CoinCorner’s CEO, Danny Scott, explains why he believes there is more positive growth set for Bitcoin in 2021.

“As we come to the end of what has been an iconic year for Bitcoin, I can only see more positive growth in 2021 and here’s why…

“Living and breathing this extremely fast-paced industry and soaking up global bullish news daily means that I’ve forgotten more good news from this week alone than Bitcoin had in years back in its early days.

“Here are a few of the reasons why I’m incredibly bullish on Bitcoin for 2021.”

1. Supply and demand

“Starting simply, Bitcoin is finite and there will only ever be 21 million. Back in May, we celebrated Bitcoin’s third halving —an event that happens roughly every 4 years, halving the supply of Bitcoin coming into circulation —and this year saw it go from 12.5 Bitcoin to 6.25 Bitcoin per block (every 10 or so minutes). There are expectations for what might come after, with history telling us that the Bitcoin price will typically begin to rise significantly (20x+) within the 18 months following a halving — often simply put down to supply and demand.

“While we know the supply is fixed, what about the dynamic demand? This is the part that I feel has been underestimated at each halving, including by ourselves at CoinCorner following the 2016 halving which led to the bull run of 2017. During the bull run, we were signing up a record number of registrations but our system and processes weren’t ready for this, and we weren’t alone. Some of the larger exchanges had to freeze registrations as they couldn’t handle the throughput, while others experienced technical issues with their trading engines locking up and websites going down due to overload.

“This time around though the industry as a whole is better prepared for the predicted 2021 bull run… it’s not perfect, but it’s better.”

Where’s the current demand coming from?

“Compared to 2017 when demand came from the retail market (this will eventually happen again, of course), the current demand is coming from an institutional level completely flying under the radar for many people and it looks set to continue through 2021.

“Roughly 27,000 Bitcoin are mined (brought into circulation) each month and although this may sound like a lot, it’s really not. For context, Grayscale added 32,000 Bitcoin to their portfolio in October, CashApp received $1.6 billion worth of revenue from their customers buying Bitcoin in Q3 2020 and PayPal has entered the cryptocurrency market, allowing customers to buy Bitcoin with full global roll out planned for next year.”

“In October, Microstrategy became the first publicly traded company to add roughly 38,250 Bitcoin to their balance sheet, with Square closely following in their footsteps with a purchase of 4,709. I fully expect to see this trend continue through 2021 as more companies look for the best place to exit their fiat positions and choosing Bitcoin as their inflation hedge asset.

“At CoinCorner, our balance sheet (like many other Bitcoin companies) already holds Bitcoin and this is likely to be a growing trend as inflation begins to kick in due to the current financial climate.”

What about traditional investment?

“Companies aside, traditional investors are also beginning to make their moves. The well-respected Rauol Pal has this year become more and more bullish on Bitcoin and his position, even more recently mentioning that he was going to sell his gold to buy more Bitcoin.

“Another example is Stan Druckenmiller and Paul Tudor Jones — two high-profile billionaires who recently opened up about their Bitcoin investments and how bullish they are for the coming years.

Stan is yet another person to compare Bitcoin to gold as an investment, stating he owns both but believes Bitcoin should outperform gold. He was quoted saying:

“…so I own many, many more times gold than I own Bitcoin, but, frankly, if the gold bet works, the Bitcoin bet will probably work better because it’s thinner and more illiquid and has a lot more beta to it.” — Daily Hodl

“Again, this is a trend we can expect to see continuing as wealthy individuals look to inflation hedge assets.”

2. Previous Bitcoin Halvings

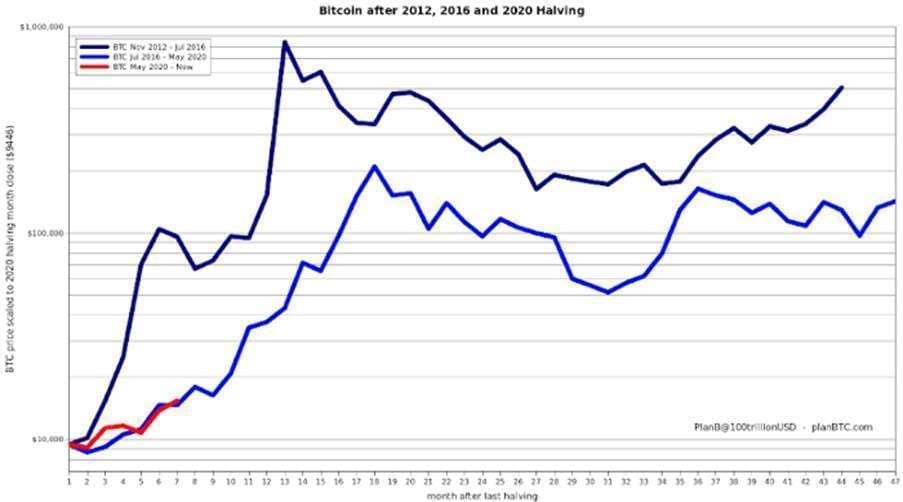

“There are lots of price models and predictions coming out, with Stock-to-Flow (S2F) from PlanB being one of the more popular ones, all ranging in price from $50,000 to $288,000 per Bitcoin in 2021.

“The chart above shows the previous halvings, with the red line indicating our current progress since the halving earlier this year. If it continues to follow the previous trends, we can expect to see the S2F model being somewhat accurate — meaning that $288,000 may not be an unrealistic target price.”

3. Coronavirus financial crisis

“Touching briefly on the unfortunate situation the world has suffered this year, the coronavirus crisis had the knock-on effect of causing a long-awaited financial crash in March. This resulted in Government bailouts: the U.S. FED printing $3 trillion (plus another $2 trillion on the way), the Bank of England likely printing towards £1 trillion and many more around the world following suit. Not to forget the introduction of negative interest rates which look to become the norm. Although this may be necessary in their eyes to stimulate the economy and its future protection, this comes with a huge risk of inflation on a scale unseen in these territories before.

“Putting this into perspective, the FED printed $3.9 trillion between 2008 and 2014 during the 2008 financial crisis, and they’ve already surpassed this in 2020 alone, with more likely to come.

“When it comes to financial uncertainty, people look for a safe haven and Bitcoin is becoming this.”

4. Bitcoiners

“61.71% of all Bitcoin in circulation hasn’t moved within the last 12 months. Bitcoin investors have stomached sharp drops greater than 50% this year and still didn’t sell. Bitcoin’s sitting comfortably around the $15,000 — $16,000 region right now and still those coins aren’t moving. Bitcoin investors are here for the long-term, they have strong hands and are preparing for the next 20x.

“This Bitcoiner crowd is also continuing to accumulate and hodl more every day, leaving less liquidity available for newcomers. In turn, this will drive the price. Once Bitcoin pushes past the $20,000 previous all-time high and starts hitting mainstream media again, retail investors will enter just as they did in 2017, but this time with the backing of public global companies, billionaires and hedge funds.”

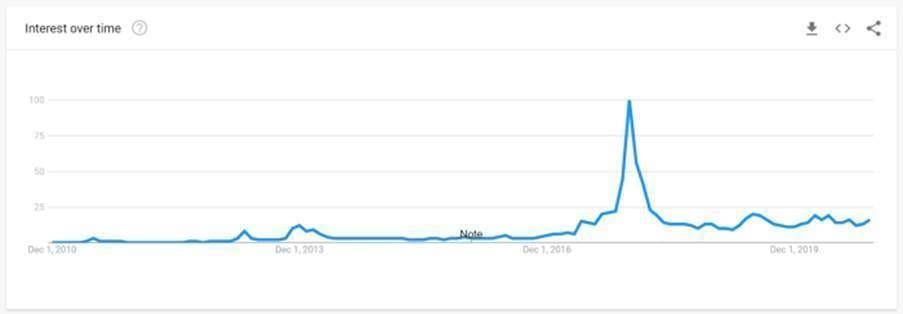

Online searches for Bitcoin

“A quick look on Google trends for the search term “Bitcoin” shows that interest today isn’t anywhere close to that of 2017, sitting at only 13%. Yet, the Bitcoin price is hovering around 75% and looks likely to hit that $20,000 before the interest spikes again.

“Interest during the 2013 bull run was only 10% of what 2017 became and so, I fully expect the 2021 bull run to peak “Bitcoin” interest in excess of 5x, maybe towards 15x, of what we saw in 2017.”

5. Interesting Bitcoin stats

“Numbers sometimes speak louder than words…”

Bitcoin vs alternative investments

“Comparing Bitcoin to alternative investments over the last 5 years, the trend is the same for 12 years also (the whole lifespan of Bitcoin so far).”

Yearly percentage returns for Bitcoin

“Bitcoin’s history shows that after a halving (2012 and 2016), the price sees an incredible increase in the following year, with the year after that being the only negative years (2014 and 2018).”

2010: ,%

2011: ,%

2012: %

2013: ,%

2014: -%

2015: %

2016: %

2017: ,%

2018: -%

2019: %

2020: % (so far)

Is Bitcoin a success?

“The industry has been challenged by a lot of negativity over the years, but as time has passed, its reputation and sentiment has grown stronger.

“At what point do we call something a success? 10 years? 20 years? What if it fails in 70 years time? Would that make Bitcoin a failure? No, it would mean that it’s had its time and something better has surfaced.

“Personally, I’ve gone past the stage of treating Bitcoin like an experiment, or wondering when it will be considered a success — I already see Bitcoin as a success.

“The Bitcoin community is continuing to build a decentralised monetary future and this is only the beginning.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading