This is a Guest Post by Nasir Zubairi, Director of Product Marketing at The Currency Cloud, the FX payments automation service. Prior to joining the firm, Nasir founded EuroTRX, an online exchange providing SMEs with simple, low cost and flexible access to capital. He is a non-executive director of Amusis, an equity investment firm, and advisor to the board of Wishbomb.com.

Nasir has held senior roles at RBS and ICAP Plc,having started his career at Reuters.  He is credited as the inventor on several patents for services that have helped evolve trading and distribution models within the finance industry. Nasir is drawn to all things related to entrepreneurship and innovation, particularly in the Financial Technology sector. He advises and mentors several small businesses. Nasir is a Sloan Fellow from the London Business School. He earned his B.Sc. in Management Sciences from the London School of Economics. He regularly writes for and is quoted in the media. He is a frequent contributor to Entrepreneur Country Magazine and blogs for their online medium, entrepreneurcountry.com . Nasir was honoured as “Business Mentor of the Year – 2012” at the UCL hosted Awards for Enterprise.

He is credited as the inventor on several patents for services that have helped evolve trading and distribution models within the finance industry. Nasir is drawn to all things related to entrepreneurship and innovation, particularly in the Financial Technology sector. He advises and mentors several small businesses. Nasir is a Sloan Fellow from the London Business School. He earned his B.Sc. in Management Sciences from the London School of Economics. He regularly writes for and is quoted in the media. He is a frequent contributor to Entrepreneur Country Magazine and blogs for their online medium, entrepreneurcountry.com . Nasir was honoured as “Business Mentor of the Year – 2012” at the UCL hosted Awards for Enterprise.

_______________________________________________________

No more excuses; this is a broken record. Credit crisis, moral hazard, payment protection insurance, taxpayer bailouts, mis-selling, bumper bonuses, rogue trading, “Muppets”, collusion, lending…..the scandals hitting the banking industry roll on and on. The time is now to shift the balance of power away from the banks, to make them sit up and listen. It is time for customers to take control and vote with their feet for better and cheaper services and for transparency and fairness.

Fixing LIBOR and EURIBOR. Mis-selling interest rate products to SMEs. “You have been a naughty boys,”say the FSA, a slap on the wrist for Bob Diamond and some fines. We, consumers and SMEs, will ultimately bear the cost for the penalties handed down, not the bank’s big business or institutional customers. We let the banks get away with it. We continue to fill their coffers. We can’t rely on policy makers or regulators to improve the banking industry. They are applying sticky tape to the gaping fractures that have been exposed and I guarantee the tape will eventually be stretched and ripped apart exposing again the hazard beneath.

If we were to design the financial services industry today, anew, what would it look like? An industry based on the world today, on a fresh understanding of incentives and needs, on technology and new business models, is what I see as the true solution to the crumbling system that surrounds us. A solution that we, as consumers of financial services, are capable of making a reality through our actions and choices.

The banks see us as the least price sensitive segment – we are their goldmine. The big 4 banks in the UK control 85% of SME banking services and about the same percentage of consumer financial services. This oligopoly has hardly been dented since 2007, even though the number of viable alternatives has risen sharply. Entrepreneurs have been drawn to solve the obvious issues and to deliver better services. The next generation of firms are spawning, focusing on specific niches within the chain of financial services.

We are unfairly taxed by the banks for our loyalty. The price discrimination applied to small business and individual customers is staggering and totally unjustified in an age of digital processing. We need the banks to hold and look after our money but we shouldn’t then be handing them disproportionate levels of our hard earned income for a range of bolt-on financial services, especially given the inferior quality of the service we receive.

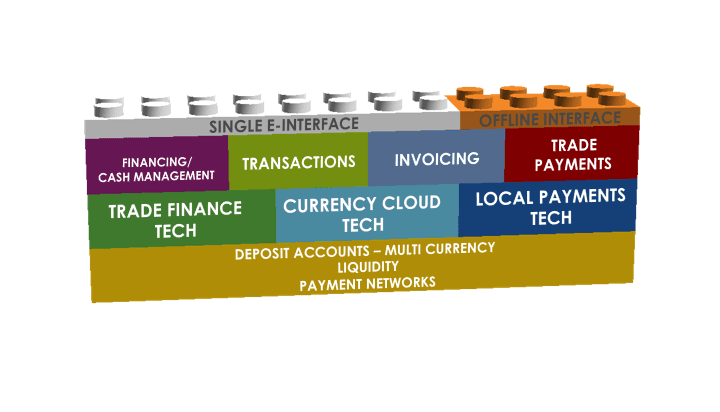

It is unquestionably cheaper to access the services we need through independent next generation providers. It will get even easier too, as “New Finance” firms come together to form complimentary ecosystems that deliver services through a single customer interface. These firms look to analogous financial technology businesses to supply the building blocks for their solutions. New Finance firms recognise, as we all should, that the real competencies of banks are in deposit management, back-office operations and capital markets liquidity – the rest is better done elsewhere.

Firms such as Funding Circle, the peer to business lender, Money Dashboard, Zopa, Tradeshift, Fidor Bank and my own, The Currency Cloud, are working hard to be excellent at fulfilling customer needs, delivering business model innovation to lower cost with high quality technology based services that provide a more fulfilling customer experience, all wrapped in the required layers of security.

It is too late and too expensive for banks to bridge the massive gap between customer needs and the services they deliver. When the banks should have been taking risks with their adoption and use of technology, they took risks with our money instead. It is time we punished them for being below par; we wouldn’t use a cowboy builder twice, so why do we stick to our cowboy banks? We must help the next generation of financial services firms succeed. The power is in our hands; we must embrace New Finance for our own benefit. Shrug off the apathy – take action.

Read More:

mt5 cumulative volume data indicator

draw regrassion channel indicator for mt4

bulls and bears indicator fot mt4

how to handle online loan harassment

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading