Editorial Note: This is a guest post by Uriel Alvarado, Chief Marketing and Public Relations Officer, Saxo Markets.

On September 13 at Bloomberg’s European Headquarters, some of Europe’s most eminent finance, trading and political speakers assembled in London to discuss whether this is the End of The Euro As We Know It. In anticipation of the timely German election, Saxo Markets held the sold-out event to consider whether the Euro dream has become a nightmare, and contemplate the precarious future of the single currency.

The event was a substantial success thanks to an audience of exceptional speakers, bloggers and attendees, and Bloomberg that hosted the event.

Over 450 guests witnessed a captivating event with first-hand insights from industry experts who highlighted Eurozone tensions and hypothesised the long-term consequences of the German election. An introduction by Co-CEO of Saxo Bank, Lars Seier Christensen, was followed by a keynote speech by Václav Klaus, former President of the Czech Republic, on the demise of democracy as nation states cede independence to the EU.

This was followed by a debate on whether growing deficits and unemployment levels will trigger the beginning of the end of the Euro project. Steen Jakobsen, Chief Economist at Saxo Bank; Bloomberg Economist David Powell; Steven Saywell, Head of FX Strategy for Europe at BNP Paribas; and Roy Sher, Founder of ISAM Fusion Hedge Fund discussed policy shortcomings which have provoked social unrest across Southern Europe and derisive reactions to the EU’ s award of the Nobel Peace Prize.

Guy Johnson, Bloomberg TV anchor, moderated the next discussion on the impact of quantitative easing and governmental monetary policy on the financial markets. Panelists also deliberated the benefits and risks of ‘forward guidance’, contemplating the hazards of enacting policies in order to drive economic ‘certainties’.

The day’s second keynote address was delivered by Nigel Farage, MEP and leader of the UK Independence Party, on why a cessation from the EU would benefit the UK, saving British taxpayers up to £60bn a year and loosening heavy regulation on businesses. Rakesh Shah, Advisory Fund Manager at Kingly Capital, closed the event with a speech on managing foreign-exchange strategies in volatile financial markets.

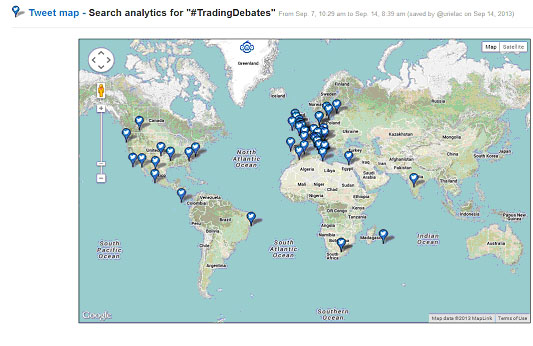

The event triggered a huge social media reaction, as #TradingDebates not only passed #EuroCrisis in the number of tweets on the day, but also eclipsed Twitter attention of the German election. In total, the event prompted over 500 tweets on September 13, drawing in social media users from 72 different worldwide locations, including contributors from Finland, the US, South Africa and Mexico.

The top influential users included @Frances_Coppola, @PaulSommerville and @NicTrades. @Frances_Coppola was also one of the most active users on the day, gaining 25 retweets for her top #TradingDebates tweet describing the EU as a ‘massive monolithic bureaucracy’:

The cumulative potential reach of #TradingDebates ran to well over 1 million users, thanks to big Twitter ‘influencers’ such as @minefornothing and @tradenextglobal. The most original content across the social networking site was produced by @garysballs, @minefornothing and @oluodeniyi while the most talked about topics from #TradingDebates were the keynote speeches from Václav Klaus and Nigel Farage, as reflected in subsequent blog commentaries by Gary Ling, eWallstreeter and Forex Magnates. MSN Money, The Independent and the London periodical City AM also reviewed the #TradingDebates event with in-depth articles.

Journalists from news publications and broadcasters around the globe also joined the event, including TV channels such as TV Tokyo, Russia Today, TV Berlin and Bloomberg TV.

Have you watched the Saxo TVC? It is also possible to join the debate by following Saxo Markets on the respective Twitter account, or check out an infographic that describes the unraveling of the Eurozone as unemployment rates escalate and debt levels worsen.

Saxo Markets will soon publish content from the event on tradingdebates.com.

It is possible to download some exclusive white papers that will cover all the speeches, debates and topics covered by industry-leaders and influential speakers from the event, as well as other relevant topics such as the Syria Crisis and the impact on commodities, emerging markets, QE tapering, the selection of next Fed Chairman, and equity and bond bubbles.

Statistics sources: twitonomy.com, hashtracking.com and tweetbinder.com

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading