Tag: risk management

Developing a Forex Trading Plan – Part 4

The first thing you need to do when developing a forex trading plan is to try to figure out who you are as a...

Developing a Forex Trading Plan – Part 3

With all this talk of sticking rigidly to a plan, you might be asking whether there are still potential benefits to deviating from your...

Developing a Forex Trading Plan Part 2

Why do you need a trading plan?

One of the main benefits of having a trading plan is that it can make your life a...

Developing a Forex Trading Plan Part 1

While it's always a good idea to learn from other traders, it's equally important to be your own trader, rather than blindly following the...

Forex Trading Golden Rules Part 10: Don’t Make Excuses

As much as we would all like it to be possible for every trade to be a winner, it just isn't possible. Even the...

Forex Trading Golden Rules Part 9: The Folly of ‘Perfect’ Strategies

One of the most commonly-heard pieces of advice for novice traders is to work out a strategy using demo mode and/or backtesting and only...

Forex Trading Golden Rules Part 8: Don’t Add to a Loser

As we covered in a previous Golden Rule, wishful thinking can be the undoing of a trader. One of the most common manifestations of...

Forex Trading Golden Rules Part 7: Timing Is Everything

Wishful thinking can be a great thing in the right context. However, for a forex trader, it's suicide. Yet, many traders indulge in this,...

Forex Trading Golden Rules Part 5: Don’t Go With Your Gut!

There's a time and a place for going with your gut instinct. Deciding on whether to accept a marriage proposal is a good one....

Forex Trading Golden Rules Part 4: Stick to Your Stops

Sticking to your strategy is one of the hardest things to do as a forex trader, especially when your emotions are running riot mid-trade....

Forex Trading Golden Rules Part 3: The Magic 2%

One of the most common - and most frequently ignored - rules in trading is to never risk more than 2% of your capital...

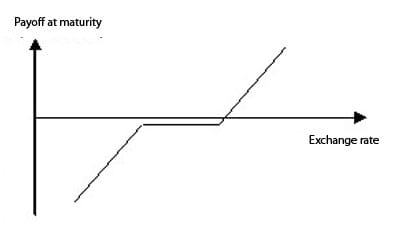

Guide to Forex Options Trading Part 9: Risk Reversals

Risk reversals reflect the expectation of the market in terms of the direction of an exchange rate. When used in the correct context, risk...

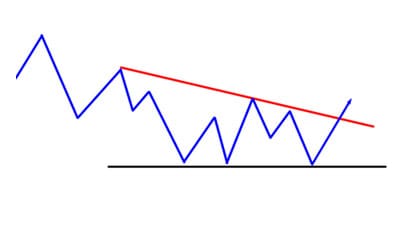

Forex Trading Strategy: Setting Stop Losses Part 2

In the previous lesson, we talked about the importance of using stop losses, and explained the simplest method for selecting a stop loss level,...

Forex Trading Strategy: Setting Stop Losses Part 1

It's a simple fact of life that the forex market is inherently unpredictable. No matter how much you research your trades, it's inevitable that,...

Guide to Currency Correlation: Part 3

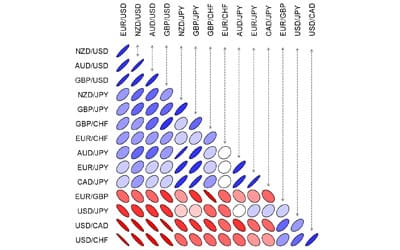

In the previous lesson, we showed you how to use a currency correlations table, and how to calculate these correlations yourself. Today, we're going...

Guide to Currency Correlation: Part 2

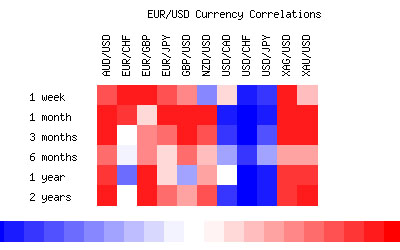

In the previous lesson, we explained what currency correlations are, and why they are useful for forex traders. Today, we're going to show you...

Guide to Currency Correlation: Part 1

If you've been following the forex market for a while, you'll probably have noticed certain trends emerging. For example, you may have noticed that...

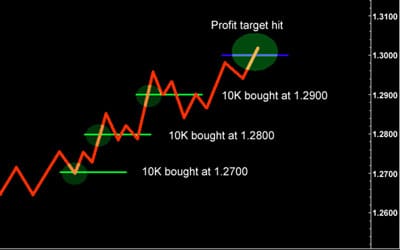

Forex Trading Strategy: Scaling In and Out Part 4

In the final part of our series on scaling in and out of forex trades, we're going to take a look at a way...