The North American currency pair back was on its heels Monday, as rebounding energy prices and better than expected Canadian housing starts supported the Canadian dollar.

The USD/CAD declined more than half a percent to 1.2454. Initial support is likely found at 1.2417 and resistance at 1.2589.

The pair rebounded on Friday after the United States Department of Labor said nonfarm payrolls rose by 257,000 in January, following upwardly revised gains of 429,000 and 329,000 in November and December, respectively. The unemployment rate edged up slightly to 5.7 percent from 5.6 percent as more people entered the workforce, while average earnings rose at the fastest rate in six years.

The stronger than forecast report sent the US dollar surging and supported expectations the Federal Reserve could signal for higher interest rates by midyear. Speculation about a midyear rate hike had cooled in recent months amid sluggish domestic growth and global volatility.

The loonie received a boost on Monday after the Canadian Mortgage and Housing Corporation reported stronger than forecast housing starts in January. Canadian housing starts rose to a seasonally adjusted annual rate of 187,300 in January, up from 177,600 in December and compared with expectations for 177,500.

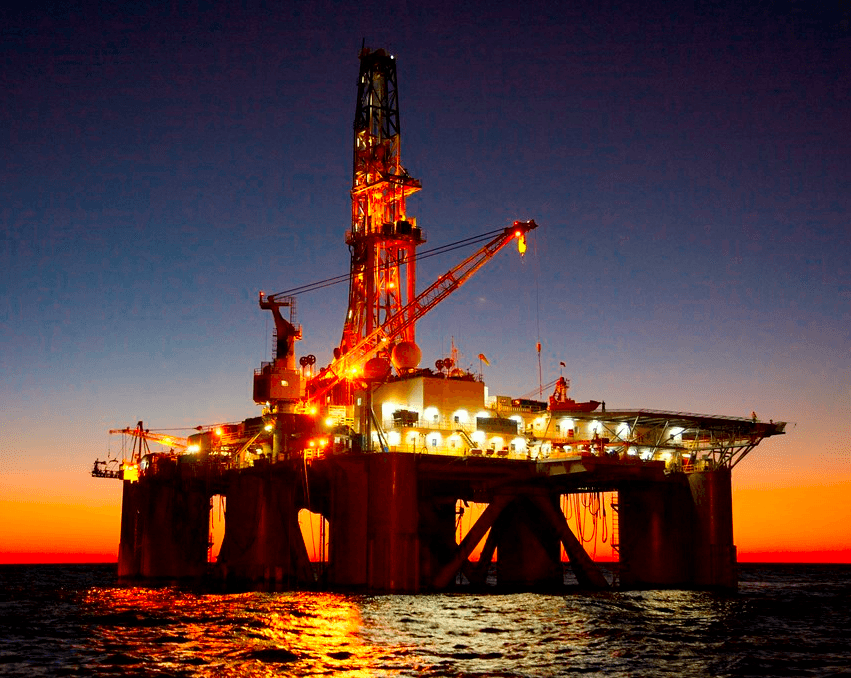

Rebounding energy prices also helped shore up the Canadian dollar. Crude prices advanced for a third day, as West Texas Intermediate for March delivery rose $1.46 to $53.15 a barrel. Global benchmark Brent crude jumped 43 cents to $58.23 a barrel.

The USD/CAD faces further upside in the short- and medium-terms, as the market continue to price in a much lower Canadian dollar. The loonie’s prospects have been shattered over the last seven months, in part by declining commodity prices but also because of a weaker domestic economy. Canada’s gross domestic product is expected to increase just 1.5 percent in the year through June, according to the Bank of Canada’s said last month. That’s nearly 1 full percentage point below the Bank’s previous forecast.

The BOC joined a growing list of central banks to cut interest rates in January. The Bank reduced its target for the overnight rate by 25 basis points to 0.75 percent. That was the first rate adjustment since September 2010. According to analysts, the BOC could slash interest rates by another 25 basis points by midyear to cope with weak energy prices and deflationary pressures.

Canadian consumer prices declined 0.7 percent in January, as annual inflation slowed to 1.5 percent from 2 percent.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading