How to Remain Patient with Long-Term Investments

For some people there can be nothing more challenging regarding their overall financial goals than remaining patient with their long-term investments. In almost all cases, particularly if you’re investing so you can save for retirement, having a set it and forget it attitude is best, but it can be tricky to overcome the nagging desire to be always checking your portfolio.

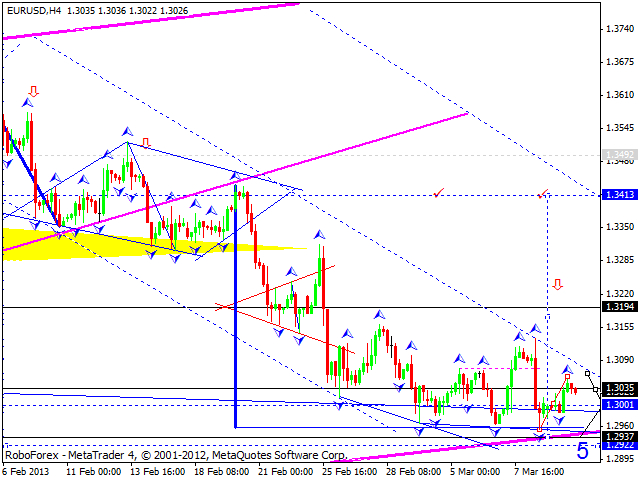

It’s certainly tempting to be watching for upswings among your investments, but just as tempting is the desire to watch every event as it unfolds and fret over what kind of impact it’s going to have on your investments.

In the Firmex report on the mid-market deal environment in 2016, they point out some of the many and very significant events that have had the potential to impact financial markets, including the Brexit vote and the U.S. Presidential election.

So how can you overcome your urges and simply stay put in terms of your investments when you’re looking at a long-term trajectory?

Know What You’re Investing In

The more you know about where you’re putting your money, the more confident you’re likely to feel, even in the face of uncertainty. If you can understand how and where you’re investing, it will give you a more meaningful foundation to also know that long-term is best.

Also, if you are forced to make any decisions that could change your portfolio or your strategy, you’re doing so in a way that’s based on rational information, rather than knee-jerk reactions or unfounded fear.

Tune Out the Media

If you have a trusted financial professional you can rely on for advice and guidance, great. If your only source of guidance comes from the financial media, it’s time to turn it off and tune it out.

The financial media is designed with one goal in mind, and that’s to attract views, readers or clicks. Often this is done through bold headlines and in some cases, scare tactics as well.

The more you follow financial media outlets, the more anxious and the less patient you are likely to feel.

Know Why You’re Investing

Goal-driven investing is one of the best ways to avoid the threat of your own impatience. First, define your overall investment goals as specifically as possible and in terms of your own life. It’s often not enough to simply say you’re investing in your retirement. Set very concrete goals and objectives for yourself that will make it easier to stay the course.

Also, have a reason for including stocks in your portfolio. If you have a well-researched, thoughtful reason you’ve included something, it will make you less likely to get rid of it based on emotion.

As a final note, even if you’re patient there might be times that you simply can’t stay the course. If you have to sell something, sit down and carefully analyze why you’re doing it. If you can provide yourself with concrete, numbers-driven reasons based on logic rather than emotionality, it’s probably okay to go ahead and make that decision.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading