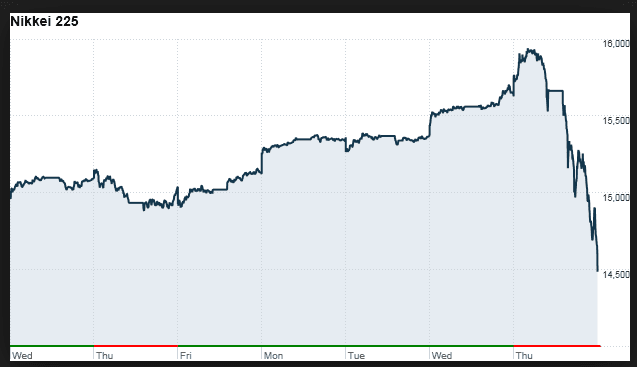

The rout in Japanese stocks intensified on Friday, with the Nikkei reporting its biggest weekly percentage drop since the 2008 financial crisis.

A litany of worries pushed Japanese stocks further into bear market territory on Friday. The Nikkei 225 plunged 760.78 points or 4.8% to 14,952.61, the lowest level since October 2014. With Friday’s drop the Nikkei is down more than 11% this week and 21% since the start of the year, putting it almost on par with China’s Shanghai Composite.

Shares were down throughout Asia. Hong Kong’s Hang Seng Index fell for a second consecutive day since the market reopened after Chinese New Year celebrations. The Hang Seng fell 226.22 points or 1.2% to 18,319.58.

The Nikkei has faced intense selling pressure since attempting a rally at the end of January, as global growth woes, a volatile banking sector and a strengthening yen have weighed on investor sentiment.

The Japanese yen strengthened further against the US dollar on Friday. The USD/JPY exchange rate tumbled 0.2% to 112.81, the lowest level since November 2014. The pair has declined more than 6% in February on broad weakness in the dollar and growing safe-haven demand in Asia.

Elsewhere around the globe, European and North American shares responded positively to rebounding oil prices. The pan-European STOXX 600 Index advanced 2.5% in afternoon trading. The major bourses in London and Frankfurt also rallied more than 2%.

Wall Street also rebounded on Friday, with the Dow Jones Industrial Average posting at triple-digit gain through the midday. The S&P 500 Index also rose more than 1%.

Oil prices were up 5% on Friday after plumbing 13-year lows earlier in the week. Nymex crude climbed $1.46 to $27.67 a barrel. Global benchmark Brent advanced $1.39 to $31.45 a barrel.

In economic data news, the Eurozone economy expanded just 0.3% in the fourth quarter, adding more pressure on the European Central Bank to ramp up its bond-buying program. The Greek economy slid back into recession in the final quarter of the year, as the remnants of last summer’s bailout talks continued to weigh on the market.

Germany, the currency region’s largest member, expanded 0.3% in fourth quarter, unchanged from the July to September period. Growth remained steady in Spain but slowed gradually in France.

US data also showed a modest pick-up in consumer spending last month. Retail sales rose 0.2% in January following a similar increase the previous month, the Commerce Department reported on Friday.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading