As political uncertainty continues, fears that fundraising opportunities will worsen in the Private Equity industry have increased, according to the latest annual industry report from IQ-EQ, a global investor services provider. The research, based on a survey of over 120 fund professionals globally, shows that despite the industry remaining resilient overall, fund managers will need to prepare for an increasingly competitive environment.

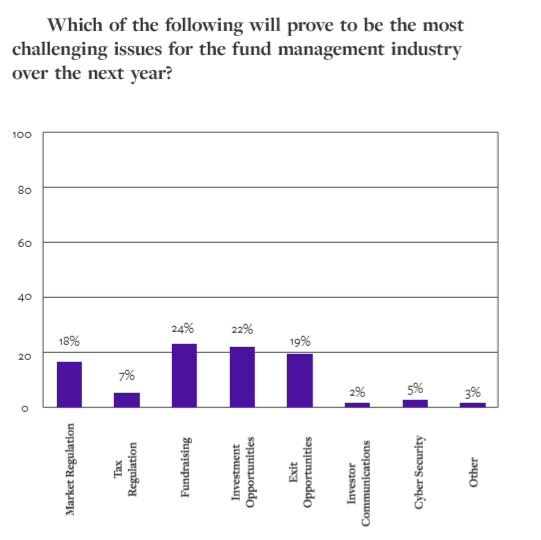

Last year half of all money raised was directed to the 50 largest funds in the industry, suggesting that competition to attract capital will be fierce, particularly for the smaller players. This is reflected in concerns from fund managers around fundraising as 30% of respondents reported that they felt fundraising would becoming more challenging in 2019 compared with 19% the year before. Similar sentiment is also seen in managers’ views on what they predict to be the most challenging issues facing the industry in 2019. Both fundraising and investment opportunities held the top spot, suggesting that stiff competition in the UK private equity market will continue.

Interestingly, the data shows that the issue of investor communications has slipped under the radar for most fund managers. Only 2% of respondents mentioned this was a focus for 2019, suggesting the industry is underestimating the importance this holds during times of uncertainty.

Speaking at IQ-EQ’s recent thought leadership event, following the publication of these results, Justin Partington, Group Head of Funds, said: “The UK is still a promising sector for long-term private equity investing. Although confidence in the market is slightly lower compared with previous years, and investors are becoming increasingly cautious, there is still an opportunity for firms to stand out. It is clear from the survey findings that building and developing strong investor relationships will need to become a priority. Improving this through class-leading transparent financial reporting and access to portfolio data will put managers in good stead to gain that crucial edge in an unpredictable environment.”

Professor Richard Taffler of Warwick Business School, also speaking at the event, commented on the results from the perspective of the investor. Taffler, who focuses on the role of emotions to explain investor and market behaviour also highlighted the importance of investor relations. He commented: “To invest is to trust and investors will stay with fund managers where this has been built. Investment decisions are inherently emotional and managers need to understand this both in dealing with their clients and the uncertain environment more generally.”

The report provides an annual snapshot of industry sentiment, and can be downloaded in full here.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading