Tag: Technical analysis

Using the Elliot Wave Theory to Trade Forex – Part 2

One of Mr. Elliott's key findings is that a trending market tends to move in what he describes as being a 5-3 wave pattern....

Using the Elliot Wave Theory to Trade Forex – Part 1

Although markets, by their very nature, are chaotic and unpredictable, this hasn't stopped countless mathematicians, accountants, scientists, and traders from trying to discern order...

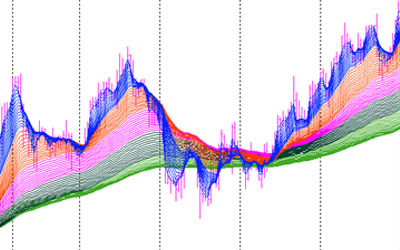

Using Aroon lines to analyse the forex market

The Aroon indicator, created by technical analysis guru and author Tushar Chande, is an indicator that can be used to determine the likely direction...

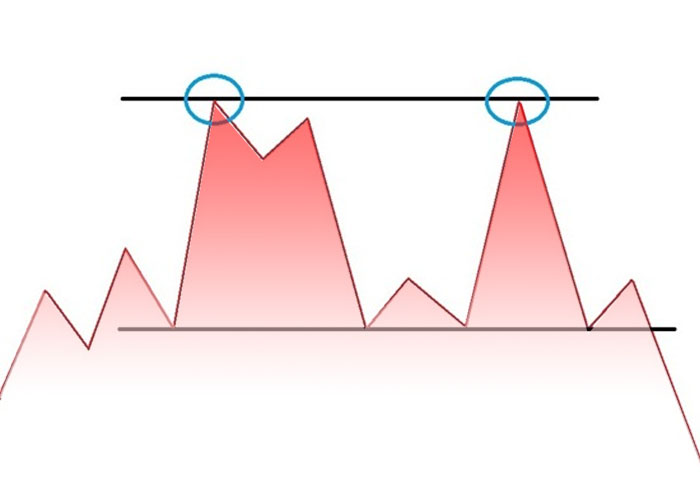

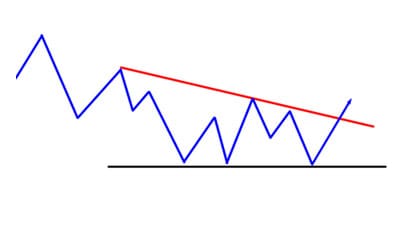

How to Spot Fake Double Tops/Bottoms

Double tops and double bottoms are classic reversal patterns, and they are especially common in charts with shorter time frames. However, you need to...

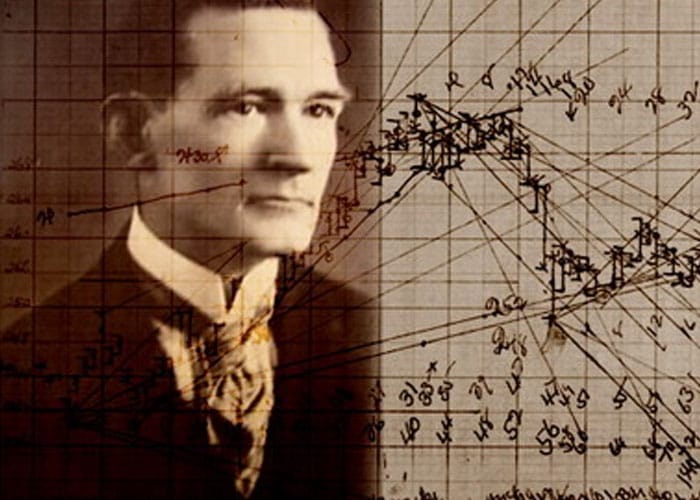

Using Gann Angles to Trade Forex

It's often written in the small print of anything forex-related that “Past performance is no guarantee of future results."

But while this is no doubt...

Developing a Forex Trading Plan – Part 7

Pre-Market Routine

Speak to any professional trader worth their salt, and they'll all tell you the same thing - the pre-market routine is all-important. Top...

Guide to Forex Chart Indicators Part 3: Momentum Indicators

When it comes to spotting trends, two of the most useful indicators are moving averages and MACD. On one hand, these are good ones...

Forex Trading: Analysing the Market Environment Part 4

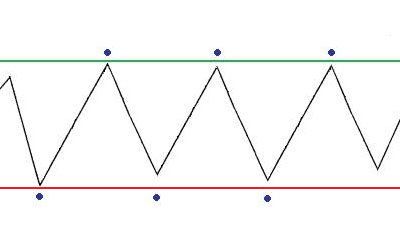

What is a ranging market?

A ranging market is the opposite of a trending market, in that the price is bouncing between a high price...

Forex Trading: Analysing the Market Environment Part 3

Moving Averages in a Trending Market

The ADX can be a useful tool for determining the strength of trends, but it's more reliable if you...

Forex Trading: Analysing the Market Environment Part 2

What is a trending market?

When a price is mostly moving in one direction - up or down - over a given period of time,...

Forex Trading Golden Rules Part 7: Timing Is Everything

Wishful thinking can be a great thing in the right context. However, for a forex trader, it's suicide. Yet, many traders indulge in this,...

Forex Trading Strategy: Setting Stop Losses Part 2

In the previous lesson, we talked about the importance of using stop losses, and explained the simplest method for selecting a stop loss level,...

Forex Trading Strategy: Setting Stop Losses Part 1

It's a simple fact of life that the forex market is inherently unpredictable. No matter how much you research your trades, it's inevitable that,...

A Forex Trader’s Guide to Moving Averages: Part 3

Using Moving Averages as Dynamic Support and Resistance

One use for moving averages is as dynamic support and resistance levels. We cal them dynamic because,...

A Forex Trader’s Guide to Moving Averages: Part Two

In the first part of this series, we looked at the two main types of moving average - namely simple moving average (SMA) and...

A Forex Trader’s Guide to Moving Averages: Part One

A moving average is a method for smoothing out price action over time, thereby eliminating some of the 'noise' to get a clearer picture...

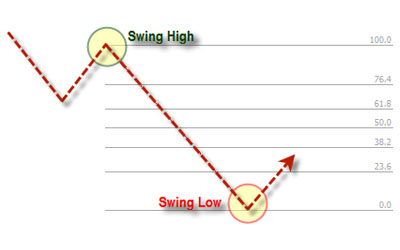

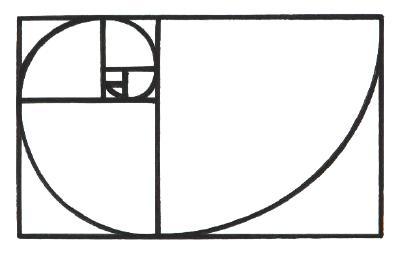

Forex Trading with Fibonacci Ratios: Part 6

In the previous installment of this series, we looked at using Fibonacci extensions to set take profit orders. In the final part of our...

Forex Trading with Fibonacci Ratios: Part 5

In the previous installment of our Guide to Forex Trading with Fibonacci ratios, we looked at how to combine the Fibonacci tool with trendlines...