Passive income can bring freedom and security, and it is even easier with new technology-powered financial products and services to achieve a diversified stream of revenues. We can find stock trading, real estate or crowdlending among the trends.

Couple months into the new decade, reports and predictions by international research and consultancy firms show optimistic trends for investing in various forms of passive income.

A recent report on ETFs/ETPs (exchange-traded funds / exchange-traded products) ecosystem showed a record net inflows of USD 3.39 billion in November 2019. The latest study on e-commerce predicted that e-retail will reach USD 4.8 trillion in sales by 2021. Real estate, specifically renting out property, has shown an increase in supply and demand over the last couple of years. While passive investing now accounts for 45% of all assets for U.S. stock-based funds (that’s up from just around 25% a decade ago) and hits USD 1 trillion assets in passive investing in Europe.

Access to the internet and mass mobile market connecting multiple users has opened up new global markets, while new tech solutions generated new investments and business models, allowing easier access to assets and payouts. New solutions have also brought down the minimum required investment and sped up the time and logistics to achieve regular revenues.

Here are the top 5 passive income streams, accessible to augment personal finance.

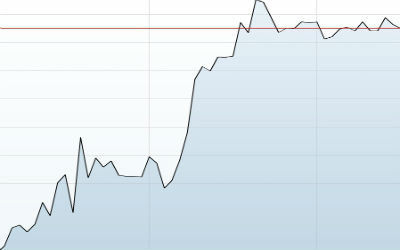

Stocks: With another good year expected for the stock market, buying and holding stocks may be a tool for passive income. This approach, however, may require a longer time frame, and does not realize profits immediately. This type of passive income relies on capital gains, which accrue over time. The actual funds may grow over the years, or even decades. Realizing profits is also required, which means the income is, in the end, semi-passive.

Dividend-yielding stocks are the classic approach to passive income, as regular inflows ensure the attractiveness of this investment. Stock investments are now also possible through apps like Robinhood, which cut the middleman and allow almost anyone with mobile access to benefit from owning shares. International purchases and trading are also available through platforms like eToro.

Real Estate: Investment in real estate may be an involved process, but also allows for long-term, regular income streams. Real estate can be rented out with better efficiency, to generate higher revenue streams. Shifts in usage, such as Airbnb, allow for significantly improved occupancy and rates.

Real estate became more accessible due to renewed financial regulations allowing the building of more agile investment products. For instance, Real Estate Investment Trusts (REITs), companies that own and operate real estate that generates income allowing investors collect dividends, now offer the opportunity to make the investment automatic, instead of buying and maintaining properties yourself. Those approaches allow for the income streams to move from semi-passive to entirely passive.

Data analysis also modernizes real estate investment. Companies such as Roofstock track profitability and the potential of properties to generate passive income.

The Sharing Economy: Sharing idle resources, such as tools, cars, or sports equipment, can become a source of small-scale income streams. Apps like JustPark direct to unused parking spaces, and car-sharing through Uber is already the norm in many cities. Sharing rides is also an option, as well as lending out storage space.

The sharing economy also opens possibilities for virtual goods sharing, such as lending out WiFi bandwidth through the Netspot app. Computational resources may also be lent out for a small payment or pro bono, to benefit scientific projects.

Content and Expertise: Content creators who are willing to put in the time may start to generate passive income streams from their completed work. Either by direct sales or subscriptions, content that has gone viral and generates new views can become a solid source of income.

YouTube has grown to be one of the biggest passive income generators, but blogging platforms follow a similar model. Amazon has expanded its storefronts to link content creation and influencer profiles with product promotions.

Crowdlending: Passive income from interest rates is at the root of the most traditional finance operations. But in 2020, crowdlending platforms rely on even more efficient tools to generate passive income from interest rates.

Crowdlending allows a direct connection between persons with idle funds, and those seeking loans. Anyone can join marketplaces to invest in loans issued by international alternative finance lending companies. The investments secure predictable liquidity streams at high interest rates.

Crowdlending is also immediately accessible, does not require brokerages or special knowledge (aside from knowing that any investment carries a risk) to start earning passive income streams. Platforms like Mintos have been expanding in the past years, leading to the trend of investing in loans becoming more popular in 2020.

The income streams are also based on diversification, avoiding single-market risks. This turns Mintos and similar platforms to superior tools for achieving passive income, adding speed, automatization and diversification.

Read More:

how to handle online loan harassment

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading