The market for online forex trading has grown massively since the first platforms for independent traders appeared in the 1990s. In all, there are probably more than 150 forex brokers globally. ForexMagnates, the bible website and portal for the Forex industry highlights in its directory a global map of 154 – just check the list Forex Brokers (154).

According to the 2011 LeapRate / Dow Jones Forex Industry Report, an average of $185 billion changes hands over online trading platforms every day, accounting for 4.6% of the entire global Forex trade.

Using data from the aforementioned LeapRate report, and various editions of the Forex Magnates Retail Forex Quarterly Report from 2011-2013, we have tried to compile a list of the top brokers in the world, ranked in terms of monthly trading volume, awards and attention gathered from the industry media.

In terms of trading volume, Japanese forex brokers dominate the market, dominating the vast Asian marketplace. However, due to regulatory issues these firms do not offer or market their services in the West, which is why we have chosen to focus on non-Japanese brokers in this article, all of whom are based in Europe or North America.

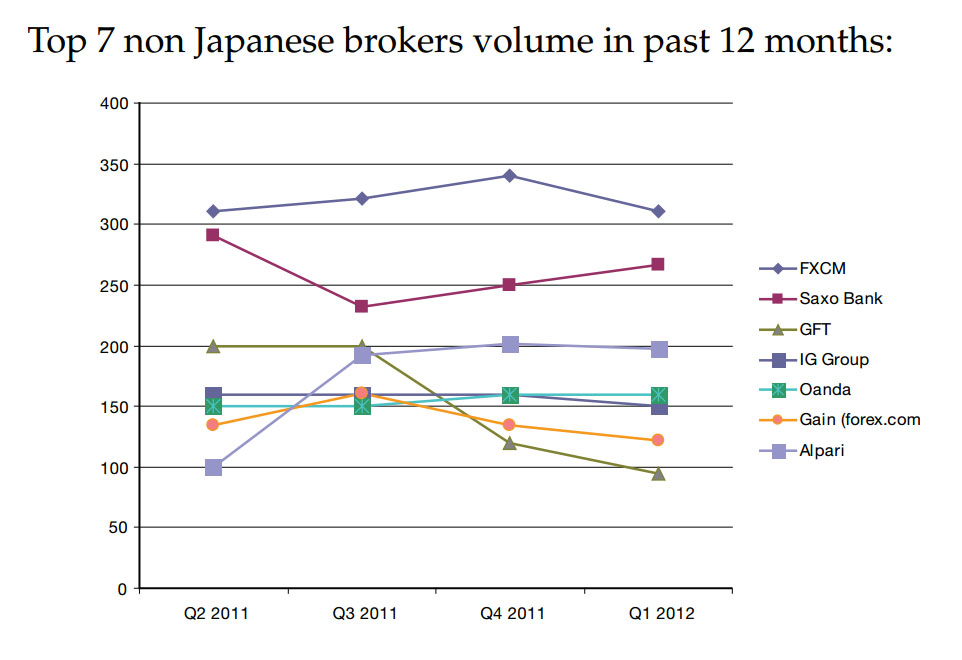

It is important to remember that the landscape in the retail forex market is always changing, with some big surprises as companies shift and acquire others. The names might change but some of them remain. Below is a graph from the Forex Magnates Q1 2012 report that shows just how much the industry map can change over the course of three months:

As we can see, FXCM have consolidated their status as the top non-Japanese forex broker, and Saxo have remained relatively secure in second place. The biggest gains have been made by Alpari, while the biggest drop-off came from GFT, who have since been acquired by Gain Capital (Forex.com).

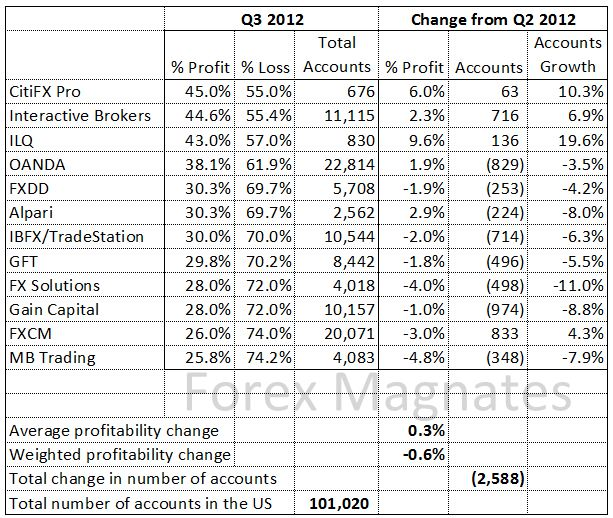

Outside of Japan, the U.S. market is by far the biggest, with around 100,000 forex trading accounts. However, this market has been shrinking in recent times, with only a few brokers making gains in terms of the number of accounts, as you can see in this table from Forex Magnates Q3 2012 report. This also shows a slight decline in the profitability of traders, which could be a result of low market volatility, and this could be a factor in the declining numbers of traders.

The list below highlights some of the top brokers in the industry, in terms of industry awards, volume, and attention:

- FXCM

- Forex.com

- FXDD

- OANDA

- IG Group

- Saxo Bank

- Alpari

- FxPro

- SwissQuote

- MahiFX

- Ava Financial

- FX Solutions

- CitiFX

- LMAX

- GFT

- IBFX

- MIG

We decided to highlight a bit of history and background for some of the top brokers in this list. There are five mentioned here, although since this article was originally written Forex.com have acquired GFT in a high-profile merger.

1: FXCM (Forex Capital Markets)

FXCM was an early entrant to the online forex trading market in 1999, and has grown to be one of the top brokers through adopting an aggressive strategy of development and acquisitions, swallowing up the retail businesses of smaller brokers such as i-Trade, ODL, and Hotspot. They report a monthly trading volume of $258bn, and can boast nearly 140,000 clients worldwide. FXCM is the biggest listed forex broker, having completed an IPO in 2010 with a market capitalization of over $1bn.

FXCM was an early entrant to the online forex trading market in 1999, and has grown to be one of the top brokers through adopting an aggressive strategy of development and acquisitions, swallowing up the retail businesses of smaller brokers such as i-Trade, ODL, and Hotspot. They report a monthly trading volume of $258bn, and can boast nearly 140,000 clients worldwide. FXCM is the biggest listed forex broker, having completed an IPO in 2010 with a market capitalization of over $1bn.

Unlike the majority of retail brokers, FXCM offer No Dealing Desk execution, which means that their clients have access to a large network of liquidity providers including global banks, financial institutions, prime brokers, and other market makers. One of the advantages of this model is that FXCM makes money on a per trade basis, so the more successful their clients are, the more money they will make. This has led to an increased focus on providing educational materials in an effort to make their clients better traders. Much of this effort is channeled through their Daily FX website, which provides news, market research, educational videos, live instructor sessions, and trading support from the course instructors.

As well as offering the award-winning Trading Station range of proprietary trading platforms, FXCM offers trading through a wider selection of third-party trading platforms than almost any broker, including MT4, NinjaTrader, and social trading platforms such as Tradeo, Tradency, and ZuluTrade.

FXCM has received several awards for its services, such as Investment Trends’ Overall Client Satisfaction award for 2012, Shares’ Best Currency Broker award for 2008, and FX Week’s Best Retail Foreign Exchange Platform award for 2009 and 2010.

2: Gain Capital (FOREX.com)

Publicly-owned Gain Capital were established around the same time as FXCM, and own the most sought after web address in the world of retail FX in the form of forex.com. It can boast an average monthly trading volume of $130bn and a client base of nearly 85,000 funded accounts.

Publicly-owned Gain Capital were established around the same time as FXCM, and own the most sought after web address in the world of retail FX in the form of forex.com. It can boast an average monthly trading volume of $130bn and a client base of nearly 85,000 funded accounts.

Its FOREXTrader platforms, which are available in web, desktop, and mobile forms, offer several advanced tools including Autochartist and eSignal pattern recognition technology and round-the-clock news updates from Dow Jones and technical analysis from Trading Central.

3: Saxo Bank

Saxo Bank is the biggest European-based FX broker in terms of trading volume, with a reported monthly trading volume of $292bn (Q1 2011). As well as its own immensely successful trading platforms, it also provides liquidity for most other retail brokers, and is a leader in providing white label forex trading solutions to other firms such as Citigroup and Microsoft. In fact, this is where they derive much of their income from, with net profits for 2010 of $120m and an estimated worth of between $1.4bn and $1.8bn.

Although it is primarily known as a forex broker, Saxo also offers trading across a whole range of other asset classes such as equities, futures, options, bonds, and CFDs, professional portfolio and fund management, and has also recently established itself as a traditional bank in Denmark.

The firm was originally founded under the name Midas Fondsmæglerselskab in 1992, and were one of the pioneers in providing online trading for independent investors. The name changed in 2001 to Saxo Bank to avoid confusion with the Nigerian Mida bank and to reflect their new banking license. From there, they expanded into several different countries, and the company is still expanding at a rapid pace.

The firm began, primarily, as a software developer, and they still develop all their software in-house. This puts them at a distinct advantage over other brokers in terms of innovation, and the firm continues to add new functions to its popular SaxoTrader range of platforms. The SaxoTrader platform has won several awards, including Fxweek’s e-FX Award for Best Retail Platform between 2005 and 2009, and the Profit & Loss magazine’s Best Retail Platform in 2008.

Saxo launched their own algorithmic trading platform, TradeCommander, in 2007, but like every other platform of its kind, it failed to challenge the fast-emerging dominance of the MetaTrader 4 platform, and the firm now offers full MT4 integration. In addition, they also operate the successful trading and investing website Tradingfloor.com, and content from this website is embedded in every version of SaxoTrader alongside other news and analysis providers such as Reuters Insider.

4: OANDA

OANDA started out in 1995 by the mathematician Dr. RIchard Olsen, author of the algorithmic trading bible High Frequency Finance and founder of econometrics firm the Swiss Olsen Group, and Dr. Michael Stumm, a Computer Engineering professor at the University of Toronto. At first, the company specialised in making live currency information available online, as at that time this information was quite hard to come by, in addition to historical data, currency conversion tools, and analysis and news in several languages.

With the launch of the FXTrade platform in 2001, OANDA branched out into becoming a provider and market-maker for online forex trading. At the time, the platform was revolutionary, offering several innovative features such as 24 hour trading, continuous interest payments (calculated on a per-second basis), and instant settlement of transactions. Even more revolutionary was their decision to offer flexible trade sizes with no lot size restrictions, which meant that traders could buy or sell any number of units at the same price. This feature was singled out for praise by no less than Benoit Mandelbrot, the godfather of fractal geometry, in his book “The (Mis)Behavior of Markets: A Fractal View of Risk, Ruin, and Reward”. He saw OANDA’s commission-free pricing as an example of how the foreign exchange market works when small investors and big investors are set on an equal footing.

OANDA’s FXTrade platform was also the first of its kind to offer constantly updated graphical price charts, and today a huge range of charts are available including HLC, HLOC, min/max, candlestick, and close price. It also provides a huge range of technical analysis tools, such as overlays and indicators, and historical tick-by-tick forex data, which can be used to test algorithmic trading strategies. The platform offers trading in over 60 major and exotic currency pairs, as well as silver and gold crosses, and live news and market analysis feeds from providers such as Dow Jones, Thomson Reuters, and UBS Analysis. More recently, they added full support and integration for the popular MetaTrader 4 software, which allows users to access a huge library of open-source trading algorithms and indicators.

Key to their success has been a strong commitment to technological and business innovation, and particularly transparency. In 2005, the firm published The Forex Trader’s Bill of Rights, outlining the company philosophy that online currency traders should have a right to a stable, free, and open forex market with unfiltered access to information and high levels of technological efficiency. This helped to create an aura of trustworthiness around the company and their FXTrade platform, which was very valuable at a time when the industry was still in its infancy and tales of sharp practice among rogue brokers were rife.

5: GFT

This UK-based broker, which was recently acquired by Gain Capital (owners of Forex.com), was founded in1997, and it is estimated that they have monthly trading volume of $200 billion. Despite its location, it is not a major player in the retail forex markets of the UK and Europe, and most of their clients are based in the US. Despite a relatively small client base, with just under 10,000 US-based clients, they still manage to have quite a high trading volume, generating more money per client than most of their competitors.

This UK-based broker, which was recently acquired by Gain Capital (owners of Forex.com), was founded in1997, and it is estimated that they have monthly trading volume of $200 billion. Despite its location, it is not a major player in the retail forex markets of the UK and Europe, and most of their clients are based in the US. Despite a relatively small client base, with just under 10,000 US-based clients, they still manage to have quite a high trading volume, generating more money per client than most of their competitors.

Its popular Dealbook range of trading platforms offer trading across over 120 currency pairs, and provides a number of useful trading tools such as tick-by-tick charting, trading directly from charts (on the desktop and web versions), and a comprehensive range of technical analysis tools and indicators. The desktop version of the platform, Dealbook360, offers eight different chart types, while the mobile and web versions offer three. In addition to providing trading through its proprietary platforms, they also offer full integration with Metatrader 4.

They are also responsible for the highly influential fx360.com information portal, which was created with the help of two star analysts they recruited from rival brokerage FXCM, Boris Schlossberg and Kathy Lien. This provides up-to-the-minute market news and analysis from top forex experts, as well as a range of tools including a forex calendar, trade ideas, and technical analysis charts.

Read More:

interactive brokers vs ninjatrader

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading