The ongoing trade war between the US and China has paid its first toll. China’s assets and its currency have been buffeted while investors have shown growing concerns for China’s economic outlook. Trump’s protectionism does only but escalating, and now he is looking into applying trade tariffs to European products, which has been a traditional ally. Some emerging market shares, however, have been benefited by the trade clash between those giants and are flourishing.

We have brought Jaisal Pastakia, investment manager at Heartwood Investment Management, the asset management arm of Handelsbanken in the UK, to tradersdna to share his expertise about how emerging markets are thriving despite the trade war.

Here are his comments:

“Investor sentiment on emerging market assets is notoriously vulnerable to economic and geopolitical news flow. Little surprise then, that China’s assets (and its currency) have been buffeted by the ongoing trade dispute with the US, alongside related and wider concerns for China’s economic outlook.

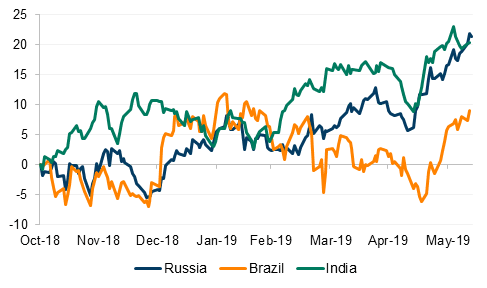

Elsewhere in the media spotlight, Indian assets have been performing well on the heels of Prime Minister Modi’s landslide general election victory. But away from the front pages, stock markets across a number of other emerging economies are also staging something of a resurgence. The Russian stock market reached new highs this month (in both local currency and US dollar terms), while Brazilian shares continue to trend higher. Smaller markets in Southeast Asia – Malaysia, Indonesia, Philippines – are enjoying similar bounces.

Past performance is not a reliable indicator of future results

Sentiment can change very quickly. However, stripping out the turbulence of the largest emerging market – China – investor sentiment on emerging markets currently appears to be holding up surprisingly well. Investor positioning matters too, though, and it is important to note that emerging market shares have not enjoyed convincing investor inflows since February this year. Going against the grain of investment market momentum can lead to interesting opportunities, but the strength of the US dollar plays a part in this picture too, and this is creating challenges for emerging markets at present. Nonetheless, we continue to see attractive underlying fundamentals and good value in emerging markets (both broadly and in specific countries), and maintain our slight overweight position in this space.”

Hernaldo Turrillo is a writer and author specialised in innovation, AI, DLT, SMEs, trading, investing and new trends in technology and business. He has been working for ztudium group since 2017. He is the editor of openbusinesscouncil.org, tradersdna.com, hedgethink.com, and writes regularly for intelligenthq.com, socialmediacouncil.eu. Hernaldo was born in Spain and finally settled in London, United Kingdom, after a few years of personal growth. Hernaldo finished his Journalism bachelor degree in the University of Seville, Spain, and began working as reporter in the newspaper, Europa Sur, writing about Politics and Society. He also worked as community manager and marketing advisor in Los Barrios, Spain. Innovation, technology, politics and economy are his main interests, with special focus on new trends and ethical projects. He enjoys finding himself getting lost in words, explaining what he understands from the world and helping others. Besides a journalist he is also a thinker and proactive in digital transformation strategies. Knowledge and ideas have no limits.