What defines a successful, wealthy, and ethical trader from a deceptive one? Some believe that trading strategy is everything, while others emphasise trading psychology and mindset. In most cases, they are correct. But, that’s not all, though. A vital element of the trading routine—possibly the most significant one—is the risk-reward ratio.

Table of Contents:

- Introduction

- What is the risk-reward ratio (RRR)?

- Key factors are in calculating the RRR

- Formula for Risk-Reward Ratio

- Managing risk and reward in forex trading

- Importance of position sizing in forex trading

- Calculating the reward-risk ratio

- Importance of the risk-reward ratio

- Finding the best risk-reward ratio for a trading strategy

- Final thoughts

Risk Reward Ratio (RRR) is one of the most important concepts in forex trading. This is a tool used to measure the potential profitability of a trade by comparing the possible loss to the expected gain. Understanding and using the Risk Reward Ratio is key to good risk management and can greatly influence a trader’s long-term success.

The Risk Reward Ratio compares the level of risk in a trade with the potential reward. It helps traders decide if a trade is worth taking based on the risks involved. Using this concept makes it easier to make smart decisions and ensure trades fit in with wider financial goals.

Forex trading, which is known for its high volatility and potential returns, requires careful management of both risks and rewards. The risk-reward ratio is a basic metric that helps traders weigh the risk of a trade against the reward it could bring, making it easier to make calculated and informed choices.

What is the risk-reward ratio (RRR)?

The risk-reward ratio is a tool used to measure the relationship between the potential profit (reward) and the possible loss (risk) in a trade. It is calculated by dividing the expected reward by the anticipated risk. For example, a risk-reward ratio of 1:2 means that for every unit of risk, two units of profit could be earned.

Managing risk effectively is essential in the forex market, and the risk-reward ratio plays a vital role in deciding if a trade is worth taking. By understanding this ratio, traders can aim for a balance between the risk taken and the potential gains, which is crucial for long-term success.

Key factors are in calculating the RRR

Several key factors are involved in calculating the risk-reward ratio in forex trading:

- Entry price: This is the price level where a trade is started, whether buying or selling a currency pair. It marks the point where the market offers a good opportunity to enter the trade.

- Risk: This refers to the maximum amount a trader is willing to lose on a trade, often expressed as a percentage of the overall account balance.

- Take profit: The take-profit level is the price at which a trader plans to exit a profitable trade, reaching the set profit target.

- Stop-loss: The stop-loss order is crucial for managing risk, as it automatically closes the trade if the market moves too far against the trader, limiting potential losses.

- Lot size: This is the number of currency units being bought or sold in a trade. Lot size affects the risk-reward ratio, as a larger lot size increases both potential profits and potential losses.

Formula for Risk-Reward Ratio

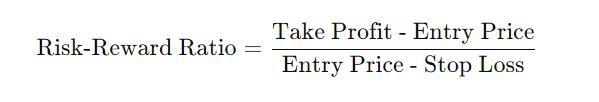

The formula to calculate the risk-reward ratio is:

This calculation gives a ratio showing how much profit could be made compared to the possible loss. If the ratio is higher than 1:1, the potential reward is greater than the risk, making the trade more appealing.

Managing risk and reward in forex trading

In forex trading, two important tools for managing risk and reward are stop-loss and take-profit orders. These allow traders to set specific points where a trade will automatically close, either to lock in profits or to limit losses.

The stop-loss order helps protect capital by making sure losses do not go beyond a set level. On the other hand, a take-profit order ensures that gains are secured before the market can reverse. Used together, these tools support a good risk-reward ratio, which is crucial for staying profitable.

Importance of position sizing in forex trading

Position sizing involves deciding how much capital to risk on a trade, based on both the risk-reward ratio and the trader’s level of risk tolerance. It is a crucial part of risk management as it helps to limit risk while aiming to maximise potential returns.

For example, if a trade has a risk-reward ratio of 1:3, it means that for every unit of risk, three units of profit could be earned. If a trader is willing to risk 1% of their account, the position size would be calculated to align with this ratio, ensuring effective risk management.

Calculating the reward-risk ratio

To calculate the reward-risk ratio, the entry point, take-profit target, and stop-loss level must be identified. The formula then provides the ratio between potential profit and possible loss. A good reward-risk ratio usually falls between 1:2 and 1:3, meaning the potential reward is at least twice the risk.

For instance, if the stop-loss is set at 50 pips and the take-profit target is 150 pips, the reward-risk ratio is 1:3. This indicates that the potential reward is three times greater than the possible loss, presenting a favourable trade opportunity.

Importance of the risk-reward ratio

The risk-reward ratio is a vital tool for traders, offering several key benefits:

- Informed decision-making: Calculating the risk-reward ratio enables traders to make well-informed choices about whether a trade is worth taking.

- Consistent profitability: A favourable risk-reward ratio ensures that profits can outweigh losses over time, even if some trades are unsuccessful.

- Capital preservation: A good risk-reward ratio reduces the amount of capital needed to generate profits, helping to protect investments while still seeking gains.

- Stress reduction: Knowing the potential risk and reward in advance lowers the emotional strain of trading, promoting a more strategic approach.

- Prevention of over-trading: A clear understanding of the risk-reward ratio helps avoid unnecessary risks, thus preventing over-trading.

Finding the best risk-reward ratio for a trading strategy

Creating a successful trading strategy involves more than just knowing the risk-reward ratio. It also requires careful consideration of factors like market conditions, volatility, and personal risk tolerance. The following steps can help find the best risk-reward ratio for a strategy:

- Define trading goals: Before creating a strategy, it is vital to set clear trading goals. These goals will help determine the right level of risk to take.

- Assess market conditions: Evaluating current trends, volatility, and potential risks in the market is essential for finding the best risk-reward ratio.

- Determine stop-loss and take-profit levels: Setting these levels at strategic points ensures that trades maintain a favourable risk-reward ratio. The stop-loss should protect against excessive losses, while the take-profit level should secure profits.

- Analyse historical data: Reviewing past performance can offer valuable insights into the average gains and losses from trades, helping to refine the risk-reward ratio.

- Test the strategy: Backtesting the strategy using historical data is crucial for understanding its profitability and risk-reward ratio in different market conditions.

Final thoughts

The risk-reward ratio is an important concept in forex trading that helps manage risk and increase profitability. By calculating the potential profit compared to the potential loss, traders can make better decisions about which trades to take and how to manage their risk.

Using stop-loss and take-profit orders, careful position sizing, and a good understanding of the market environment allows traders to use the risk-reward ratio to improve their overall trading strategy. The balance between risk and reward is vital for long-term success in forex trading, enabling traders to achieve consistent returns while minimising the risk of losses.

Key Takeaways

- The risk-reward ratio is a comparison between potential profit and possible loss, helping traders decide if a trade is worth the risk.

- A good risk-reward ratio, often set at 1:2 or 1:3, helps manage risks while aiming for higher returns.

- Stop-loss and take-profit orders are essential tools for managing risk and securing profits.

- Position sizing ensures that risk is controlled while maximising potential rewards.

- By calculating and applying the risk-reward ratio, traders can support long-term success and consistency in forex trading.

Read More:

how to handle online loan harassment

how to get personal loans with income verification?

Himani Verma is a seasoned content writer and SEO expert, with experience in digital media. She has held various senior writing positions at enterprises like CloudTDMS (Synthetic Data Factory), Barrownz Group, and ATZA. Himani has also been Editorial Writer at Hindustan Time, a leading Indian English language news platform. She excels in content creation, proofreading, and editing, ensuring that every piece is polished and impactful. Her expertise in crafting SEO-friendly content for multiple verticals of businesses, including technology, healthcare, finance, sports, innovation, and more.