Saxo Bank and CME Group sign content sharing agreement

Agreement bolsters Saxo’s educational resource offering.

Saxo Bank, the online trading and investment specialist and CME Group, the world’s leading and most diverse derivatives marketplace, today signed a content-sharing agreement rendering CME Group’s educational materials available to Saxo Bank’s global client base.

CME Group’s Futures Institute works with industry partners across the globe to distribute best-in-class education aimed at providing market participants with the knowledge and resources to trade futures. To ensure investors understand both the benefits and risks of futures, and options on futures, CME Group provides education on a range of basic to advanced strategies.

Patrice Henault, Head of Futures and Listed Options at Saxo Bank, commented, “Saxo Bank has a proud history in investor education. We want our clients to be able to trade to the best of their abilities and therefore place great importance on broadening knowledge across a range of financial instruments. This partnership with CME Group will further enhance our educational offering.”

Mark Omens, Executive Director and Head of Retail Sales at CME Group, said, “Saxo Bank’s deep network of clients provides CME Group with a great opportunity to actively engage with global traders of all types, giving them a solid foundation on the futures markets. The Futures Institute is focused on taking individuals that are interested in trading in the futures markets and providing them with the proper knowledge and resources to enhance their skills. Teaming up with Saxo Bank helps us achieve that goal.”

CME Group’s Futures Institute is an innovative online platform for futures markets education, trading simulation and market research. The Institute offers a blend of live instruction, interactive training modules, market research and simulated training. Through the interactive website (www.myfuturesinstitute.com/saxo), participants learn about the futures markets and are exposed to numerous trading strategies with the ability to test them out in the simulated trading environment.

Saxo Bank is a leading player in global online trading of margin, derivatives and multi-asset products, with more than 30,000 financial instruments available on its platforms. Saxo’s multi-asset trading platforms deliver reliable, competitive and innovative trading solutions to both institutional and retail customers.

About Saxo Bank

The Saxo Bank Group (Saxo) is an online multi-asset trading and investment specialist, offering a complete set of trading and investment technologies, tools and strategies. A fully licensed and regulated bank, Saxo enables private and institutional clients to easily trade multiple assets from a single margin account on multiple devices seamlessly.

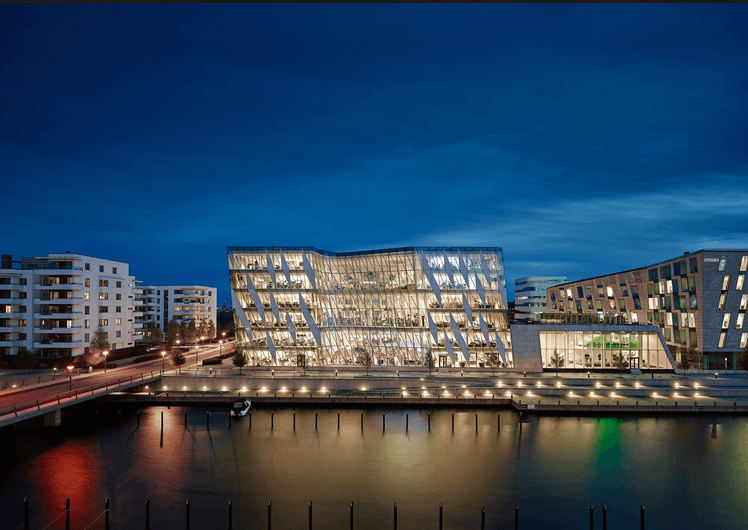

Saxo’s award winning trading technology platforms are available in more than 20 languages and form the technology backbone of more than 100 financial institutions worldwide. Saxo also offers traditional banking services through Saxo Privatbank in select markets. Founded in 1992 and headquartered in Copenhagen, Saxo employs 1500 people in 25 offices across the five continents.

About CME Group

As the world’s leading and most diverse derivatives marketplace, CME Group (www.cmegroup.com) is where the world comes to manage risk. CME Group exchanges offer the widest range of global benchmark products across all major asset classes, including futures and options based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, metals, weather and real estate. CME Group brings buyers and sellers together through its CME Globex® electronic trading platform, its trading facilities in New York and Chicago, and through its London-based CME Europe derivatives exchange. CME Group also operates one of the world’s leading central counterparty clearing providers through CME Clearing and CME Clearing Europe, which offer clearing and settlement services across asset classes for exchange-traded contracts and over-the-counter derivatives transactions. These products and services ensure that businesses everywhere can substantially mitigate counterparty credit risk.

CME Group is a trademark of CME Group Inc. The Globe Logo, CME, Globex and Chicago Mercantile Exchange are trademarks of Chicago Mercantile Exchange Inc. CBOT and the Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX, New York Mercantile Exchange and ClearPort are registered trademarks of New York Mercantile Exchange, Inc. COMEX is a trademark of Commodity Exchange, Inc. KCBOT, KCBT and Kansas City Board of Trade are trademarks of The Board of Trade of Kansas City, Missouri, Inc. All other trademarks are the property of their respective owners. Further information about CME Group (NASDAQ: CME) and its products can be found at www.cmegroup.com.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading