For centuries, before fiat money was introduced, gold was the main means of exchange in many countries.

Today, gold is one of the most important metals in the world, yet it has no major uses. A large percentage of all gold that is mined is used for investing purposes. Investors and central banks hoard the commodity for its role of a store of value. On the other hand, its ‘poor cousin’, silver has many industrial uses such as the manufacture of pennies, utensils, and jewelry.

As such, there is always a battle among investors on the real definition of gold. Is it a currency? If it is, why does it not have any yields? Is it a commodity? If it is, it has no real large-scale use.

Therefore, to many investors, gold is used as an insurance policy. In other words, they invest in gold to protect themselves in case the fiat currencies and other financial assets collapse.

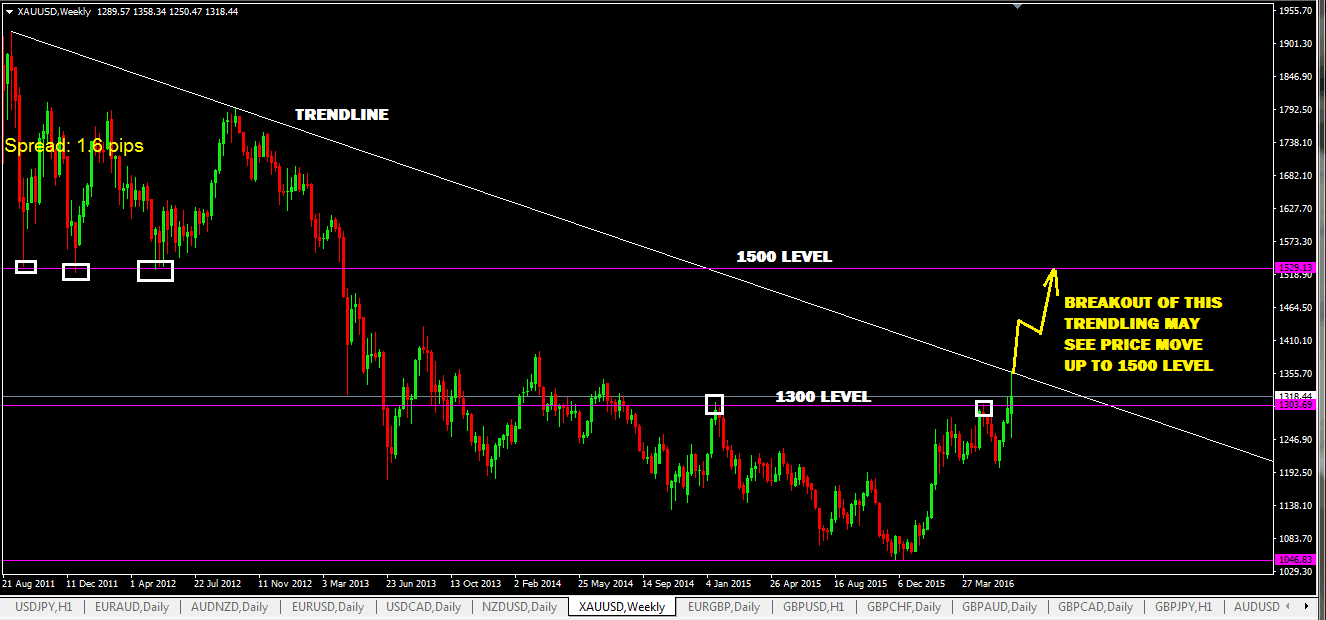

This narrative has worked well for decades as evidenced in the chart below. The chart shows the inverse relationship between gold and the dollar. When the dollar strengthens, traders tend to move from gold to the dollar and vice versa.

As a trader, there are a few options for you if you want to trade in gold. First, you can decide to trade the physical gold where you go to a dealer or miner, buy the gold and sell it. Of course, this is a significantly difficult method to go about it.

The other option is to trade gold mining stocks. Here, you will be trading in companies that mine gold by betting whether their stocks will go up or down.

Trade Gold ETFs:

Third, you can decide to trade gold ETFs. These are Exchange Traded Funds that are focused solely on gold mining companies.

Finally, you can trade gold futures using the Contracts for Difference (CFD) model. A CFD is a financial instrument which allows you to trade on the real price of an asset while not owning the physical asset. As a starter, this is possibly the best way to start trading gold because, you don’t need the full amount of money to trade. Instead, you can use leverage to either buy or sell the futures.

To succeed in gold trading, you need to understand about what moves its price. In this, there are the technical and fundamental factors.

The technical factors work when traders use certain models or indicators to predict the future price of gold. For example, when the Relative Strength Index (RSI) is above 85, chances are that the price will come down as traders take profits.

The second factor is fundamental. Here, traders focus on the major news that could affect the price of gold. As mentioned, traders use gold as an insurance policy. Therefore, when global market risks are rising, traders tend to move to gold. They dump gold when the markets are very stable. Therefore, you should have fast access to financial news, which will help you know how to position your trades. In addition, you need to do the correlation analysis for gold and the dollar. This will help you know whether there is a major or minor correlation on the two.

At easyMarkets, you can create your trading account, fund it, and start trading gold within minutes. To stay protect, we recommend that you always have a stop loss on your gold trades. Also, we recommend that you always risk a tiny part of the money.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading