A recently disclosed financial update show that mining hardware giant Bitmain lost about $500 million in the third quarter of 2018. The company’s financial update has gone public as the company currently goes through an Initial Public Offering (IPO) that was first filled on September.

As it was mentioned by specialized site CoinDesk, “The Beijing-based company recently provided an update on its financial results to the Hong Kong Stock Exchange (HKEx), which is reviewing Bitmain’s application for an initial public offering (IPO) first filed last September.”

The update showed Bitmain earned around $500 million in the first nine months of last year, on slightly over $3 billion of revenues, according to a source familiar with the situation. The filing, which is not public, does not break down the results by quarter.

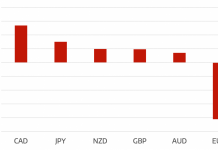

However, “Bitmain previously disclosed it had grossed profits of $1 billion in the first half of 2018. Subtracting that from a $500 million profit for the first nine months leaves it with a net loss of roughly $500 million for the third quarter,” was disclosed by the magazine.

The same update shows that the company had also previously reported $2.8 billion of revenues for the first half, so the $3 billion figure for the first nine months works out to third-quarter revenues of just about $200 million.

These are the first figures that clearly indicate the company’s reversal of fortune following the significant growth in revenues and profits over the past several years documented in the IPO application filed in late September.

The online media also wanted to make clear their multiple efforts to reach Bitmain, though with little success. “When contacted by CoinDesk, Bitmain declined to comment, citing its pending IPO application.” However, the mining giant did contacted the Chinese media outlet Caijing, which quoted an unnamed representative for Bitmain denying the report. “The rumors are not true, and we will make announcements in due course in accordance with the requirements of relevant laws and regulations,” the spokesperson said, according to a translated version of the Caijing article.

However, Bitmain had already signaled it had fallen on harder times with layoffs and office closures around the world beginning at the end of the last year that affected almost every unit of the company. Its main businesses are manufacturing mining equipment and operating mining farms and pools – activities that have broadly suffered from the slump in crypto prices.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading