Last week the US Dollar remained in a tight range as other geopolitical news took the fore.

Oil prices surged along with metals such as Copper reigniting inflationary warning signs which could leave central banks powerless to reduce rates in the coming months.

Dollar ended the week roughly where it started despite good economic data. By the end of the week the DXY had falling marginally to 104.28.

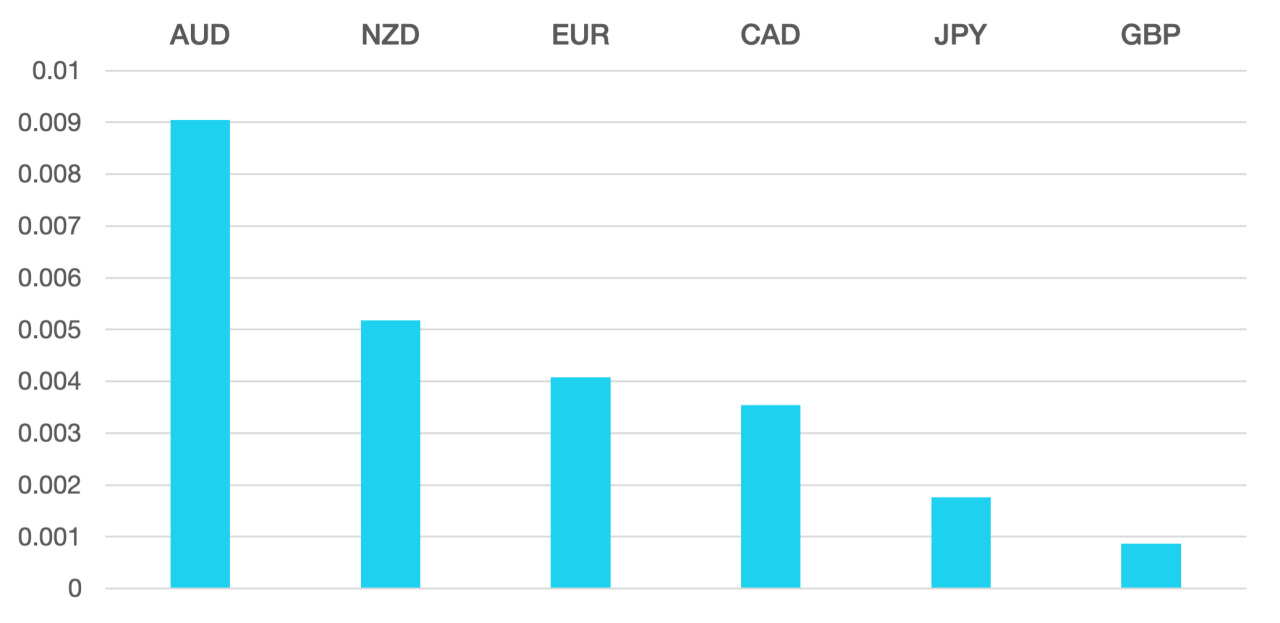

The winners on the week where commodity-based currencies. AUD and NZD both moved higher as the commodity risk on formed during the week. Copper was especially the winner as prices rose to the highest in a year buoyed by expectations on global demand.

CAD was the loser of the week despite the higher oil price. Poor job data weighed heavily on the currency.

Both GBP and Euro have traded sideways for some time now and both continued that theme. Data continues to trouble the Euro with poor data and both central banks are looking for the ideal time to cut rates into 2024.

We would expect to see volatility to continue to be elevated and we had some major economic data coming out. We have inflation numbers from the US, Japan, and Germany along with the US CPI.

On interest rates we have decisions from the BoC and ECB this week.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Inflationary Pressure Resurfaces first appeared on trademakers.

The post Inflationary Pressure Resurfaces first appeared on JP Fund Services.

The post Inflationary Pressure Resurfaces appeared first on JP Fund Services.