Last week saw the US Dollar struggle for direction, initially weaker but stabilizing as risk sentiment soured late in the week.

Concerns over inflationary pressures from tariffs and a sharp drop in US consumer confidence led to renewed risk aversion, helping the Dollar find support into the weekend.

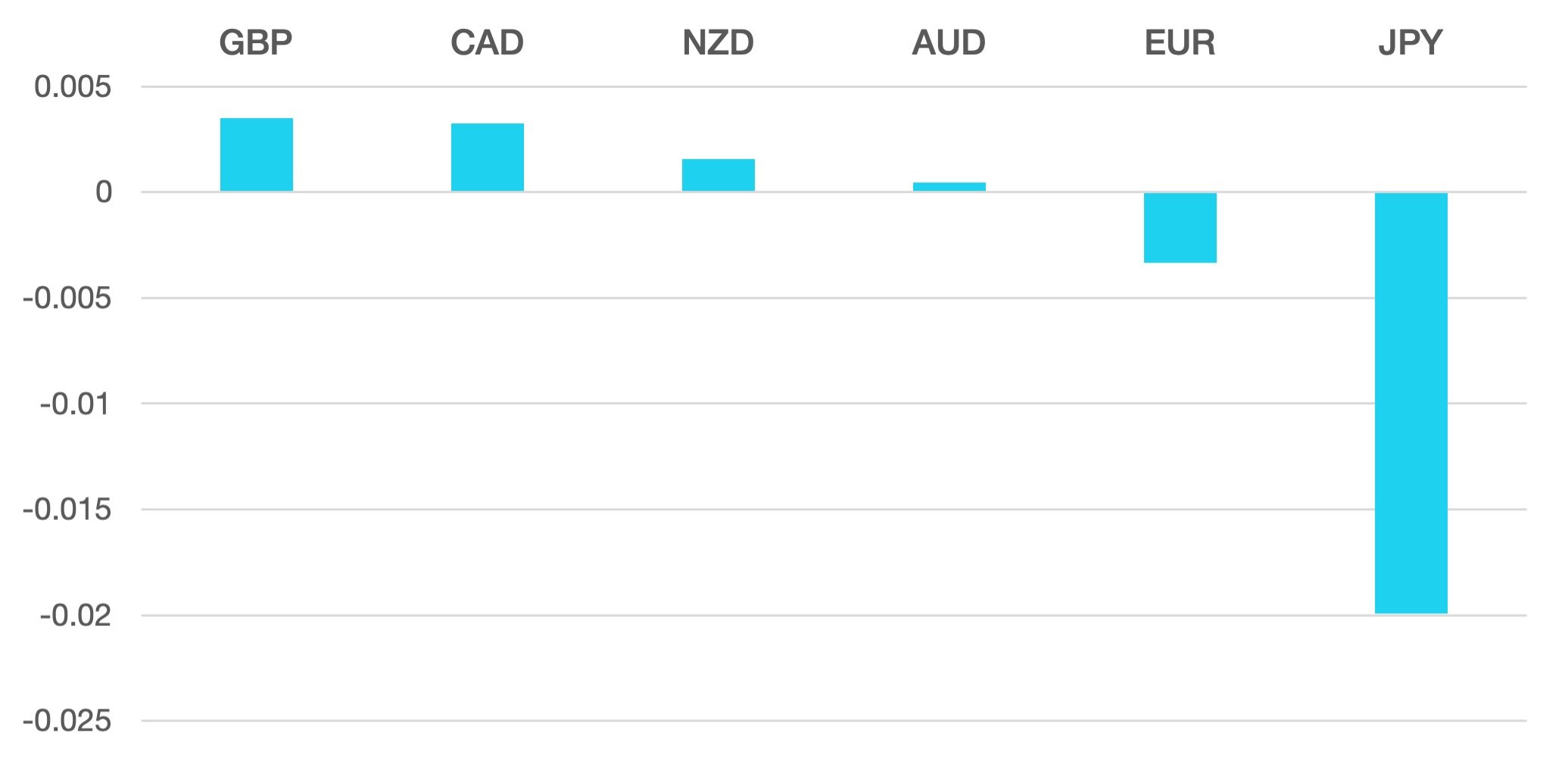

Despite this, other major currencies also lacked a clear trend. The Euro and Canadian Dollar were the weakest performers, with the Euro weighed down by soft PMI data and trade concerns pressuring the CAD. Meanwhile, Sterling gained ground as UK inflation and wage growth surprised to the upside, reinforcing expectations that the Bank of England may hold rates steady for longer.

The Japanese Yen was the standout performer, rallying 2% against the Dollar as speculation grew that the Bank of Japan could raise rates sooner than expected. The Swiss Franc also saw support, benefiting from broader uncertainty in European markets. Meanwhile, commodity currencies ended mixed, with the AUD and NZD posting slight gains, while the CAD and NOK saw marginal losses.

In commodities, oil recorded its fifth consecutive weekly decline, but downward momentum appears to be slowing near a key support zone, with WTI closing at $70.18 (-0.4%).

This week’s focus will be on US-Russia negotiations and their potential impact on global risk sentiment. In terms of data, markets will be watching Core PCE inflation from the US, as well as inflation figures from the Eurozone, Japan, and Mexico.

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs. The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Tariffs Continue To Dominate first appeared on trademakers.

The post Tariffs Continue To Dominate first appeared on JP Fund Services.

The post Tariffs Continue To Dominate appeared first on JP Fund Services.