2019 is just around the corner, and it promises three key tailwinds that will help positively drive returns for investors. In first place, the decline in stock markets offers opportunities in the shape of valuations, attractive in many sectors and countries, especially in emerging countries. Secondly, with the global growth forecast to slow down, it is expected a continued corporate profits growth in many of the major economies. Lastly, banks and other financial institutions have significantly enhanced their capital levels over the last decade, making up for the healthier financial system we have seen in years.

All of these assumptions come from the CEO of one of the world’s largest independent financial advisory organisations, Nigel Green. However, the expert also states that there are clear headwinds on the horizon that could weigh on investor outcomes. In an optimistic optic, he states that 2019 is set to deliver decent returns to those invested with a properly diversified portfolio.

The three key tailwinds

Mr Green believes that 2019 would be a good year for investors if they are able to diversify their portfolios and and are up to invest in the upcoming opportunities.

First, following stock market falls in recent months, valuations are attractive in many sectors and countries, relative to the returns on cash and likely corporate earnings growth. Emerging markets in particular are offering value.

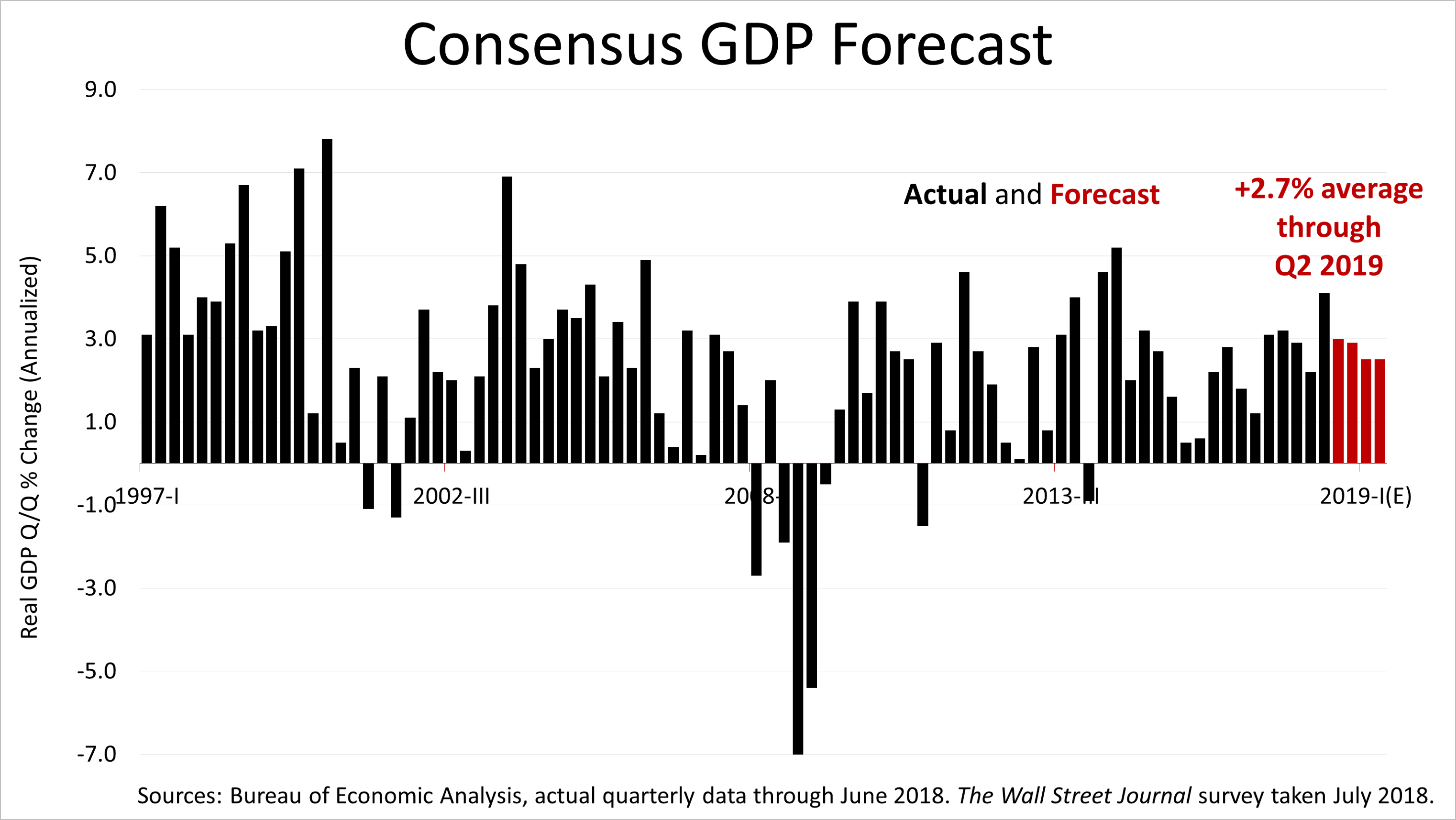

Second, global growth expectations have been reduced in recent months But with global GDP growth in 2019 likely to be 3.0% plus, we expect continued corporate profits growth in many of the major economies and in particular the U.S. In addition, the U.S. Federal Reserve has signalled that next year’s planned interest rate hikes may be delayed if economic data weakens, which last week’s relatively modest payrolls data and November’s inflation data suggests is the case. Should the Fed push back raising rates, this will help support the U.S., and therefore global, economy.

And third, the world’s financial system is in a much better condition. Banks and other financial institutions have significantly enhanced their capital levels over the last decade, making them more capable to withstand defaults on loans.”

Whilst these factors can be expected to boost investor outcomes in 2019, there are also issues that may do the opposite.

The deVere CEO comments: “The main headwinds that could drag on investor returns include the ongoing trade dispute between the world’s two largest economies; higher Treasury yields, which will raise the risk-free rate of capital; higher inflation; and the uncertainty of Brexit.”

Nigel Green concludes: “History teaches us that stock markets go up over the long term, so I would urge investors to remain invested. No-one wants to miss out on returns. But investors need to ensure that their portfolios are well diversified, meaning across asset classes, sectors, regions and even currencies. This is the best way to mitigate risk and take advantage of the important and rewarding opportunities.”