US employment growth cooled more than forecast in March, as the economy failed to add more 200,000 jobs for the first time in over a year, payrolls processor ADP reported on Wednesday.

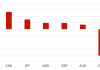

Employers added 189,000 nonfarm payrolls last month, after adding 214,000 in February. A median estimate of economists called for a gain of 225,000 in March.

The goods-producing sector added only 5,000 jobs, down from 22,000 in February. The construction sector added 17,000 payrolls, while manufacturing shed 1,000 jobs.

Employment in the service economy slowed to 184,000 in March from 192,000 the previous month. Employment in professional and business services increased by 40,000, while trade, transportation and utilities added 25,000. Employment in financial activities grew by 16,000, ADP figures showed.

“March job gains came in under 200,000 for the first time since January of last year,” said ADP president and chief executive officer Carlos Rodriguez. “The decline was centered in the largest companies, those with 1,000 or more employees.”

Companies employing more than 1,000 workers added just 12,000 jobs last month. Most of the gains were concentrated in small businesses employing fewer than 49 workers.

Added Mark Zandi, chief economist at Moody’s Analytics, “Job growth took a step back in March. The fallout from the collapse in oil prices and surge in value of the dollar is hitting the job market. Despite the slowdown, underlying job growth remains strong enough to reduce labor market slack.”

The ADP report comes just two days ahead of the government’s official nonfarm payrolls report. The Labor Department on Friday is expected to show the addition of 244,000 jobs in March. The unemployment rate is expected to hold steady at 5.5%, a more than six-and-a-half year low.

In a separate report today the Institute for Supply Management said US manufacturing activity cooled more than expected in March, which partially explains the sudden drop in manufacturing employment. The ISM manufacturing PMI fell to 51.5 from 52.9, as ten of the 18 manufacturing industries reported growth.

US economic growth is forecast to remain subdued in the first quarter after the economy grew at an annual rate of 2.2% in the fourth quarter. The economy is expected to rebound in the second quarter, as more plentiful jobs and fuel savings boost consumer spending.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading