TradersDNA presents interview with Jean-Fancois Owczarczak, CEO of FinGraphs and Director of Management Joint Trust (MJT).

Jean-François acts as chief investment officer and head of business development for Management Joint Trust SA, Geneva, a company active since 1969 in providing market advisory services to institutional investors. He holds a masters degree in business from the University of St Gallen and holds the CFTe (Certified Financial Technician) and FRM (Financial Risk Manager) certifications. He is also a member of the Swiss and UK Societies of Technical Analysts. His activities as an institutional advisor to large corporations in Switzerland, France, Germany, and the UK lead him to focus on subjects such as diverse FX exposure, interest rate refinancing, commodities, and equity markets. He is also a regular blogger and web-TV interviewee.

Since September 2012, Jean-François has also been leading the launch of Management Joint Trust’s new platform, FinGraphs (www.fingraphs.com). Simple and didactic, the FinGraphs platform focuses on the essentials (i.e., investment horizons, trends, price targets, and risk indications) in order to bring a unique decision-tool to a large audience of investors and traders.

| 1. Can you tell us about yourself, your background, and your education?

I was raised in French speaking Geneva, Switzerland, studied business in the German speaking part of the country at the University of St Gallen and then went on to London to be an M&A and leverage finance banker for 5 years. In 2003, I returned to Geneva to join my father in his business, Management Joint Trust SA (MJT).The company, founded in 1969, has been providing institutional market consultancy based on technical analysis since the 1970s.In the 1980s, MJT was early in computerizing its systems and our decision helping colour charts were made available on-line as soon as 1984 (through X25 lines or the ancestors of the Internet). This traditional business is 100% institutional and since I joined in 2003, I have been consulting with bulge brackets institutions, mostly in Switzerland, on directional market analysis and market timing over a wide spectrum of asset classes. In the meantime, I passed my CFTe technical analysis certification where I achieved best exam paper in the world in 2012 and was awarded the Bronwen Wood Memorial Award by the International Federation of technical Analysts (IFTA). 2. What can you tell us about Fingraphs and how you differentiate yourself from the competition? In September 2012, we created FinGraphs.com as a new product offering.Indeed, our traditional institutional business is mostly local and the methodology applied does need some explaining and regular coaching. Furthermore, the consultancy services we offer are very personalised, focusing on specific asset classes for each client with supporting conference calls and regular client visits. Although high end and bespoke, our institutional offering does not provide the economies of scale necessary for international expansion.Hence, when creating FinGraphs, our main intention was to streamline the methodology and present it in a visual and didactic way. Our aim was/is “to make chart analysis visual and straightforward for all Investors and Traders”. The product is structured as or a “Do it yourself” and the methodology can be on-boarded in a matter of hours. It is hence accessible to a wide audience. Our first drive was to focus on the essentials of market trend analysis by offering simple indicators to

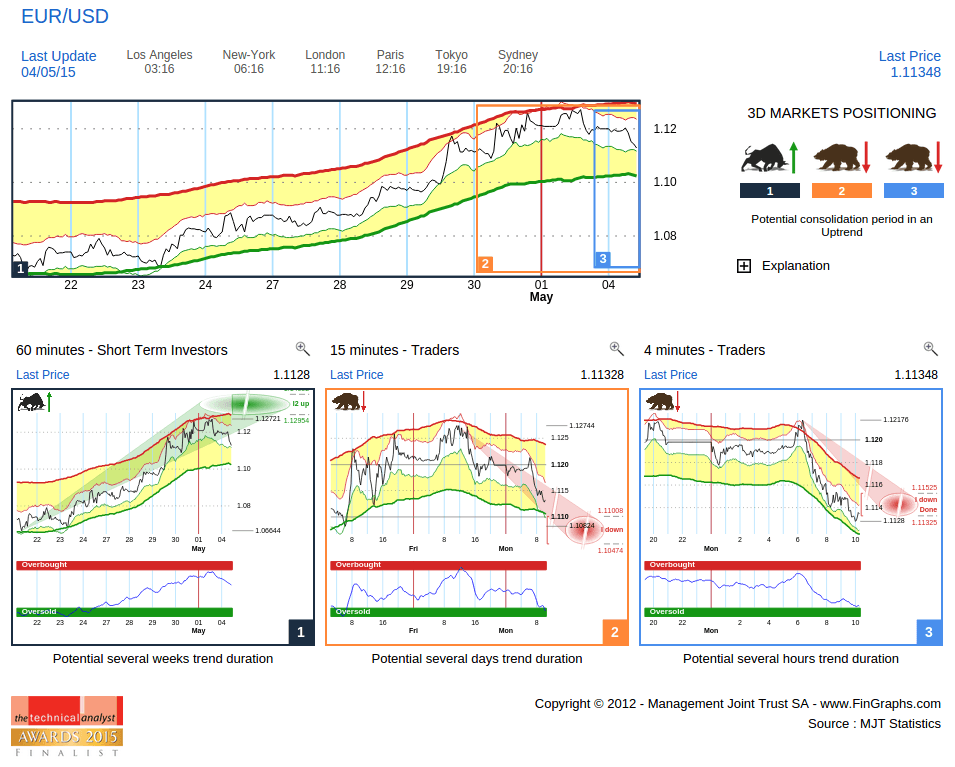

The next step was to offer a visual presentation over 3 investment horizons (“Markets in 3D”). Indeed, when considering any markets, we believe it is essential to put the current trend in the perspective of the longer term price move as well as offer the possibility to monitor the shorter term price swings. Based on these simple concepts, FinGraphs offers a unique Decision helping tool. It differentiates from traditional technical analysis toolboxes as you do not need to be a market technician to use it. The concepts are straightforward, yet encompass all aspects of market decision making.You can be operational within the day. FinGraphs also differentiates from recommendation engines. Indeed, instead of delivering punctual calls on specific investment horizons, it offers a continuous live updated analysis on any covered instrument (5’000+) over a wide area of investment time frames (weekly to 5 seconds). Finally, from a technology standpoint, FinGraphs is 100% HTML5 (latest web technologies) and can be accessed on any recent device without downloads or plug-ins (FinGraphs.com has received the newly introduced Google “mobile friendly” denomination). Use FinGraphs and get an instant opinion anytime, anywhere, on any covered instrument over any time-frame in seconds. Finally, FinGraphs does support its product offering by issuing regular promotional research contributions (notably in StockCharts.com’s Top Advisors Corners). This research was nominated as Finalist in the Technical Analyst Awards 2015. 3. How can traders use Fingraphs’ tools to improve their activity and performance? FinGraphs offers a working framework for all Investors and Traders. Indeed, its “3D views” adapt to the investment horizon of each type of market participant. For longer term players, there is an Investor’s View or a combination of a Weekly, Daily and Hourly chart. These time frames will give the trend perspective respectively over the next few Quarters, Months and Weeks. For Intraweek Traders, there is a Trader’s View combining a 60min, a 15min and a 4min chart (perspective over the next days, day, hours). Finally for Intrahour Traders, there is the Scalper’s View (4min, 60sec,15sec) and the Super Scalper’s View (60sec, 15sec, 5sec). All charts continuously update in live streaming mode. Once a Trader (or Investor) has identified the time frame combination that best matches his objectives, FinGraphs deliver an instant yet structured opinion. It’s like a market GPS: in a matter of second, you can assess where you are in terms of trends and how these interplay over your chosen 3 investment/trading horizons. For example, if your longer term and medium term timeframes are labelled as “Bull” and your shorter time frame as a “Bear”, the situation is called as “an intermediate top in an uptrend”. Price targets and Overbought/OverSold indications then help you refine your position in terms of risk/reward: has a trend just reversed, is it sustainable (still corrective or already impulsive), is it reaching exhaustion (targets fulfilled) or in exaggeration (Overbought/Oversold)? All these decision helping elements are presented in a simple visual way. Trading newcomers will gain perspective and structure. They will avoid the traps of continuous bottom and top fishing and more generally of wishful thinking (e.g. shorting the market when it shows 3 Bulls with green upward price projections). More structure over the long run, usually means more successful trading and with success, more transactions. For more seasoned traders, FinGraphs offers instant insight into any situation. You can browse through many situations in minutes and follow your positions in live streaming modeTo do so, FinGraphs offers many monitoring functionalities such as Mosaics of up to 16 instruments on one page with your choice of instruments and frequencies (all live updating, saved into your favourites and that can be popped-out to stream next to any other applications on your screen). All FinGraphs algorithms have been tested for resiliency and accuracy over many years as part of our institutional consultancy activity. On the platform, you can browse back on any chart as far as we have data to see how FinGraphs’ indicators have reacted in past situations (a proof of concept, but also a great training tool). 4. Your offer targets both traders and institutions, what is the main differentiator? For individual Traders/Investors, FinGraphs is available on-line at www.fingraphs.com. Try it out; a 7 days demo is available upon Registration (no further engagements. Subscriptions run at U$60 a month thereafter.The offer includes circa 5’000 instruments in delayed mode as well as 250+ FX, Precious Metals and CFDs instruments in real-time live streaming mode sourced from OTC sources.If you can’t bother registering, please also note that all historical charts older than 3 months are available for free without even registering. For example, you can browse back through our Dow Jones Industrial charts into the early 1900s or through several years of intraday/intrahour charts. For institutions, FinGraphs can seamlessly integrate into your current platform and infrastructure. These corporate packages can integrate any price feed (any coverage), be white labelled as well as link in and out from your environment wit no separate Login. The technology, which is based on extensive clustering, can manage extensive data acquisition and storage into our databases. On the server side, it can deliver high accessibility to large populations of end-users. For more information, please contact us at support@fingraphs.com. 5. Data is becoming increasingly a bigger area when it comes to trading. What is your advice to traders about using data and graphs for trading and investing performance in general? Data is essential for trading (price, volumes, open interest, social sentiment data, …) and especially for technical analysis. Yet, in years to come, Data provision will be increasingly decentralized and commoditized as more OTC sources become accessible through simple APIs.The real valued added will lie in the treatment and structuring of the data to create meaningful decision helping applications. 6. You are quite active in Twitter. Can you tell us what accounts you and your company are managing and what of those feeds can be interesting for traders to follow? FinGraphs runs a series of promotional theme based Twitter accounts (@fgforex, @fgusequity, @fg4eft) as well as several co-branded accounts with specific on-line brokers (@fg4oanda, @fg4Dukascopy). These accounts are non invasive: they do not engage in aggressive follow/unfollow tactics and only sporadically in marketing activities. They are meant to help followers discover our methodology. Every several minutes, they generate randomly chosen charts on a selected coverage corresponding to their theme. A general account (@FinGraphs) consolidates all theme based posts and picks and chooses specific posts from my personal account and the co-branded accounts. We are also quite active on StockTwits and Linkedin. 7. With the daily trading volume of the Forex market reaching $5.2 trillion in 2014, what do you see as being the most important considerations for the industry going forward? FX trading in emerging markets is on an aggressive growth path and strategies focused on client acquisition will remain the norm. In the more mature markets, the market is quite crowded and client acquisition costs are quite high. We believe that brokers will attribute increasing value to their existing client base, offering additional value added services (such as FinGraphs or other decision helping and educational services) to extend their client’s trading life expectancy and generate more organic growth from this existing client base. Larger players will also try to differentiate through more price transparency in order to gain institutional market share. 8. What is your perspective on the emergence of new digital currencies such as Bitcoin in the context of Trading? It’s the Wild West of FX trading and as such holds great promises. The idea of a worldwide electronic currency independent of Central Banks and their money creation is very appealing. In one form or the other, Bitcoins or an alternate electronic currency will probably thrive in the near future. Such initiatives have existed locally for many years. For example in Switzerland we have the WIR system, which has been in place since the 1930s . You can actually buy gas anywhere in Switzerland using WIR. Yet, none of these have been able to gain enough traction globally, probably do to a simple lack of ambition. If Bitcoin can shrug off their “Dark side” (money laundering, embezzlement scandals) and gain more institutional backing, we believe it may even replace Gold someday as a wealth preservation vehicle. Indeed, it bears no storage cost and can be “physically” exchanged with a click. 9. Do you expect to integrate Bitcoin data in your charts in the future? They certainly seem fun to trade. The spike in 2013 reminds me of Gold in 1980. Let’s hope it will take less time to recover and starts moving again. Unfortunately, none of our current data providers follow Bitcoins prices. We would be delighted to integrate them if they did and are open to suggestions. 10. Algorithm trading represents around 80% of trading activity at the moment. How do you see the future for algorithm trading, in terms of technology and regulation? The proportion of volume traded through algorithms has gradually increased over the last 30 years.One may wonder if any human being will be participating at all in the future Yet, it follows the democratization of computer power and programming languages (think ZuluTrade or our newly met friends from Qubitia for example). On the institutional front, issues related to fiduciary duty, alignment of strategies and risk management are also pushing for more systematic processes. When considering algorithm trading, it is crucial to differentiate certain unethical High Frequency trading tactics, mostly focused around front-running other market participants, from mainstream computerized trading, which is perfectly legitimate. As for regulation, they will follow the path of least resistance as long as excesses don’t become blatantly outrageous or result in substantial market damage. 11. What is your take on social and mobile trading technologies? Social trading is yet another example of the dis-intermediation of the financial industry and more generally of the peer to peer economy. Qualitative performance assessment will be key in determining which platforms dominate the space in years to come. Mobile trading is a leapfrogging technology, especially in emerging markets where people often have access to mobile phones before any other connected devices. In the developed world, brokers and banks are competing aggressively on mobile trading innovations.The aim is to keep traders captive and connected throughout the day. In a recent example, IG group, Etrade, Fidelity or Robinhood, among others, have already rolled out their Apple watch trading applications. A significant portion of the trading activity has already shifted towards mobile. Today, mobile trading is a must have for any serious trading venue. Yet, mobile developments are still expensive. Indeed, they need to adapt to a large spectrum of devices and operating systems. Doing it correctly requires a large development infrastructure in order to continuously adapt to new versions and technologies. As many smaller players, FinGraphs has chosen to focus on HTML5 web technologies and the related responsive design concept. It’s a gradual process and each version of our website improves its mobile friendliness. That said, we are always be open to any partnerships or co-operations initiatives to further boost our mobile capabilities. 12. In your opinion how will the new generation of investors and traders manage the accelerate growth of social trading, regulation, social media, and online gaming? Possibilities are immense and new product offerings will multiply. In our view, the biggest challenge going forward will be to identify quality offerings among the crap. There will always be hoaxes, there will always be credulous investors, yet quality will prevail as on-line communities help differentiate the good from the bad in an increasingly connected economy. As for official regulators, it is increasingly difficult for them to reign in a globally decentralized peer to peer economy. |

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading