• Brent crude price hovers around $80 amid supply concerns but gains held back over global growth worries.

• Gold sparkles as dollar declines, with prices hovering around six-month highs, helping mining stocks.

• Covid infection rates lead to fresh sell offs for Chinese stocks.

• Ukraine’s Zelensky in Washington amid expectations of further US military aid pledges.

• Speculation lifts Patriot system manufacturer Raytheon in after-hours trade.

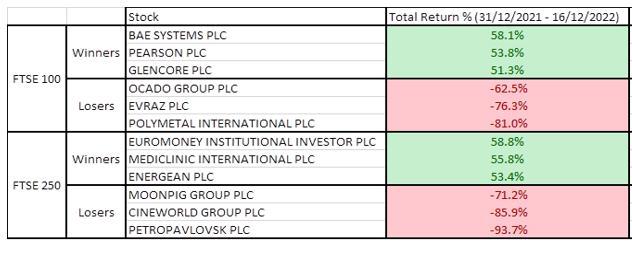

• BAE Systems and Pearson the biggest gainers on the FTSE 100 this year, while Russian miners were the biggest losers.

• Ocado and Moonpig also big fallers as cost-of-living headwinds mounted in 2022.

By Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown:

There are fresh supply concerns in oil markets after a bigger than expected fall in US stockpiles amid hopes that China will try and stoke domestic demand with a stimulus plan to boost growth. The benchmark Brent crude is hovering around $80 a barrel but gains are still being capped by worries hanging over financial markets about ailing economic growth across the global economy as the monetary screws are turned even tighter. Central bank policymakers may seem Grinch-like in their determination to raise rates further but they believe rampant inflation will prolong problems for companies and consumers if it’s not wrestled down.

Some sparkle has been reserved for gold investments though, with the drop in the dollar helping spot prices reach six-month highs. The weaker dollar makes the metal cheaper for foreign buyers and there may also be a ‘safe haven’ play coming in as well, given the pessimism surrounding prospects for the global economy. This is helping the fortunes of mining companies, with Rio Tinto and BHP rising during the trading session in Australia, which is likely to help the sector during the London session. The FTSE has opened 0.2% higher with its defensive nature coming to the fore again, spreading a small sprinkle of Christmas cheer.

High hopes that the easing of China’s Covid restrictions would see a spurt of energy dart through the economy have been dashed, as infection spreads across the vast country and speculation grows about rising fatalities, even though the official death toll remains very low. The about-turn in policy appears to have caught hospitals off-guard and there are concerns that the infrastructure won’t cope with the number of patients expected to flood into hospitals. Any significant revival in the country’s economic fortunes won’t materialise until these winter waves of infection have passed, so it’s little surprise Chinese shares look set to end the year sharply lower, with the Shanghai composite down 16% year to date and the Hang Seng in Hong Kong down 17% since the start of 2022.

The entrenched war in Ukraine will be pulled into sharp focus, with the visit to Washington by President Volodymyr Zelensky, his first visit outside his battle-worn country since February. Kyiv has been beset by drone attacks, targeting its utilities infrastructure and it’s expected a fresh package of support will be pledged by the US to help its defences, including a Patriot missile defence system. Shares in the Patriot manufacturer RaytheonTechnologies Corp lifted higher in after-hours trading and this focus on contracts for military hardware is likely to provide a tailwind for other defence manufacturers. They have seen their share prices soar since the outbreak of the war in Ukraine as NATO has enlarged and nations have pledged to increase budgets.

Shares in BAE Systems listed in London are up around 50% year to date and the company has posted the biggest total return, including dividends, of any FTSE 100 company, coming in at 58.1%. This is in stark contrast to the fortunes of Russia-focused commodity companies Evraz and Polymetal which were the biggest fallers of the FTSE 100 before being deleted from the index. Russia focused gold miner Petropavlovsk in the FTSE 250 faced a similar fate.

Ocado was also among the biggest fallers on the FTSE 100 having been sideswiped by a mini-reversal of the huge upswing in pandemic business and cost-of-living pressures with shoppers drifting off to cheaper competitors. It’s been affected by ever-increasing price pressures such as higher energy bills and staff costs. There was also disappointment for its high growth Solutions Business, which provides robotic systems for third party retailers to use. In contrast, Pearson has been one of the biggest gainers on the FTSE 100 in 2022, as it shifted up gears in its digital transformation and this acceleration is showing up in sales growth in almost every part of the business. That’s being achieved by some well-suited acquisitions, as well as growth through its own efforts focusing on direct-to-consumer sales and slimming the group’s physical footprint.

In the FTSE 250 Moonpig really came down to earth with a bump, with the Royal Mail strike badly affecting UK orders and customers spending less on gifts as the cost-of-living crisis intensified. Revenue may recover but investors are still clearly nervous about the prospect of sustained growth for the e-card retailer. Cineworld filing for bankruptcy in the United States has culminated a disastrous few years for the cinema chain, as it struggled to recover from the pandemic horror story so it’s little surprise shares also sank like a stone this year.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading