Policy 4.0., a global emerging technology think tank that combines engineering and policy disciplines, has launched a significant new study on the crypto contagion of 2022-23.

Analysis of the drivers of the contagion derives from a disjointed array of social media posts and legal disclosures. Many hypotheses and narratives exist about the causes, which may not necessarily be rooted in comprehensive analysis. However, it is important to understand the real drivers of the crisis if effective regulations are to be designed.

As its contribution to the debate, Policy 4.0. has led one of the first comprehensive research studies to analyze on-chain, off-chain and legal data around the events of the contagion. The findings from this study will contribute to a series of policy reports to be released in the coming months.

The first report in the series, titled Interdependencies in Crypto Ecosystems: Drivers, Implications and Policy Responses, launches today for public access via Policy 4.0. website. This study delves into one of the key findings from the research – that the contagion is transmitted not merely through large actors, but through what can be envisaged as “systemically important actors” in the crypto ecosystem. Interestingly, the most acute contagion impacts were felt, not because of the collapse of a large conglomerate such as FTX but because of the collapse of a much smaller hedge fund, Three Arrows Capital.

This has significant implications for regulatory approaches being actively formulated globally. Data shows that a paradigm shift has now manifested in the global crypto ecosystem, where akin to traditional financial systems, crypto markets have developed into networks of complex interrelationships between systems and significant market participants. While a lot of debate may focus on large visible actors, it is in fact, interdependencies in the cryptosystem that have played a much greater role in its fragility.

A second key takeaway is that while the contagion is being attributed to CeFi or Centralized Finance Institutions in crypto, the same risks, in fact, exist in DeFi systems as well. The report proposes a two-part classification of interdependencies in crypto – Institution-based and System-based and illustrates the same with detailed case studies.

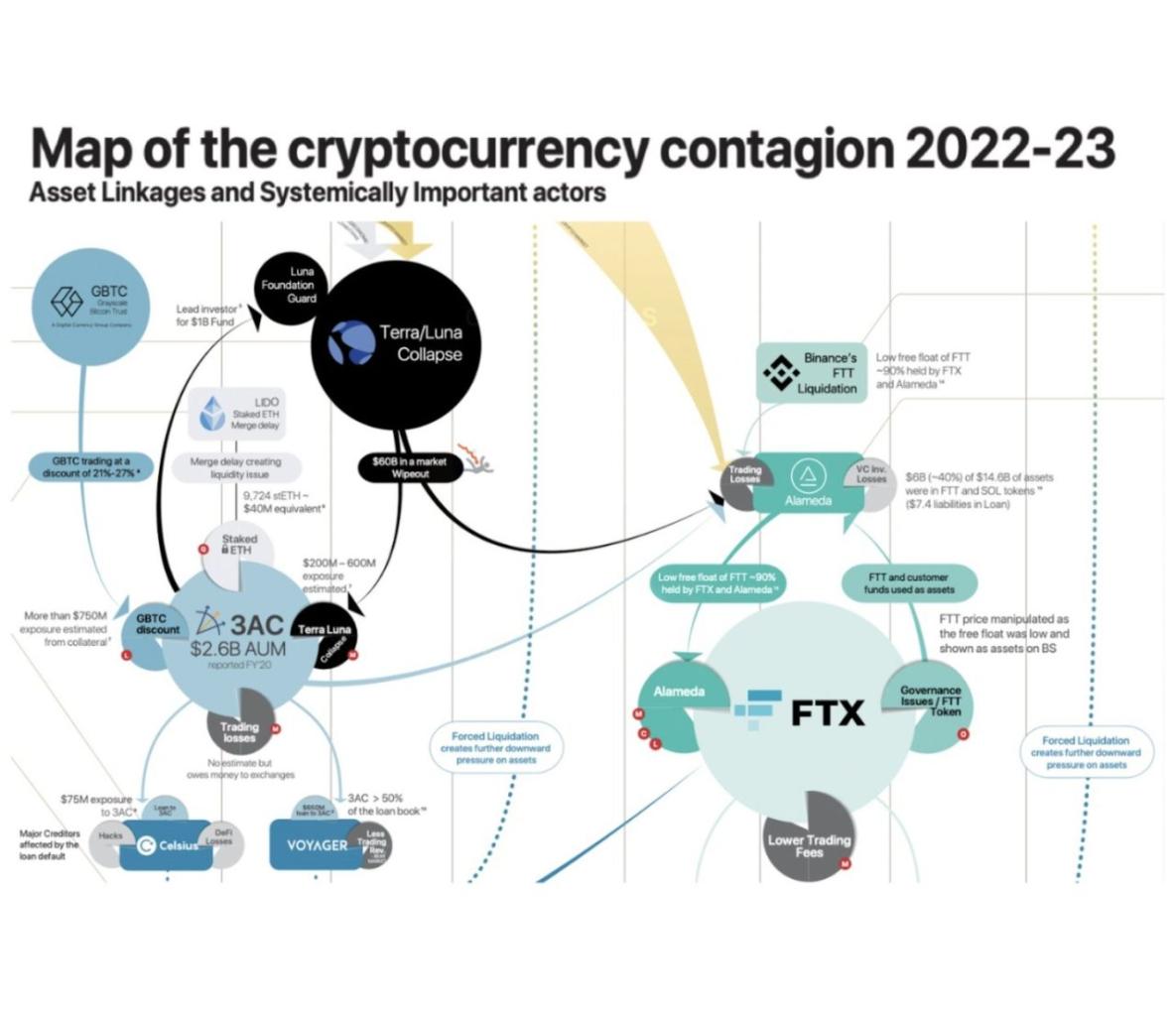

Apart from the case studies illustrated in the report, the researchers have developed a detailed visual map of the contagion, highlighting asset linkages in the form of credit, investment and asset management between players that were key to the collapse of the entities involved. These highlight clearly the diverse nature of interdependencies within the system.

The report concludes with recommendations to policymakers to focus on interdependencies and internal risk control mechanisms of crypto firms as a key focus of regulations. The report also throws new light on provisions being discussed in recent FSB, G20 and IMF recommendations on crypto assets.

Policy 4.0. is a unique new Bangalore-based think tank that combines engineering, policy, finance and legal expertise to develop innovative frameworks for emerging tech policy. Their past work includes a 4-part report series reverse engineering the eCNY, as well as an innovative technological solution to cryptocurrency regulation. Their board includes members of the Monetary Policy Committee of India as well as global and Indian financial regulation specialists.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading