Liquid alternatives can play an important role in identifying alpha – the excess return compared with a benchmark. In this constant search for alpha, three themes will stand out over the 12 months ahead.

By Cédric Vuignier, portfolio manager of the OYSTER Alternative Uncorrelated fund at SYZ Asset Management

In the search for a balance of risk and reward in a portfolio, liquid alternatives can play an important role in identifying alpha – the excess return compared with a benchmark. The challenge is true alpha only exists where there are market inefficiencies. Once too many investors are attracted to a strategy, those inefficiencies are simply eroded back into beta.

In this constant search for alpha, we believe three themes will stand out over the 12 months ahead.

Capturing bond arbitrage

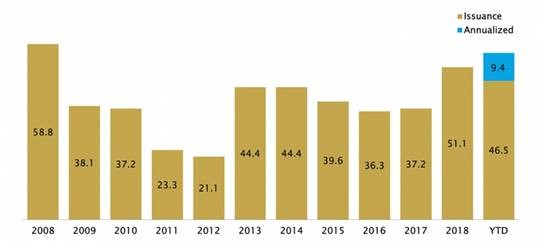

The first is convertible bond arbitrage, which involves capturing value in the difference between a convertible bond and its underlying stock. The outlook for this strategy has not changed significantly over the last year. It can take advantage of a more volatile environment and, at the same time, maintains a position in the equity market. This strategy is also backed by a favourable corporate action pipeline and improved US new issuances, thanks to a new tax law.

Go big in Japan

Secondly, we think there is value to be found in Japan, perhaps ironically given our conviction the world’s developed economies are threatened with ‘Japanification’. Yet, thanks to recent reforms under Prime Minister Shinzō Abe, Japan’s corporate sector is undergoing profound changes.

By making cash more expensive for businesses to hold, Japanese companies are being encouraged to engage in more corporate activities such as merger and share buybacks. This is working. Activity is picking up, creating opportunities with more value for shareholders.

Disruptive technology

Finally, our third investment theme for the year ahead is ‘machine learning’. This is a revolutionary technology profoundly altering our experience of the world as computers develop their own algorithms, creating new applications to address new and existing problems.

We are at a stage where machines are data mining to build models and make discoveries in a range of fields that are independent of human hypotheses. This has created a race for data, and among investors, a search for alpha in the market. These are investable technologies, through highly specialised managers, working to optimise portfolios and create investment and forecasting models.

We believe each of these themes will play out over 2020 and each has the potential to add diverse sources of return to investors’ portfolios.

Read More:

when is the target car seat trade-in 2025

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading