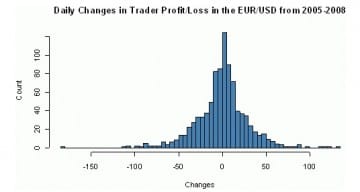

The increase in volatility in the forex market over the past few years has been something of a double-edged sword for traders. On one hand, it has increased the potential for profit, but it has also made it a much more risky business, especially for novice traders. This has led to a high ‘churn rate’ among inexperienced traders, with many giving up trading forex altogether due to big losses before they have had the opportunity to develop their skills properly. So why are so many trading strategies failing in the current markets?

The Secret of Money Management

One of the cornerstones of any money management strategy is to let your profits run while cutting losses short. The idea behind this is to make your profit targets bigger than your your loss thresholds. It sounds simple, but it’s not quite as easy as it sounds.

Two Strategies Compared

In order to explain what we mean by letting profits run and cutting losses, let’s look at two hypothetical trading strategies. The first is geared towards making profits on the majority of trades – which necessarily involves allowing loss-making trades to climb back into profitability. This means letting losses run, which exposes you to a big downside risk, but should give you a higher percentage of profitable trades. However, because this strategy also exposes you to the risk of outsize losses, one big loss could cancel out lots of smaller gains – which means that you’re more likely to end up with a net loss at the end of the trading month.

The second strategy is less concerned with making lots of profits, and is aimed squarely at making a few big profits and minimising losses. With this strategy, most of the trades will be likely to make losses, but because the average profit is substantially bigger than the average loss, the big wins cancel out these losses. Effectively, this strategy is focused solely on the bottom line, rather than relatively meaningless statistics such as win ratios. Obviously, it takes a lot more courage to adopt a strategy of this type, as you have to be able to stomach more losses and hold your nerve when in profit, but if employed effectively, it will be more likely to succeed than the first strategy in the long term.

The Bottom Line

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading