Although much of the chatter on the currency trading scene of late has concerned the Federal Reserve’s plans to scale back, or ‘taper’, their bond-buying monetary stimulus programme, there is a much bigger event on the forex horizon – the German elections.

Source: Wikimedia Commons

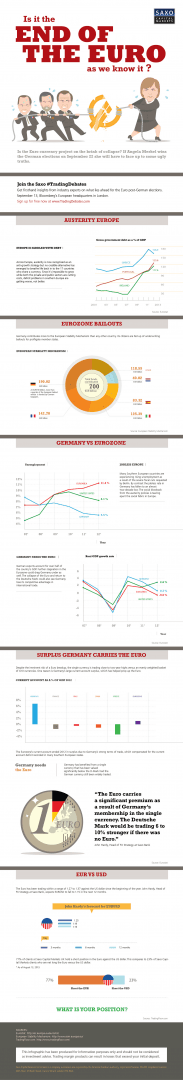

Throughout the Eurozone crisis, Germany has been the key player in efforts to keep the single currency together, with German Chancellor Angela Merkel being at the centre of all the efforts to keep things from boiling over. However, this has come at a cost, and it may not turn out to be a cost that the German public are happy to bear for much longer. As Europe’s strongest economy, only Germany has really had the clout and the financial wherewithal to sanction bailouts for profligate national governments such as those of Greece and Portugal. But no matter who wins the election, they will face a difficult situation in terms of the euro question afterwards, and here’s why:

Austerity Isn’t Working

In an effort to cut down on crippling sovereign debts, most European countries have adopted austerity programmes with sweeping cuts to public services. In many cases, these have been forced on countries such as Greece as a condition of receiving bailout funds from their European partners – particularly Germany. In theory, these should enable governments to bring down their debt to sustainable levels by cutting costs. However, in practice, these policies have given rise to fresh economic problems, cutting off growth when it is needed most. The recession across Europe has taken its toll on tax revenues, and the upshot of all this is that austerity programmes are not having the desired effect, and in most cases government debts are still on the rise.

But is there a better option? There simply isn’t the money available to bring government spending back to pre-crisis levels in the worst-affected countries, and in the absence of a credible alternative, it looks unlikely that the 17 countries that share a currency will be able to get their economies back on track any time soon.

Bailout Fatigue

The European Stability Mechanism is a fund set up to provide emergency funds for those member states that need them, and to date, over 700 billion euros have been contributed to the fund. Most of the funds have come from Germany, Italy, and France, with German taxpayers contributing over a quarter of the total, at over 190 billion euros. Naturally, the German taxpayers are getting a little tired of underwriting bailouts for profligate member states, and this is set to be one of the biggest issues – if not the biggest – at the forthcoming election.

Source: libcom.org

Rising Unemployment in Southern Europe

While the jobless rate in Germany has recently fallen to a two-decade low, the rate for Europe as a whole has been steadily increasing since 2008, largely as a result of harsh austerity policies requested by the German government. This has caused huge social problems, particularly in Greece, where there have been riots in the streets, and if this trend continues the Eurozone could become politically as well as economically unstable.

Why Does Germany Need the Euro So Badly?

There is a widespread perception that Germany, along with its key partners in the Eurozone Italy, Spain, and France, is clinging to the euro for ideological, rather than practical reasons. What is often glossed over is the fact that Germany gets a huge economic benefit from being part of the euro, and this is the main reason why they have been willing to go to such great (and expensive) lengths to keep it together. If the euro collapsed, and Germany went back to using the Deutsche Mark, they would lose their competitive advantage in international trade.

“The Euro carries a significant premium as a result of Germany’s membership in the single currency” said John Hardy, Head of FX Strategy at Saxo Bank in an infographic that can be viewed at the end of this article “The Deutsche Mark would be trading 6 to 10% stronger if there was no Euro”

The fact that the euro is undervalued with regards Germany’s economy in isolation has given them a big advantage in terms of being able to provide cheaper exports. With exports accounting for over 50% of German GDP, further stagnation, or even a total break-up of the Eurozone, could see Germany dragged into the economic mire along with the rest of Europe. It is this prospect that makes Germany so concerned with the preservation of the euro, and the economic health of its Eurozone partners, rather than any ideological or philanthropic agenda.

German Surplus Keeping Euro Strong

In spite of the risk of an imminent break-up of the Eurozone, the euro itself has been gaining strength of late, trading at two year highs against a weighted basket of G10 currencies. One of the main reasons for this is Germany’s huge account surplus, which is enough to tip the Eurozone as a whole into current account surplus, despite all the other countries posting a deficit.

So What Could Happen?

With Chancellor Angela Merkel enjoying a healthy lead in the polls, there is a strong likelihood that she will be re-elected, but whether she will keep the country on its current trajectory regarding the Eurozone is another matter entirely. A big swing against her could reduce her parliamentary power, making it more difficult to push through further bailouts. However, if the bailouts end and the Eurozone breaks up, it could be potentially disastrous for Germany, pushing the prices of their exports up to uncompetitive levels, so it is unlikely that she would take such a step unless circumstances absolutely demanded it.

However, if her opponents win or form a winning coalition against her, there could be a dramatic shift in the direction of Germany’s European policies. This would make it far more likely that Germany would cease to bankroll the stability mechanism, which could lead to the collapse, or at the very least a dramatic scaling down of this institution. Without it, Southern and Eastern European states could go to the wall, forcing them out of the Eurozone, and probably paving the way for a complete abandonment of the single currency project.

Another possible outcome could be that Germany leaves the euro and re-adopts the Deutsche Mark, which would reduce government expenditure significantly, but this would be counterbalanced by a dramatic drop in the export trade. Without Germany, the whole euro project would most likely collapse, with potentially disastrous consequences across Europe, especially in the short term. So, it’s a very tense time for Europe, and potentially a very interesting time for currency traders, as whatever the result of the election, it’s bound to be a pretty major market mover when it comes to currency pairs involving the euro.

The End of the Euro As We Know It? An Infographic from Saxo Capital Markets

As part of the campaign for the forthcoming Saxo Bloomberg #Tradingdebates in London, Saxo Capital Markets have prepared an infographic detailing many of the issues we have discussed here. For more information, or to register for the upcoming event, visit the #TradingDebates web page.

Tradersdna is a leading digital and social media platform for traders and investors. Tradersdna offers premiere resources for trading and investing education, digital resources for personal finance, market analysis and free trading guides. More about TradersDNA Features: What Does It Take to Become an Aggressive Trader? | Everything You Need to Know About White Label Trading Software | Advantages of Automated Forex Trading