Japanese stocks were back in bear market territory on Wednesday, as investors poured into the safety of the yen amid global economic instability.

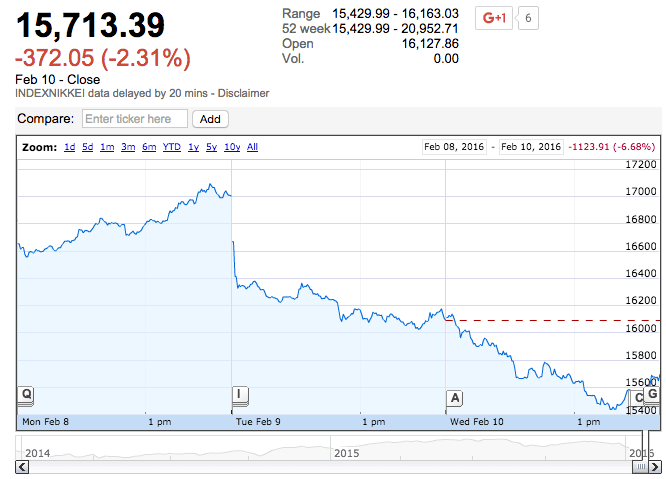

The benchmark Nikkei 225 dropped 372.05 points or 2.3% to 15,713.39, adding to Tuesday’s 5.4% decline. The Nikkei is down more than 20% since mid-2015, signaling that it had entered a bear market.

The Nikkei first entered into bear market territory last month following a two-week rout to start the year. Japanese stocks are down more than 17% for all of 2016. The Nikkei has fallen more than 5,000 points since its July 21 high.

Other Asian markets remained closed on Wednesday for the Chinese New Year holidays.

A surging yen continued to pressure Japanese equities on Wednesday. The global safe-haven currency strengthened to 14-month highs against the US dollar. The USD/JPY exchange rate fell 0.2% to 114.87, the lowest level since November 2014.

The US dollar is currently trading near four-month lows against a basket of world currencies. The dollar index, which measures the performance of the US currency against a basket of rivals, has declined in six of the past sessions. It was little changed at 95.15 on Wednesday.

European markets finally emerged from a seven-day rout that pushed key stock indices to multiyear lows. The Europe STOXX 600 Index rallied 2%, paring its losses for the year down to around 13%.

London’s FTSE 100 Index rallied 0.6% after reaching a three-year low in the previous trading day.

American stock futures were trading higher ahead of Wednesday’s opening bell, indicating a potential for upside movement after US stocks registered declines in the previous session. The Dow Jones Industrial Average has declined more than 8% since the start of the year.

Energy futures rebounded on Wednesday following heavy losses in each of the previous two days. The West Texas Intermediate (WTI) benchmark for US crude recovered around $28.46 a barrel, gaining 52 cents or 1.9%. Global benchmark Brent crude climbed 61 cents or 2% to $30.93 a barrel.

Oil futures took a beating on Tuesday after the Paris-based International Energy Agency (IEA) said it expects the global supply glut of crude to worsen through the first half of 2016. The supply overhang was largely attributed to higher production from OPEC members. The IEA said that supply is expected to outstrip demand by 1.75 million barrels per day through the first six months of the year, up from a prior estimate of 1.5 million barrels per day.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading