In fact, as long as Disney doesn’t have a concrete solution to the ESPN problem it will always be an asterisk at the end of every bullish statement made by an analyst or investment firm.

That said, I’m confident Disney will find a solution. The company has been remarkably innovative despite its size and age, and that’s not something you can say about any of its peers. Live sports will always be of interest to consumers, Disney just needs to find a way to adapt its approach, and it will.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading