Stock markets in Europe and Asia swung higher on Wednesday and oil prices also rebounded after better than expected Chinese trade figures eased concerns about the health of the world’s second-largest economy.

European markets rose for a second consecutive day, with the Euro STOXX 50 adding 1.5% in intraday trade. The major stock indices in London, Frankfurt, Paris and Madrid were up at least 1%.

In Asia, Japan’s Nikkei 225 Index closed up 497 points or 2.9%, snapping a six-day losing streak that wiped out nearly 2,000 points from the benchmark index. All but one of the Nikkei’s 225 members reported gains on Wednesday.

Chinese markets ended mixed after a strong start to the day. The CSI 300 Index of the largest companies listed in Shanghai and Shenzhen fell 1.9%.

Meanwhile, Hong Kong’s Hang Seng Index closed up 1.1% for the day.

American stock futures also spiked ahead of Wednesday’s opening bell, with the Dow Jones mini climbing more than 100 points.

Global markets received a lifeline after official Chinese trade figures showed a much smaller than expected contraction for the country’s exports and imports. Chinese exports declined 1.4% annually in December, following a 6.8% drop the previous month, government data showed. The median forecast of economists polled by The Wall Street Journal was for an 8% annualized drop.

China’s imports were down 7.6% in December, well below the 11.5% drop forecast by economists. Its trade balance improved to $60.9 billion in December from $54.1 billion the previous month.

December figures capped off a disastrous year for China’s export sector, which reported its first annual decline since 2009. Investors are hoping that the improved December figures are a sign that the worst may be over.

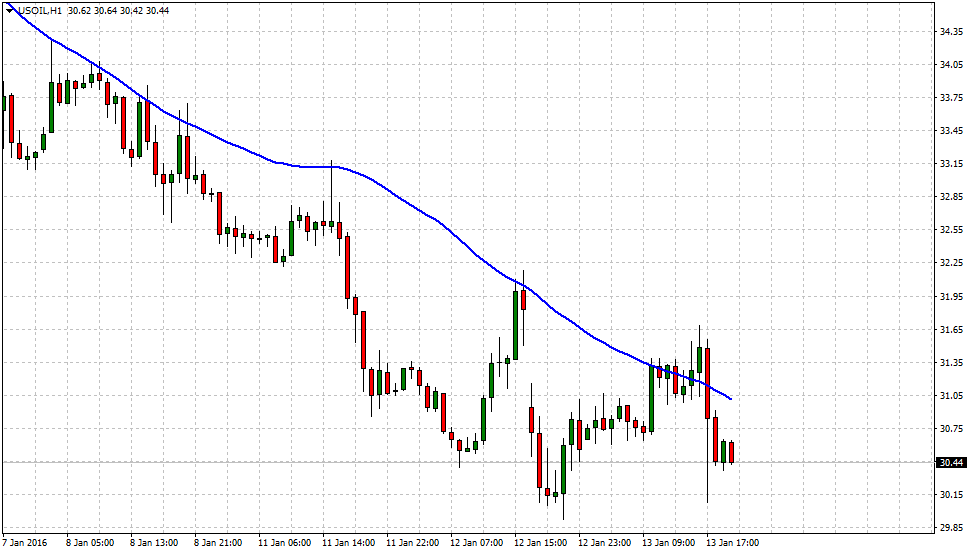

Improved trade figures from the world’s largest energy consumer lifted oil prices for the first time in seven trading days. The West Texas Intermediate (WTI) benchmark for US crude climbed 97 cents or 3.2% to $31.41 a barrel on the New York Mercantile Exchange after briefly falling below $30 on Tuesday. Brent crude, the international futures benchmark, climbed 64 cents or 2.1% to $31.50 a barrel on ICE Futures Europe.

The US dollar continued to dominate the currency markets on Wednesday, climbing for a fourth consecutive day against a basket of world peers. The dollar index reached a session high of 99.33. It was last seen hovering around 99.16, a gain of 0.2%.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading