Interview with Marshall Gittler Head of Investment Research at FXPRIMUS.

Marshall Gittler is the Head of Investment Research for FXPRIMUS, and previously he had some high-profile roles such as Chief Investment Officer Bank of China (in Switzerland), Chief EMEA Strategist, Chief Asian Strategist, Deutsche Bank Private Wealth Management, Head of Asian Currency Strategy Group Bank of America and a position in Merrill Lynch.

Marshall Gittler is a world leading capital markets strategist, investment specialist, and economist with a successful track record at managing research trading-investment for banks-brokers and in private wealth management. You can see him in the likes of Bloomberg, Reuters, and many other key financial players talking and analyzing the markets.

Cypriot fast growing retail Forex broker FXPRIMUS appointed Marshall Gittler as its new Head of Investment Research in late 2015 where he leads the research and capital markets specialists. This hire by FXPRIMUS shows how much they are investing in forex education – FXPRIMUS EDUCATION – and in creating a stable focus in becoming the “safest place to trade”.

Marshall is an international rated analyst in FX and fixed income; he is well versed in equities and alternative assets. His experience is close to none as an experienced high profile analyst of global economies and markets with particular expertise in Asia.

Marshall is an articulate communicator with considerable experience in media and also making trading and market analysis presentations and appearing on TV. Have written reports at all frequencies: daily, weekly, monthly, quarterly, and ad hoc.

Throughout his financial career has managed international trading and investment teams in different high profile financial and trading organizations. He speaks and reads Japanese at a professional level.

tradersdna interviews Marshal and talks about his profile, education and long career where he has keeping a high profile as one of the top capital market analysts, initially in big banks and now in fast growing brokers. We asked Marshal his views about the market, currencies, the industry, innovation and how he sees the future of trading and investing.

tradersdna Question 1: Can you tell us about yourself, education and career in the markets

M. Gittler: The formative experience of my life was that I spent a year as a high school exchange student in Japan. I then went on to college where I studied history, went back to Japan to study Japanese history for a year, and then got a job as a journalist with a financial newswire. They sent me to London to cover the financial markets. That’s how I learned about markets: by talking with traders, salespeople, and economists and writing about the markets every day. Many people were very generous with their time and would explain difficult concepts to me quite patiently, even though I had only had one introductory course in Economics. Others…well, I had a few people slam the phone down on me when I asked them a question that I should’ve known! But I learned through that, too.

Until 1985, the Tokyo Stock Market didn’t allow foreign firms in, but then that year they allowed all the foreign corporations to have a seat at the same time. That created a huge demand for bilingual people and in 1987, I moved from being a reporter to being a bond market analyst in Japan. I spent 11 years analyzing the Japanese bond market for UBS, Merrill Lynch, and SBC Warburg.

Then when Japanese interest rates got so low that foreign investors were no longer interested, I switched over to foreign exchange, where there’s demand for information from non-Japanese as well. I got a job as Head of Asia FX and Rates Strategy for Bank of America. Subsequently, my old boss from Merrill Lynch, who had since moved to Deutsche Bank, recruited me, and I went to work as the yen strategist there.

Eventually, I moved from FX strategy into Private Banking in Singapore as the Chief Asian Strategist for Deutsche Bank Private Wealth Management. After a few years, they moved me to Geneva as the Chief Strategist for Europe, Middle East, and Africa.

Later I decided to go back to foreign exchange analysis and so here I am at FXPRIMUS.

Question 2: You are a renowned expert in the field of fundamental analysis, with over 30 years’ experience researching the markets, how do you see the markets now?

Marshall Gittler: We are now in a unique time in financial history. Never before in the history of humankind have interest rates been this low, indeed harmful in many cases. Never before has so much depended on the actions of a few people running the central banks. The overwhelming influence of central bank policy makes it difficult to read market signals because the impact of the central banks’ activities drowns out all the information coming from other sources. It’s like you’re trying to hear someone whispering far away while a trumpet player blares his horn next to you.

The other significant change in the markets in recent years is the increased correlation among markets. There seems to be only one trade: risk-on or risk-off.

The low (or even negative) level of interest rates means investors can’t find any suitable risk-free investment while the increased correlation among markets means investors can’t get safety through diversification. The net result is that this is one of the most difficult times in history to be an investor.

Against this background, the FX market shows its advantages. It’s the most liquid market and is usually the first to react to any change in the investment outlook. Plus there are always some opportunities: currencies are always moving.

Question 3: Your career spans a range of elite investment banks and international securities firms including UBS, Merrill Lynch, Bank of America and Deutsche Bank. You are now with FXPrimus can you tell us why your choice and what you highlight in this financial company?

Marshall Gittler: I was attracted to FXPRIMUS by its ethics. You know, we bill ourselves as “The Safest Place to Trade.” I’m in Research. That means my success can be judged in part by how successful my clients are. I wanted to work in a firm that values the security of its clients over all else. In this case, the company’s fundamental pillar of safety goes hand-in-hand with the work that I do to educate clients for them to make informed trading decisions.

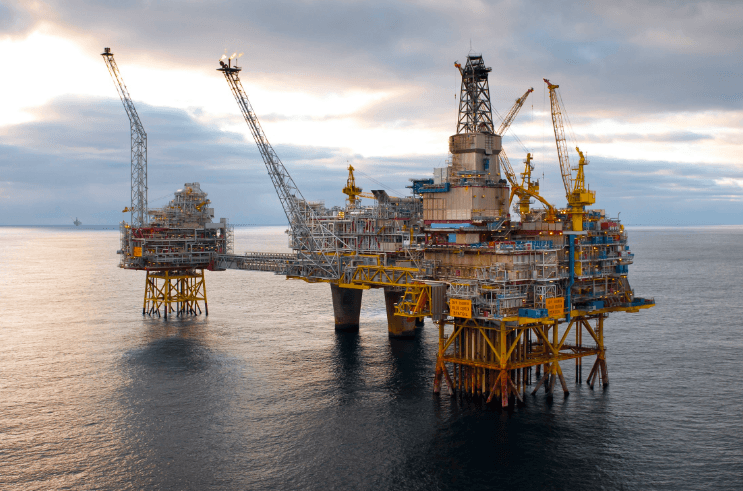

Question 4: Commodities are going through big moves, particular the Oil price has been going through very lows and now some growth, what are your view on that?

Marshall Gittler: The movements in commodities recently have been nothing short of astonishing. Oil collapsed over many months and then rose 50% in a few weeks. Meanwhile, iron ore and steel prices have been soaring because of extraordinary speculative trading in China. My feeling is that the big recovery in commodities recently is somewhat of a bubble. I was surprised that oil didn’t fall after the meeting between OPEC and Russia broke up with no agreement, and amazed that it has managed to stay high ever since. I expect the Saudis to continue their policy of flooding the oil markets, and I expect oil prices to fall back later this year. Meanwhile, iron ore, coal and steel prices have already started to come down sharply as the

Question 5: How do you see the main present Forex trends and what are your views and highlights for the main currencies?

Marshall Gittler: Markets had been driven by the “monetary policy divergence” theme, but investors have now largely discounted the possibility of any tightening by the Fed this year. That’s left people searching for a new theme. There has been some speculation that the US agreed to cap the dollar’s strength to prevent the CNY from devaluing, which would have made life even more difficult for Asia’s currencies and could have sparked a new round of the currency wars.

I think the market is now focusing on two major themes: commodities and China. Of course, these two are intimately related, in that demand for commodities is largely a function of Chinese growth. But they form two different channels of transmission to the FX market.

Weakness in commodities, particularly oil, affects a few specific currencies, namely CAD, NOK, RUB, MXN, NZD, and AUD. Weakness in Chinese growth, however, has an impact on all of the Asian currencies, including the yen, and also has an impact on the US. The Fed has made it clear that “global financial conditions” are one of the major factors that it takes into account when setting monetary policy. “Global economic conditions” is a code word for Chinese financial markets. So a weak CNY or weak Chinese stock markets tend to push out expectations of Fed tightening and thereby weaken the dollar, too.

However, I see many Fed officials pushing back against the market’s view on interest rates. I think the market is underestimating the possibility of rate hikes in the US and that as opinions change, the dollar will strengthen.

Given my view on oil mentioned above, I would expect the oil currencies and commodity currencies, in general, to do poorly.

The big wild card for the FX market though is Brexit. As the polls show the “Remain” side winning, the market seems no longer so worried about that factor. But it still is hugely important. If they vote “Leave,” not only might the pound collapse, but the impact on the euro would be severe as well. That would be the defining event of 2016.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading