Bitcoin is finally on the verge of breaking out of the bearish sentiment that has gripped the cryptocurrency market, affirms the CEO of one of the world’s largest independent financial advisory organisations.

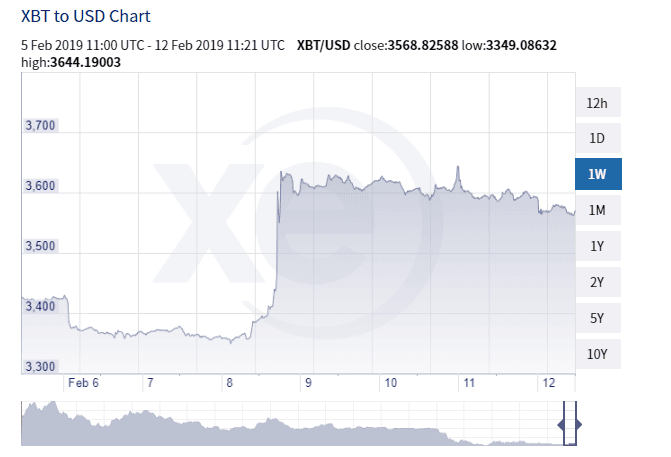

The comments from Nigel Green, chief executive of deVere Group, follow surging Bitcoin prices at the end of last week. On Friday, the world’s largest and original digital currency jumped around 10 per cent within 24 hours, pushing past $3,700 for the first time in three weeks.

He observes: “It was a relatively sudden jump, and, of course, positive news for those currently holding Bitcoin.However, the price only reached the top of the trading range and investors should not be popping champagne corks just yet.”

“There are three likely drivers of Bitcoin’s price spike,” Mr Green continues, “First, there are widely published reports that according to a leaked interview with a commissioner, a Bitcoin ETF could imminently secure approval from the U.S. securities watchdog.”

In this respect, The U.S. Securities and Exchange Commission (SEC) has postponed its decision to approve or disapprove the VanEck/SolidX bitcoin exchange-traded fund (ETF), according to Bitcoin Magazine. Per an official document published by the agency, the new deadline to review the VanEck proposal has been shifted to February 27, 2019, which the regulator claims would afford it the time needed to review the potential rule change further. This would give a precious time to the exchange to comply with the SEC’s concerns regarding that these are being worked on and rectified in the form of improvements in the markets on pricing, custody & surveillance.

“Second,” mentioned Mr Green, “the development of the lightning network which will dramatically improve Bitcoin’s well-documented scalability issues, allowing it to move towards mass adoption.”

As we announced recently on tradersdna, since it went live early last year, the Lightning Network has skyrocketed. With over 630 Bitcoin (BTC), more than 23,000 channels and a total network capacity of $2 million on the Bitcoin mainnet, according to data from 1ML, LN’s capacity for BTC has had crazy growth, going from 4 to over 600 BTC since last February.

“And third, the 2020 Bitcoin halving. The code for mining Bitcoin halves around every four years and the next one is set for May 2020. When the code halves, miners receive 50 per cent fewer coins every few minutes. History shows that there is typically a considerable Bitcoin surge resulting from halving events.”

And the deVere CEO concludes: “Bitcoin is the flagship cryptocurrency and, as such, we can expect when its values climb, it will drive prices of other major digital currencies such as Ethereum and XRP.”

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.