In the aftermath of the US Federal Reserve’s decision not to scale back its monetary stimulus programme, for the time being at least, all the attention in the forex markets has shifted towards Sunday’s German elections, which could determine the fate of the euro.

These elections could mark a hugely important turning point in the eurozone crisis, and also in the wider history of the single currency. As Europe’s biggest – and healthiest – economy, Germany has had to shoulder much of the burden of propping up the euro in recent times. A large proportion of the bailouts provided to debt-laden national governments in the eurozone, particularly Greece, which has had several such bailouts, have been paid for by the German taxpayer.

These elections could mark a hugely important turning point in the eurozone crisis, and also in the wider history of the single currency. As Europe’s biggest – and healthiest – economy, Germany has had to shoulder much of the burden of propping up the euro in recent times. A large proportion of the bailouts provided to debt-laden national governments in the eurozone, particularly Greece, which has had several such bailouts, have been paid for by the German taxpayer.

Naturally, this has caused a few divisions among the German population, many of whom feel that they should not be paying for the profligacy of their partners in the euro project, and the general elections will be their first real chance to express their collective opinion on the matter. The current government, led by Angela Merkel and her right-wing Christian Democratic Union party (CDU), has been at the heart of German efforts to keep the euro project going at all costs, but their efforts have not been met with universal approval – least of all in the countries that Germany has been instrumental in bailing out. In particular, the austerity conditions imposed on Greece in exchange for bailing them out of their debt crisis have been accused of doing more harm than good, with rioters taking to the streets of Athens in protest.

What’s in it for Germany?

So why has Merkel been so keen to spend billions of euros of her own country’s money supporting the euro when it has led to such unpopularity at home and abroad? Well, part of the reason stems from Germany’s historical commitment to the single currency project, and the European Union in general. After expending so much effort and funds to help set up these institutions, Germany would be loath to see them crumble at the first real crisis they face.

However, the reasoning behind Germany’s seemingly unstinting support is more than just ideological – there are pragmatic reasons for their actions also. Unlike pretty much every other nation in the EU, the German economy has been performing very well recently, and their membership of the euro has had a lot to do with that. As an economy that is heavily dependent on exports, Germany has gained a competitive advantage from the relative weakness of the euro. If it were to revert back to the Deutsche Mark tomorrow, Germany would have a currency that is a lot more valuable than the euro, due to the strength of the German economy relative to that of the eurozone as a whole. This would dramatically increase the price of their exports, making them far less competitive in the international marketplace.

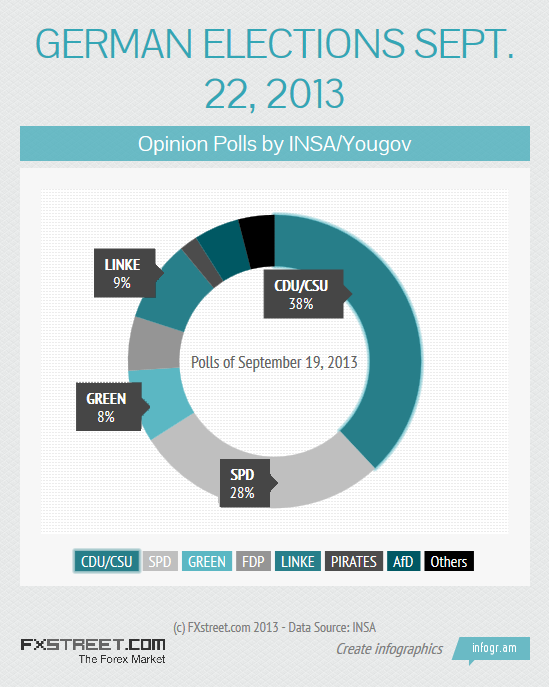

Merkel’s detractors believe that Germany has reached – and passed – an inflection point with the euro project, where the disadvantages (huge bailout costs/tensions with euro partners) outweigh the advantages (stability/cheap exports). Chief among Merkel’s detractors is her main rival in Sunday’s election, Peer Steinbrueck and his Social Democratic Party (SDP). But while Steinbrueck seemed to have a high level of momentum early in the campaign, this appears to have petered out, and Merkel has a substantial lead in the polls. So, does she have anything to worry about?

If it were a straight fight between Merkel and Steinbrueck, then the answer would be no. The problem for Merkel is that she is not the head of a majority government, but of a coalition with the classical liberal Free Democratic Party (FDP). Worryingly for Merkel, the FDP now appear to have little or no support among voters, and in last weekend’s bellwether Bavarian elections, the FDP failed to get the 5% voter threshold that is needed to take up seats at the state assembly.

How Would the Markets React to a Change in Germany?

In contrast with Merkel’s policy regarding limited bailouts for countries on the European periphery, with strict conditions attached, Steinbrueck has proposed a policy of European debt mutualisation, which would see Germany’s power to impose conditions on bailouts ebbed away. This could save Germany – and Europe – money in the short term, but would potentially open the door to a ‘blank cheque’ scenario for profligate countries in the longer term.

Steinbrueck takes a very left-wing view over banking and financial regulation, and has proposed banning highly speculative trading techniques, such as high-frequency trading, an end to state guarantees for banks, and the forced separation of investment banking and deposit banking. He has also been a vocal supporter of a financial transactions tax, and this could potentially have the biggest impact on the markets. Opponents of the tax – which are unsurprisingly quite prevalent in the financial sector – fear that it could increase capital flight, exacerbate asset bubbles, and drive up volatility, as has happened when similar taxes have been imposed in the past.

However, a Grand Alliance would have some benefits for markets. The SPD currently controls the Bundesrat, the German upper house, and many proposals from Merkel’s coalition in the lower house have been blocked by the upper chamber, making it difficult to push through measures intended to stabilise the eurozone. With the SPD and CDU in a Grand Alliance, these objections would be less frequent, and far less of an issue, and the much quicker pace of negotiations that would ensue would probably have more of an impact on European bond market yields than the political leanings of the coalition.

Three Likely Outcomes

The upshot of all this is that there are three likely potential outcomes for the forthcoming elections:

The status quo – a Merkel-led conservative coalition between the CDU and the FDP

A “Grand Coalition” with the CDU and the SPD, as seen between 2005 and 2009

A left wing coalition of the SPD, Left Party, and the Green Party

Another dark cloud on the horizon for the CDU is the rise of the anti-europ Alternative for Germany (AfD) party, which according to recent polls is on course to pass the 5% threshold required for parliamentary representation. The same poll saw a rise to 6% in popularity for Merkel’s coalition partners, the FDP, but if the poll is correct, this combined with the CDU’s 38% would still place the coalition with 44% of the vote – 1% behind a potential left-wing coalition.

At present, the most likely outcomes are a continuation of the CDU-FDP coalition, or a Grand Coalition between the CDU and the SDP. A Grand Coalition would most likely be led by Steinbrueck rather than Merkel, and could herald a change in direction for German policy over the euro. The emergence of the AfD, coupled with an expected surge in voter turnout, could make the latter scenario more likely, as a high electoral turnout usually favours the SPD at the expense of smaller parties such as the FDP and the Green party. Also, if the AfD achieve the necessary 5% of the vote, it will be at the expense of Merkel’s FDP, and effectively spell the end of her current coalition.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading