Capital Markets Industry and The advent of social media Trading, Introduction!

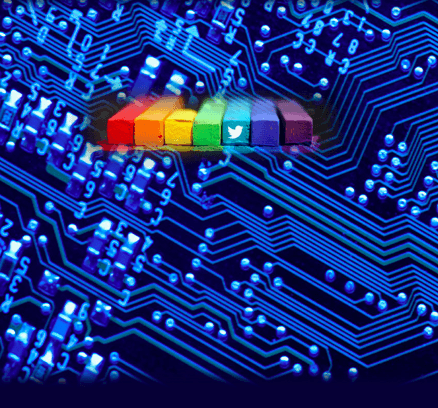

With the advent of the web and social media the finance and trading world are facing new challenges in opening its way of trading, business models, new ways to trade in groups, copy trading and of course with it the related issues and challenges that the social networking and related platforms and communities process bring to traders. There are over 7 Billion people in the world and over 1 billion in social networks so it obvious these people are going to increasingly use social networks for their business, finance and trading activities. The trend will be to see bigger number of users using social related platforms for their trading and financial efforts.

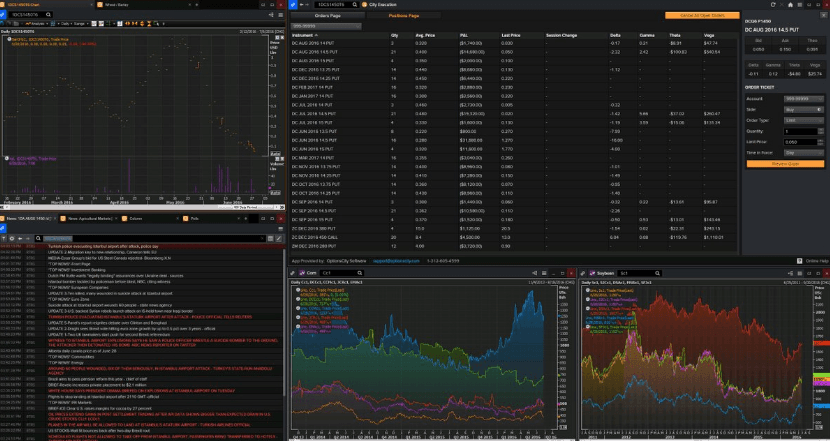

The challenge nowadays is how to react and find ways to monitor possible social media hacking or algorithm trading events. Recently the Securities and Exchange Commission’s decided to let companies and executives use social media sites like Twitter and Facebook to broadcast market-moving news is a huge step ahead and an irreversible move from market makers admitting the importance of social media trading. This alone is now the roule and in fact constitutes a big opportunity for traders to use new extra real time info and social media platforms to improve capital markets signals, sentiments in their ongoing daily activities.

Social Media Trading is disrupting conventional ways of trading and managing finance and investment activities. Whatever the industry sector trading recurs to social media tools and information is now irreversible real time, mobile and social. From Stock trading, CFDs Trading, Futures Trading and specially Forex trading, where there has been a boom of innovating uses of social media trading there are a lot of ways to use social media trading.

So when understanding and using, engaging with specific trading communities such as: eToro, Myfxbook, Currensee, ZuluTrade, MeetPips, Bfxconnect, fxstat.com, StockTwits, Invstr, MetaTrader you can trade and get market insights in ways never possible or imagined in the past. With Social Media trading you can connect with other traders, you have the possibility to discuss, trade, invest, learn and share knowledge across the network, trade targeting new ways.

Some of the top ways you can use social media trading:

- Be able to follow, and automatically replicate top performing real traders with real money in a given account setting specific risk parameters of a trader choice.

- Engage with top traders, capital market news websites, organisations and follow them and get their advice in real time.

- Analyse your performance with hundreds of statistical fx tools, ratios, correlation, charts and graphs using a careful approach to the privacy setting of your choice.

- Discuss relevant capital market calendar events and share trade ideas with your social connections or community.

- Compare your performance to other chosen traders and map evolution of trading and other related critical factors for trading.

- Automatically publish your trades to Facebook and Twitter and engage in specific conversations or groups that can monitor you performance and support better discipline in trading.

- Use the preferred auto trade copy model by paying or receiving commission per trade or success fee based on high water mark only quality of trading.

These new possibilities of democratization of the financial and special the trading industry are possible thanks to the development of new innovation technologies and content access to data, stats, stock data and numbers in the web, digital and social media platforms, technologies, applications available to a much larger amount of people. This fact creates considerable risks and compliance implications for industry professionals but of course enormous opportunities.

How the financial industry and government regulators are trying to answer to the challenges of social media Trading?

The financial industry and government regulators are trying to answer to the challenges of socialmedia trading and to events such as the Twitter hoax that wrongly claimed President Obama was injured in an explosion at the White House. That report alone through the hacking of a serious and credible Twitter account caused the Dow Jones industrial average to drop temporarily by 150 points, erasing $136 billion in market value in a question of a few minutes.

This episode has heightened many concern among traders, regulators about the combination of social media applied for trading and special when in combination with algorithm trading and high-frequency trading. These events shows the vulnerability of capital markets technology systems, but at the same time demonstrates how technology and social media are now part of the game. This fragile systems are at the same time a powerful display of technology and social media innovation and should bot be seen as the problem but also as part of the solution, as the markets were always sensitive to information. The issue nowadays is how to deal with cyber security and answer to hacking disruption or machine conflicts. This challenge is the same big data organisations are facing, government and intelligent agencies worldwide.

High-frequency trading systems are designed to make trades based on specific keywords within milliseconds and this in itself is a powerful advanced and possibility. The challenge is that this technology poses important risks that have to be wisely managed. Events such as the hoax message on Twitter create distractions and poses the threat of in the question of seconds of minutes the possibility of a financial markets crash occur based simply through machines conflict or hacking. This hacking such as the Twitter hoax if entering through credible Twitter sources are them diffused on on Bloomberg’s financial data terminals, Reuters and are diffused as viral powerful poison that when delivering specific messages and information through select Twitter accounts when posting to hedge funds, investment banks and other users can create substantial damage. Here is where advanced control systems need to be put in place and well developed to manage these threats.

However rather than focusing on social media in itself, the emphasis for traders in this new landscape should be on using financial and trading information and the right social media tools and platforms to make decisions that deliver better trading activity and shareholder value in their personal activity and organisation.

These technological and innovation trends that are shifting the trading world are not the end in itself, they are just a way and during history a lot of technologies and innovative approaches were put in place. Change is the rule when it come sto social media and trading. What traders and the overall capital markets professionals need to know and work out are new ways of understanding this new trading ecosystem that is in fast forward evolution with innovative algorithm and social media taking over as the ecosystem where trading operations are now working.

Social Media and Trading Guide to what a Trader and Capital Market needs to work

Having said this some ideas for a draft we will be further exploring in Traders DNA editorial approach about a Social Media and Trading an Introductory GuideAny present trader has to able to work on the bellow:

- Be able to get out of the confort zone of conventional traditional old fashion ways to look at finance and trading activities;

- Understand change, innovation and technology are the only way to go. Although this does not imply any wrong doing or irresponsible use of technology and social media trading for wrong ethical purposes;

- Be technological driven but master the financial and trading DNA settings;

- Interpret digital networking, social media platforms and trends for the finance and trading industry;

- Look at the main challenges and risks social media brings to trading and how to cope with it;

- Learn how to use social media management information to make strategic decisions and develop business;

- Hands-on skills to manage social sentiment, prepare, enter and exit a news related trade;

- Examples of social media trading from the instructors’ own social networks;

- Perform project and personal appraisals and company valuations through social media insights;

- Assess and manage the key drivers of performance and shareholder value though social media indicators;

- How to use social media on a personal and professional level;

- Understand the main compliance and legal risks with social media;

- Get the top insights about social media marketing for trading and finance and how to use it in your organisation;

- Include social media, Twitter, LinkedIn, Google+, Facebook and other community platforms in trading and other financial transactions;

- Master correctly each social media platform you decide to use and invest in education and professional training.

Sources to look and to bookmark:

London New Finance Meetup: 2012-12 Social Media in Finance videos

Twitter Speaks, Markets Listen and Fears Rise

Even Among Quants, Twitter Hoax Raises Skepticism About Tracking Social Media

http://blogs.wsj.com/moneybeat/2013/04/25/even-among-quants-twitter-hoax-raises-skepticism-about-tracking-social-media/

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.