Will Brexit Create a Domino Black Swan Effect in Markets?

Brexit is a strange somehow seminal event, a black swan effect, a denial of globalization, and all the opposite the advanced open world defends. As it still develops is and will lead to a less predictable, stable, and effective policy framework in the UK, and as a domino effect to the EU and the world economy.

UK is getting exactly what it voted (a percentage of its population at least as in a full scale it was only less than 40% of the population, this if the 100% of its voters would have voted) for when it will move for an exit from the European Union.

In a time of AI, Blockchain and Fintech innovation the denial or reality shows the kind of cyber punk reality or of chaos society that UK the 5th, now 6th economy in the world is facing.

The UK is already hurtling toward a solid and uncertain recession and probably a deep schizophrenic fractured political landscape that now seems aiming towards the irreparable, and worryingly reminiscent of the 1930s years, that originated the Nazi ecosystem. It is also a cry wolf of a big part of the population that is struggling to understand what is going on around them. The world of the end of a work for life, precarious situation, delusion, nothing to loose and denial. And paradoxical of an elite that in order to get what they want don not care about destroying an entire economy and risk the global fragile sociology-political ecosystem.

All of this is not fear mongering, unfortunately, these are capital markets crashing, economic hedge facts. Independent of the developments that the situation is bring the alarming is trying to deny it and not realizing it is even more alarming… The paradox of this is the irrationality of the UK Tory driven government and the 52% voters that stubbornly seem to be so right that prefer to destroy the economy of decades in order to blame the status quo and the immigrants…

The global warnings were laid out repeatedly across a seemingly endless raft of worldwide non political reports, a big list of organisations that goes from the Treasury, to bank analysts, and independent research firms, statistics and think tanks. These predictions were dubbed “Project Fear” by the Leave camp that mostly could be branded project Hate or Blame Immigration, which suggested that such doom laden forecasts were designed to scare voters into submission to vote for the fragile status quo.

But the reality is that it is all coming very true. A big part of people were frustrated, “fed up of hearing from experts,” and got into a social hysteric paranoia and denial. Ironic that Google reported that one of the last days top search queries in its search engine is What is Europe.

But all this wilful ignorance, or arrogance in same cases, does not negate the socio, economic and politic events we are living, and the fact that all the warning signs were there in big, blaring neon lights. All those forecasts are now happening, and the question remains: is the worst yet to come?

Here goes a list of things happening and that no one in the world can ignore:

1. Domino Effect – this will define what is going to happen to all the fintech landscape as a whole. Finance innovation / finance technology can only thrive with a global financial strong landscape. With the Brexit vote wiping $3,010,000,000,000 value lost in global stocks since the #Brexit vote – source CNBC – off global stocks and has knocked the pound to 31-year low (source http://www.telegraph.co.uk/business/2016/06/24/brexit-vote-wipes-2-trillion-off-global-stocks-and-knocks-pound/) the most important now is to stop the domino effect and eventual Black Swans…. The division in UK politics and lack of preparation is not helping and unfortunately it will take time to clear all the instability;

2. AAA ratings downgrade: UK lost its AAA ratings and that will push the debt forward and a solid economic strategy is about stability and scale. Two major rating agencies downgraded the United Kingdom’s credit rating on Monday. S&P Global Ratings lowered the UK to AA from AAA, with a “negative” outlook. And, Fitch cut its rating to AA from AA+, with a negative outlook as well. The downgrades come following the UK’s surprise vote to leave the European Union last week.

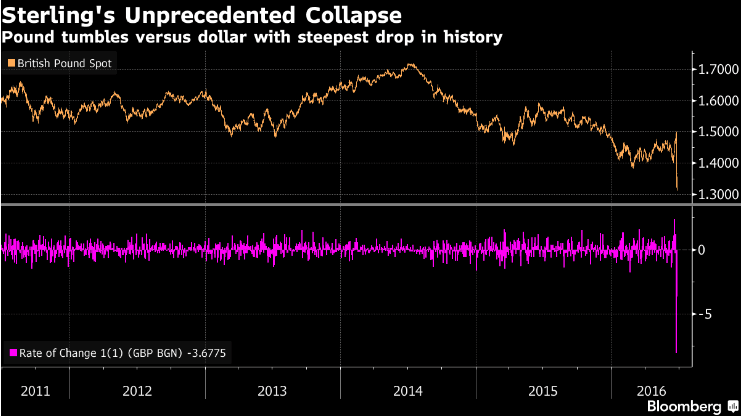

3. GBP Pound 30 years lowest: The pound is at its lowest against the dollar in 30 years. Increasing the cost of imports.

4. Cost of Borrowing. The irony is that in 4 days the UK lost as much money as in the last 5 years of austerity. With the ups of the cost of borrowing for UK Govt the wipes out is still in its beginning.

5. UK disintegration. The Ukas we know it will disappear: Scotland, North England and Gibraltar now want to continue in EU and Scotalnd wants to leave the UK. Which means England will be renegotiating as a smaller economic block

6. Denial by Politicians will increase social hysteria and markets volatility. The Leave team have already back tracked on both money saved from EU going to NHS and a block on EU iimmigration. Moreover the incidents with racist attacks are jumping in a country that so far has been quiet peaceful.

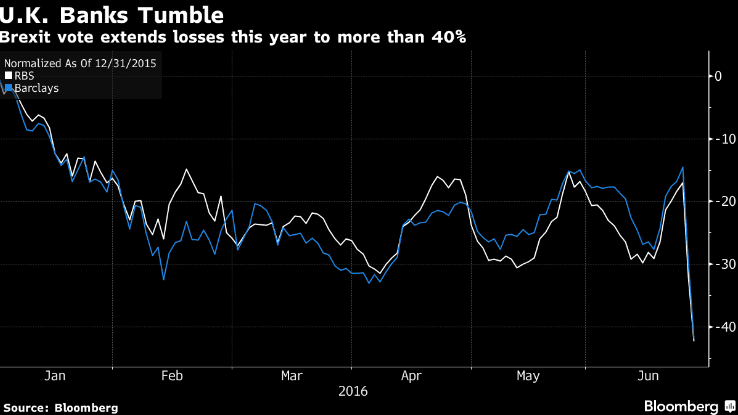

7. UK Banking System is collapsing. While Barclays and RBS stopped trading for today all the other major banks are already formally considering relocation to Frankfurt and Dublin. I work in this industry and can’t name names but you will hear in due course.

8. $2 some $3 Trillion wiped from the global stock market. Different sources announce / state that Brexit has wiped off $2 some $3 Trillion from the global stock market… The world economy is around $68 trillion so this is close to 5% of the world economy?

9. FTSE 7% fall. £140bn, that’s 7% fall, (greater than 2008 crisis) has been wiped off the FTSE 100 (the top 100 UK companies). The FTSE 200 a broader reflection of domestic economy is down 15%

10. US looses US special privilege. John Kerry has formally stated the UK is no longer going to be the US go to in Europe (as reported by the FT today).

11. Will London and UK loose all its momentum as a Fintech and tech emerging worldwide top capital? In the last 5 years the UK and special London emerged as a Fintech and tech emerging worldwide top capital. This might finish. Mark Cuban said recently in Bloomberg that US needs to attract the tech companies that are struggling with all the uncertainty. If Trump does not win I presume all big tech players will move to US as Bill Clinton when president was responsible for the biggest business / tech boom in US so I am assuming Hillary will be as good of even better; 4. Europe is struggling and due to the different regulations will have to fight to open its conservative laws and push entrepreneur spirit.

12. The entire world is more worried about the Brexit than its politicians. As the situation erupts the UK’s decision last week to leave the European Union is putting the global leaders alarmed. Markets around the world are distressed, people within the country are shocked, and people outside the country are wondering whether there’s a way to take it back and asking alarmed why in a global world something like this is happening.

13. China’s Brexit position. China has been no different and somehow strong in this circumstance. The Chinese government reaction to the Brexit has been powerful:

“Against the backdrop of globalization, it’s impossible for each country to talk about its own development discarding the world economic environment,” Chinese Premier Li Keqiang said at a World Economic Forum meeting on Monday.

13. Invest in Gold, Ethereum and Bitcoin?

Nouriel Roubini, one of the global leading economist at New York University at the World Economic Forum in China, described Brexit as “a major significant financial shock” that would create “a whole bunch of economic, financial, political and also geopolitical uncertainties”.

So be safe and wise out there!

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.