Last week the markets got the data which will in the short-term dictate where the Fed should be going. The possibility of a further 50bps rate cut has all but gone as the market now sees just two 25bps cuts between now and the end of the year.

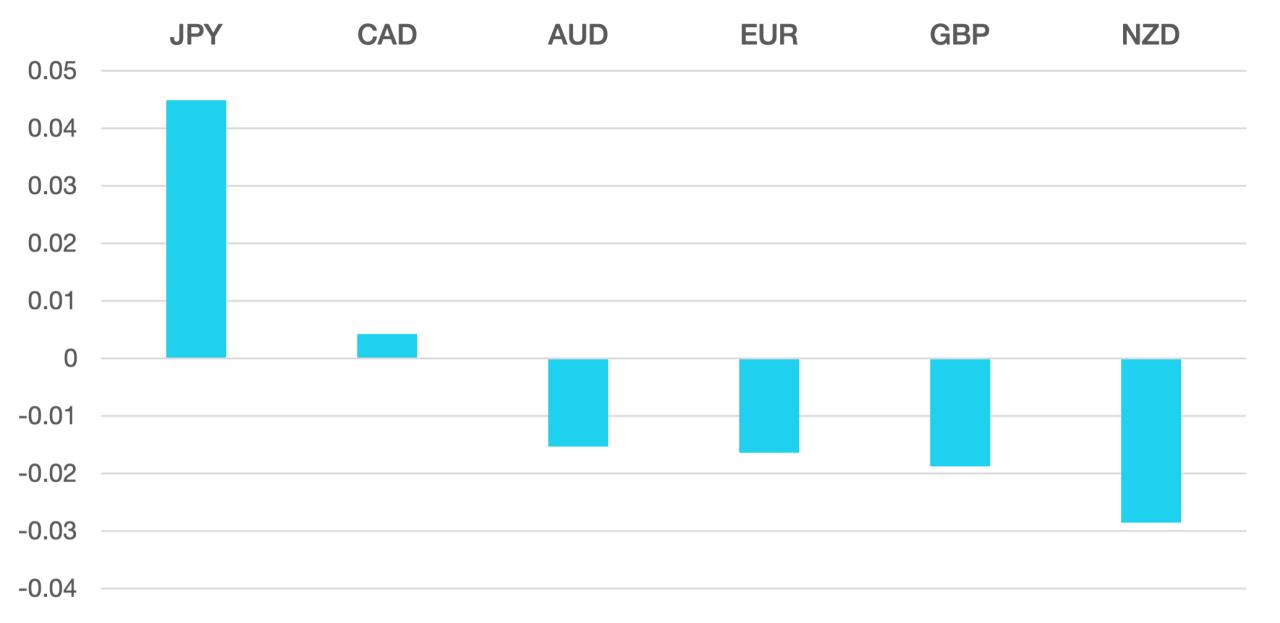

The strong payrolls last week were more in line with the Feds policy outlook and the data boosted the US Dollar which ended the week the strongest, coupled with fresh flows into the bond markets which in turn lifted equities.

CAD ended the week as second strongest as the oil rally continues. Clear escalation in the middle east poses a serious threat to global supply as well as global inflation. Yen struggled all week with the New Prime Minister dovish on monetary policy but with the strong US Dollar all week the Yen had a very disappointing week.

Both GBP and EUR settled into a more mid table position. The ECB unanimous position on October rate cut was in sharp contrast to the BoE divisions with the BoE top officials conflicting views on future monetary policy.

Oil continued to rise as the tension and escalation in the middle east continued to build. WTI rose 8.5% to close just below $75.

The week ahead the markets is expected to be volatile. Any further escalation in the middle east is an unknown and we are now within touching distance of the US Elections.

Market wise we have the RBNZ interest rate decisions along with CPI and PPI data from the US.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Strong Data Drives the Dollar first appeared on trademakers.

The post Strong Data Drives the Dollar first appeared on JP Fund Services.

The post Strong Data Drives the Dollar appeared first on JP Fund Services.