The payments tech space remains hot as several venture capital (VC) investors ranging from Sequoia Capital to Tiger Global Management to Ribbit Capital continued to grab a piece of this massive industry, says GlobalData, a leading and data analytics company.

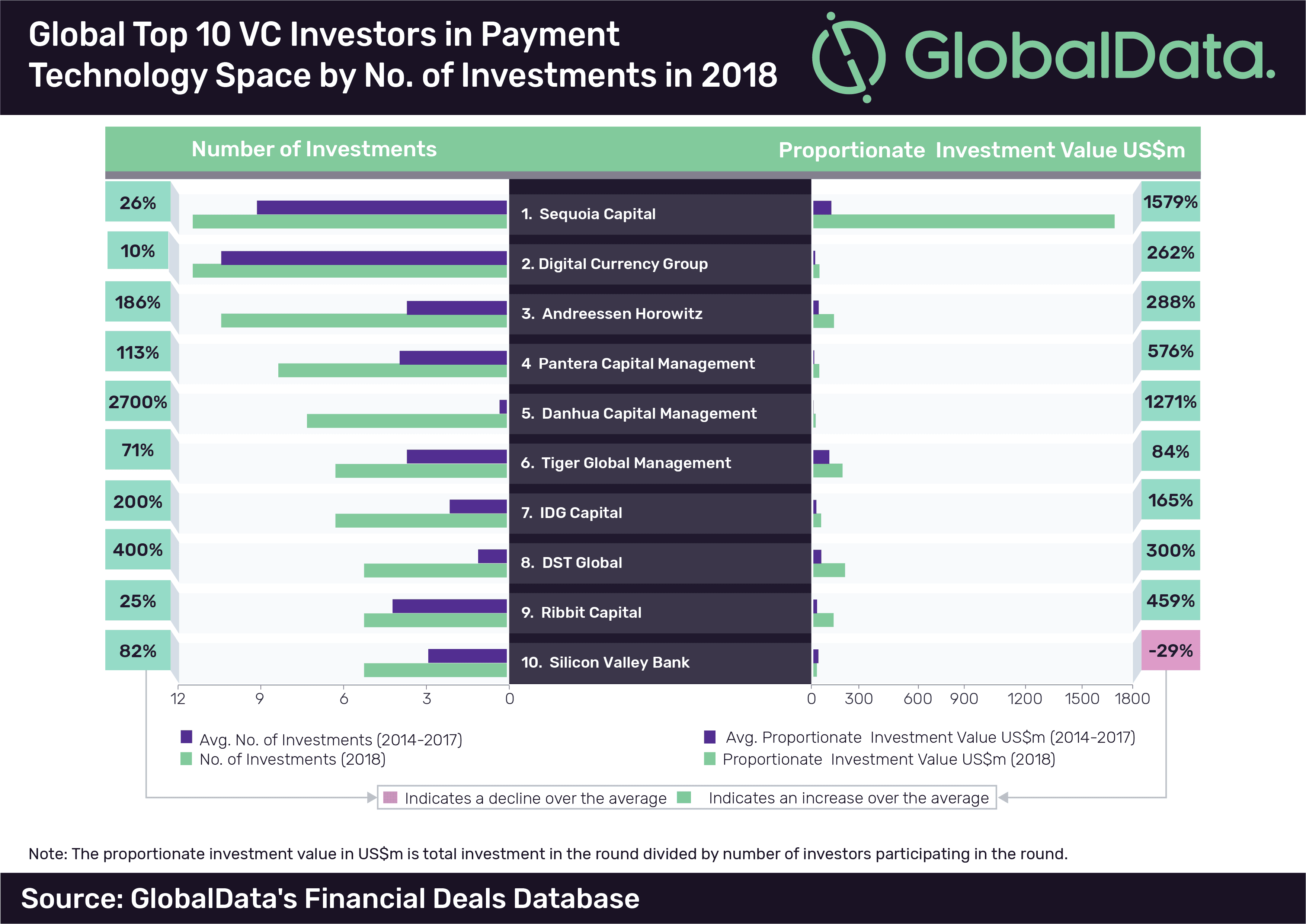

All the top 10 global VC investors (Sequoia Capital, Digital Currency Group, Andreessen Horowitz, Pantera Capital Management, Danhua Capital Management, Tiger Global Management, IDG Capital, DST Global, Ribbit Capital and Silicon Valley Bank) registered an increase in investment volume in the payment tech space in 2018 compared to the 2014-2017 average. On the other hand, all, except Silicon Valley Bank, reported increase in investment value.

Aurojyoti Bose, Financial Deals Analyst at GlobalData, says: “The increase in the investment volume and value by VC investors can be attributed to the growing buzz around digital wallets and online transactions.”

The top 10 VC investors participated in more than 70 funding rounds in 2018 compared to an average of around 40 funding rounds during 2014-2017. Total proportionate investments by these investors stood at around US$2.5bn in 2018 compared to an average of around US$355m during 2014-2017.

The spike in the investment value in 2018 can be majorly attributed to Sequoia Capital’s participation in US$14bn funding round for Ant Financial in June 2018, which is the single largest fundraising ever by a private company. Sequoia Capital has topped the list in terms of both investment volume and value in 2018.

Payment tech start-ups in the US accounted for around 50% of the total investment volume, distantly followed by China, which accounted for approximately 10%. However, China surpassed the US in terms of total investment value by a great margin in 2018. While China accounted for a whopping 70% share, the US accounted for around 18% share of the total investment value during the year. Interestingly, China’s share (of total investment value) falls to little more than 5% on excluding the US$14bn fundraising by Ant Financial.

Bose concludes: “Though China is catching up fast in the payment tech space and consistently closing the technology gap with its western counterparts, the US still remains the leader. Majority of the global top 10 VC investors investing in payment tech space are also headquartered in the US.”

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading