Why Liquidity is a Slippery Concept When Applied to ETFs?

This is the second part of the article about Liquidity and ETFs. As we started in the last article about this subject Liquidity is a Slippery Concept When Applied to ETFs Part 1 we will follow up and conclude our reflections about the subject.

At that point, or perhaps a little later, a trader can place orders within this bid/ask spread and they are very frequently filled. It is important that traders use limit orders in situations such as these, in part because there is often a small time delay that must elapse before the market makers can fill the resting limit order, and also because chasing many of these (thinner) ETF markets can result in large “slippage” costs. Also, the “Assets Under Management” (AUM) statistic seems to be far less relevant in ETF trading.

Chris Hempstead, head of ETF Trading for WallachBeth Capital said some time ago, “There are very few examples of ETFs that come to market with more than $5 million in AUM or an excess of 200k shares outstanding.” He explains that those investors who fund or “seed” new ETFs are usually quite knowledgeable and competent. Moreover, according to Seeking Alpha, ten of the top 30 performing ETFs year to date have AUM below $50 million.

An understanding about how market making and arbitrage work can help traders devise a strategy for trading larger size orders without moving the market any more than necessary. That said, arriving at a detailed understanding of most of these markets is a very painstaking and time consuming process and anyone trading in size should probably seek some help from a professional at the beginning. Many of these markets have their own “personalities.”

An example of how this sort of internal market knowledge might help traders place the best trades is the case of an ETF that follows an index of relatively thinly traded smaller cap issues, perhaps one of the small cap technology or emerging market ETFs. These kinds of markets frequently carry underlying issues whose total bid/ask spread is ten or even twenty times as wide as the bid/ask spread of their respective ETFs. (The bid/ask spread of the underlying issues, or iNAV or “Intraday Indicative Value,” is calculated every fifteen seconds and is available through a variety of vendors.) Thus we can picture a frequently occurring scenario where there is a wide band representing the wide bid/ask spread of the aggregate prices of the underlying issues (NAV). Also, within this wide band there is a narrower band that represents the narrower bid/ask spread of the ETF.

Now when this narrower band trades near the periphery defined by the wider band, large orders strategically placed are often much less likely to move the market. Say the narrow band is trading near the top NAV offering boundary. Since the midpoint of the ETF bid/ask spread is higher than the midpoint of NAV bid/ask spread, the ETF is thought to be trading at premium to the underlying equities. Since arbitrageurs generally tend to move prices closer to the midpoint of the NAV bid/ask spread, a big buy order here is less likely to move the market very much. Moreover, the price of the ETF is less likely to trade all the way to the NAV offer (the top band line) because most of the arbitrageurs will usually have executed their arbitrages before that price. Both the premium ETF valuation and the nearness to the NAV offer are preconditions that will ordinarily slow down price movement and “backstop” large orders.

Thus we see that by understanding the arbitrage process and the creation/redemption mechanism in ETF trade, we can arrive at a more accurate notion of what “liquidity” means in these markets, and simultaneously understand more thoroughly which markets to trade and how to trade them.

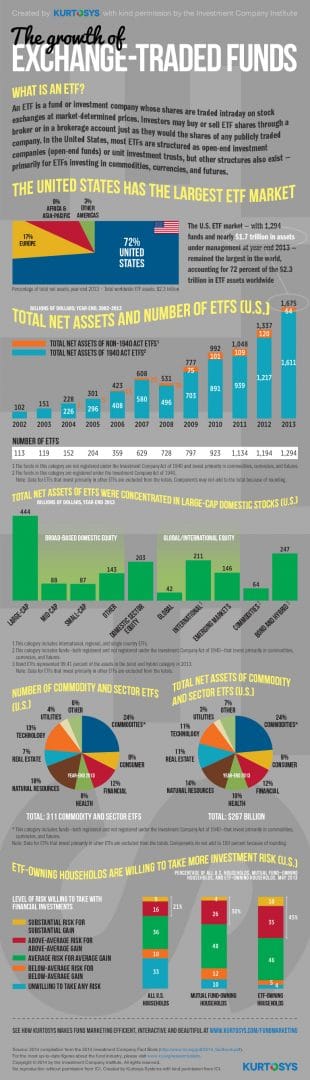

To finish an excellent educational infographic about The Growth of ETFs Infographic created by Kurtosys with kind permission by the Investment Company Institute.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading