Senator Cynthia Lummis introduces a bold proposal that could position the United States as a frontrunner in digital asset adoption. The proposed bill seeks to establish a U.S. Strategic Bitcoin Reserve, requiring the Federal Reserve to purchase and hold 1 million bitcoins over the next five years. This initiative, equivalent to approximately 5% of the total bitcoin supply, aims to safeguard the nation’s financial stability and align with emerging global trends in digital finance.

The U.S. political and regulatory environment is poised for a significant transformation in the cryptocurrency sector. The Republican Party’s success in securing the White House, Senate, and Congress has laid the foundation for legislative momentum, which could lead to a more structured and predictable crypto framework.

With campaign rhetoric now transitioning into actionable policy discussions, the proposed U.S. Strategic Bitcoin Reserve is gaining attention among policymakers and industry players.

Proposed strategic Bitcoin reserve

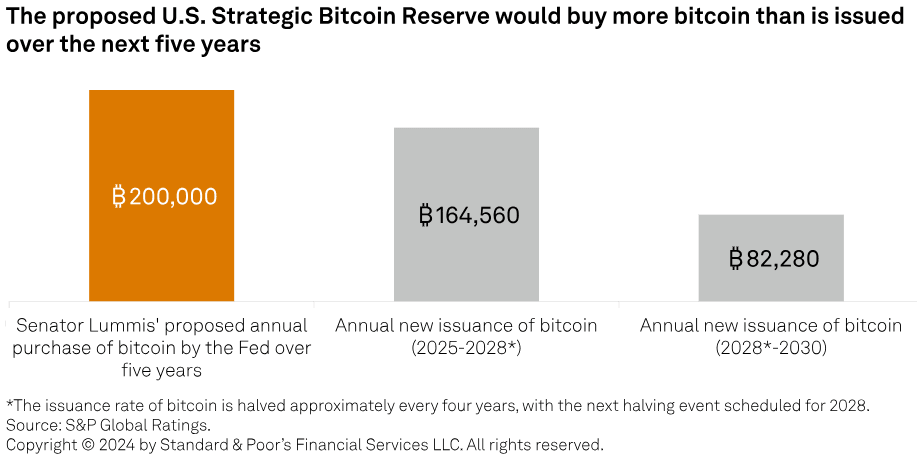

One of the most notable legislative proposals is Senator Cynthia Lummis’ bill advocating for the Federal Reserve to purchase one million Bitcoins over the next five years. This move, equivalent to 5% of the total Bitcoin supply, underscores the increasing recognition of Bitcoin as a strategic financial asset. The proposed reserve aims to counter currency debasement and strengthen national financial security.

If implemented, this annual purchase of 200,000 Bitcoin by the Federal Reserve would exceed the annual Bitcoin issuance for the next five years. This proposal reflects growing interest in the role of decentralised assets in stabilising economies.

The need for regulatory clarity in the U.S. crypto sector

Despite the U.S. being a global economic leader, its progress in crypto regulation has lagged behind other regions. Key developments in 2024 include the House’s approval of the “Financial Innovation and Technology for the 21st Century” (FIT21) bill, which seeks to delineate the responsibilities of U.S. regulatory bodies in overseeing cryptocurrency activities. However, this bill, along with other legislative initiatives such as stablecoin regulations, has yet to gain full congressional approval.

Industry participants face significant challenges due to the lack of clarity on issues such as staking services, the classification of crypto assets as securities, and crypto custody rules. These gaps have led to enforcement-driven approaches rather than rule-based regulation, creating uncertainties for businesses and investors.

Key areas of focus for the upcoming legislative cycle include:

- Stablecoin regulation: Stablecoins remain underutilised in U.S. financial markets due to a lack of clarity on custody and operational frameworks. Early 2025 may see progress on these fronts.

- Custody challenges: Existing rules such as SAB 121 have deterred U.S. banks from offering crypto custody solutions. Revisiting these rules could unlock opportunities for institutional involvement.

- Scaling blockchain innovation: Increased U.S. involvement in global regulatory coordination could help scale-tested blockchain use cases for financial market applications.

Global implications and the role of stablecoins

The absence of a robust regulatory framework for stablecoins has constrained innovation in tokenised financial markets. While the U.S. has made strides in tokenising money-market funds, regulatory clarity is essential to scaling these efforts and boosting investor confidence. This aligns with global trends, where other nations are advancing in blockchain innovation and digital asset adoption.

A significant regulatory hurdle is the “Special Accounting Bulletin (SAB) 121,” which makes it costly for U.S. banks to provide crypto custody services. Addressing these regulatory issues under the new administration could pave the way for broader adoption of crypto assets and enhanced financial market integration.

Opportunities for the U.S. Crypto Industry

The proposed policy changes present opportunities for the U.S. to catch up with global peers in the crypto and blockchain space. Early 2025 is expected to bring legislative developments on stablecoins and crypto custody, potentially shifting the regulatory approach from enforcement to structured rule-making. This transition could not only bolster innovation in blockchain but also enhance the predictability and stability of crypto businesses.

The global community is watching closely as the U.S. explores its role in shaping the future of decentralised finance. The establishment of a Strategic Bitcoin Reserve, combined with improved regulatory frameworks, could position the U.S. as a leader in the digital asset economy.

Shikha Negi is a Content Writer at ztudium with expertise in writing and proofreading content. Having created more than 500 articles encompassing a diverse range of educational topics, from breaking news to in-depth analysis and long-form content, Shikha has a deep understanding of emerging trends in business, technology (including AI, blockchain, and the metaverse), and societal shifts, As the author at Sarvgyan News, Shikha has demonstrated expertise in crafting engaging and informative content tailored for various audiences, including students, educators, and professionals.