A cooling property market in the UK means flat values are plummeting by more than 7% in some areas in a boon for first-time buyers trying to buy their first home, research by home finance provider Gatehouse Bank reveals.

Significant price falls in specific areas, including key commuter towns, are presenting first-time buyers with opportunities to get on the property ladder.

Charles Haresnape, CEO of Gatehouse Bank, said: “Affordability is a significant issue for those looking to take their first step on the housing ladder, so our research provides some positive new for those struggling to find their first home. Flats appear to have fallen from favour to a degree over the last year, but some buyers are inevitably going to take advantage of this opportunity.”

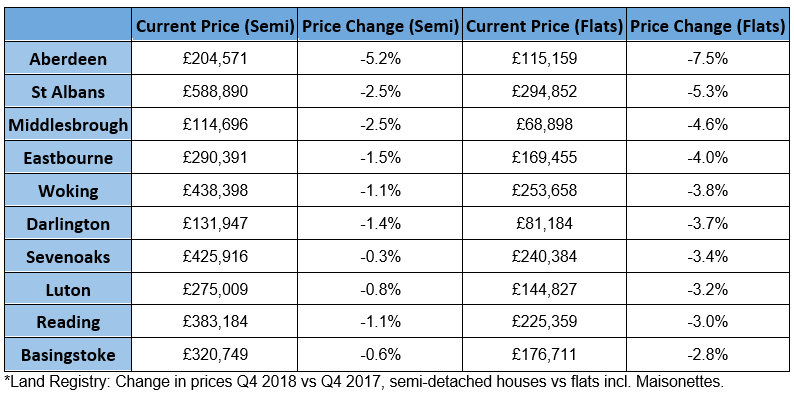

Indeed, Land Registry data shows Aberdeen is offering the biggest discount year-on-year, with the price of flats in the Scottish city dropping annually by 7.5% in the last quarter. The price of flats in St Albans decreased by 5.3% and in Middlesbrough they fell by 4.6%.

Retreating prices are likely to be linked to government schemes supporting first-time buyers combined with falling demand from landlords. The Help To Buy scheme and Stamp Duty Land Tax relief have effectively boosted the budgets of first-time buyers who can afford to stretch themselves to larger properties.

Transactions of flats have dropped 20.6% in the past two years, falling from 196,273 in 2016 to 155,801 in 2018. Over the same period, sales of semi-detached homes fell only 1.1% to 247,8532.

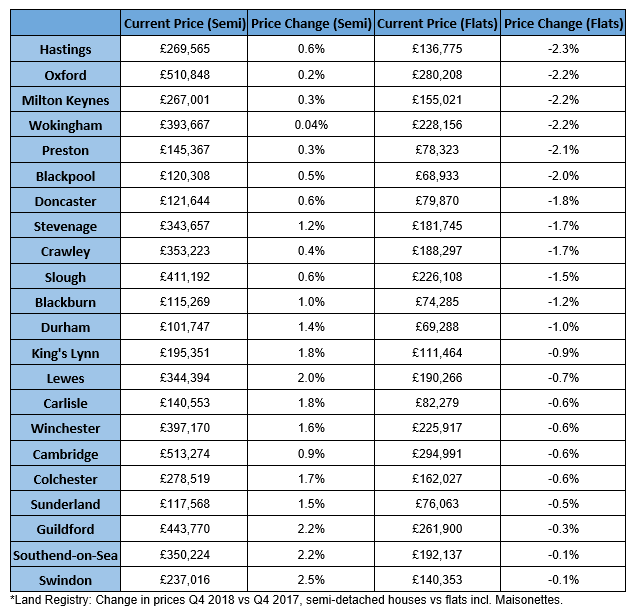

Gatehouse studied Land Registry data on the price of semi-detached houses and flats in 108 major local authority areas across the UK.

It found that the price of flats is falling in 30.6% (33) of these areas, although on average flat prices are still growing at a rate of 0.95% a year. This is nearly four times slower than the 3.39% annual growth being recorded for semi-detached houses. In 22 areas (20.4%), the price of flats is falling while the cost of semi-detached houses continues to rise.

“Our research shows that the value proposition of flats in these areas is changing far more rapidly than it is for larger properties and this is likely to prove tempting to many prospective purchasers in the coming months,” the CEO concluded.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading