After over $1 Trillion was wiped off wlobal Stock Markets wince wonday and $3.2 trillion has been wiped off global stock markets(!) last year alone. What’s Next?

The reality is we are in one of the most strange financial crisis in history a crash in a world of super advanced algorithm technology, the emergence of alternative finance driven by fintech and new digital currencies, and abundance of resources. But at the same time we are in a serious reality of a financial volatile ripple that has made $3.2 trillion wiped off global stock markets so far this year. Last week $1,2 Trillion…

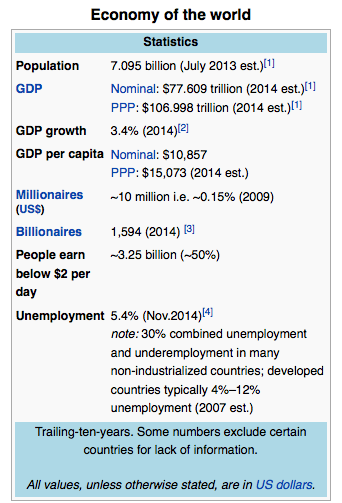

If the GDP (official exchange rate) in 2014 was estimated in around $77.609 trillion, and the PPP estimated in $106.998 trillion (source Economy of the world Wikipedia). So how much is the world debt?

From Wikipedia

Jeff Desjardins at Visual Capitalist broke down how much of the world’s sovereign debt each country holds. The biggest chunk of the $60 trillion in debt belongs to the US, which holds 29.05% of all of it as of 14 Aug 2015.

Europe has a high frequency of large debts, with 7 of the top 15 countries coming from the continent, Desjardins has noted. This was 2015! These numbers have now been climbing since the last months due to the growing size if the Chinese debt and emergent markets.

$60 Trillion of World Debt in One Visualization, visualcapitalist.comThis scenario and scary numbers explains why we are in this critical financial situation. The ratio of GDP and debt are almost the same…

With this in mind the dramatic crash in markets in the last weeks pushed by the accelerated drop oil prices, the big debt of central banks, (ironically trying to stop this debt while creating more debt) and all its ripple effects have returned with a bigger vengeance and now the question is: are we already in a massive financial crisis / crash? Or are we in the middle of a complex paradox black swan that this time a lot of people saw, but cannot understand?

Saxo Bank economist Steen Jakobsen added recently: “This week may go down in financial history as the week when central bank planning died – the 2016 version of the fall of the Berlin Wall.”

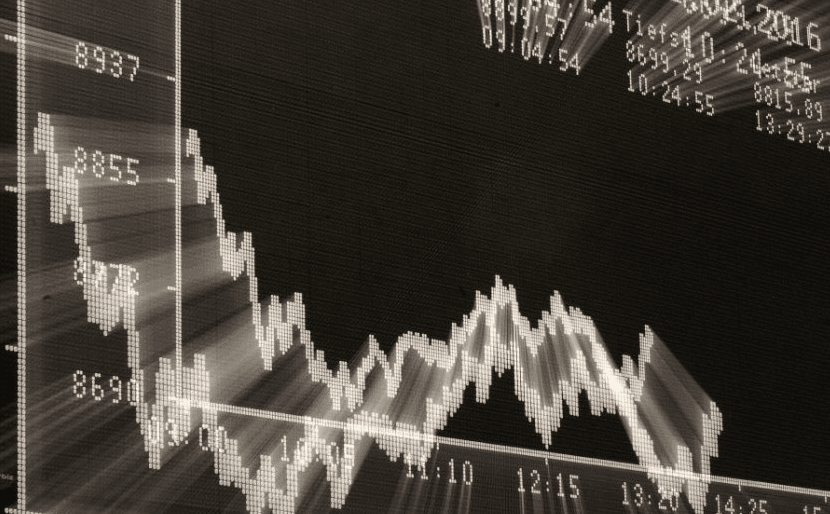

As Trading floors throughout the world continue overwhelmed by the last days events, and investors continue pulling cash out of risky assets stock markets plunging further into the red, the question is now what?

If the significant $1.2 trillion that was wiped off the value of global equities since the start of the week of 9th to 13 of February continues, will banks survive under all the pressure and bearing the brunt of widespread concern that another crash or massive recession could be on the cards. This time is even bigger than 2008… The problem now is that everyone is seeing somehow the film… And the day after the next Valentine’s day will be a critical question mark day about what’s next?

The continuation of financial events advances with London FTSE 100 have dropped to its lowest level in the last three years and ripping £35 bIilion in the process. To increase to this the dimension of all of this in Europe shares that sank to a two-and-a-half year low.

Are we going in the direction of one of the major financial crisis in history? It is not necessary a black swan this time as it seems everyone is looking at it. What is strange is the lack of concrete action / solutions to stop the events, that now are rolling in a powerful snow ball, and the important question is how different financial organisations, economists, central banks, investors and traders are lost when looking at what is happening at their eyes!

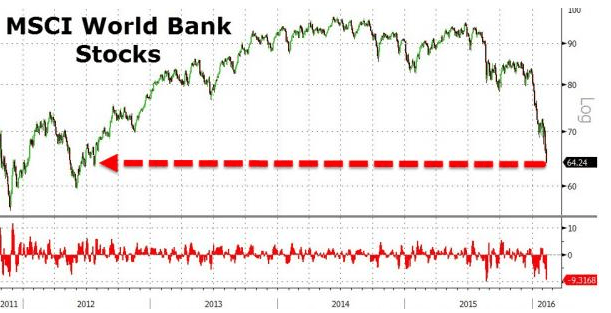

Some macro data that reveals the scale of this:

- European Banks are down 6.8%.

- Soc Gen is down 14.5%.

- Deutsche Bank is down 9.3% and is a major focus of the market’s concerns.

- Credit Suisse is down 17.7%.

- StanChart is down 14.7%.

- Credit Suisse fell to levels last seen in 1989.

- Gold hit a year high of about $1,235 an ounce.

- Nikkei index suffers worst plunge since 1987

In the US and EU the question that arises is: has the Fed, the ECB and now the Chinese central bank painted itself into a corner with all the quantitative easing, and sophisticated efforts to stop the bleeding? The fact so far is that the gambling did not work! and now what?

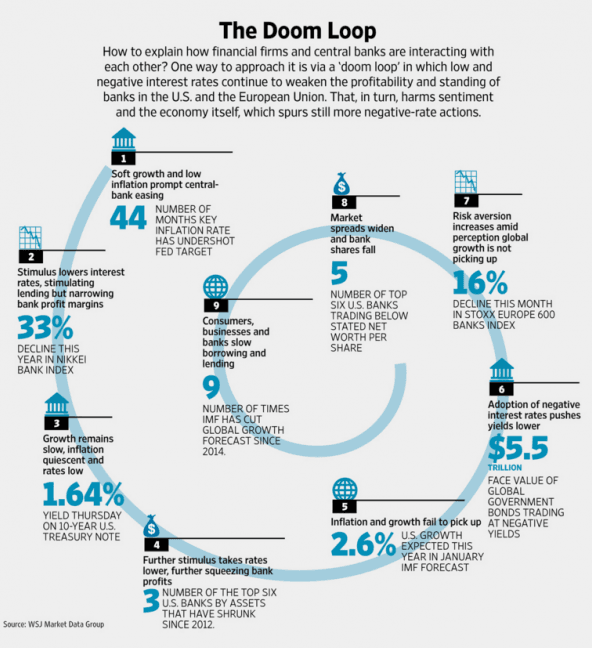

The international community of economists and market analysts are divided between austerity and different medicines, and now are suggesting among other things that policymakers, who really want to get on with the process of bringing interest rates back to a normal level, just won’t be able to do the deed as the financial events continue in its bear negative scale. So what is the solution for this Doom Loop (as the WSJ put it)?

The bellow graphic by WSJ explains the ripple effect of the Doom Loop we are seen some kind of black hole. Some kind of the sound of financial black holes colliding away, in a fleeting chirp that replicates the recent fulfilled last prediction of Einstein’s general theory of relativity.

On the top of this this week economists at BNP Paribas added to this questions in a research note that they do not expect any additional rate increases from the Fed at all in 2016 – nor in 2017. They stated:

“We see the Fed as trying to manage a retreat in an orderly fashion, while hoping for the best,” the economists wrote. “We do not think the best will materialize.”

All the global macro date and stats are affirming that there is something big going on, from the deeper pain, almost scary fragility in emerging markets (Brazil and Venezuela already on the edge, Russia on the financial knees, Africa struggling with the oil prices and USD dependency) to further easing from other major global central banks, all of this conspiring against the Fed, the ECB and other global banks.

China is now a critical element contributing for the global selloff as investors are caught in a loop of worry over one of the world’s biggest growth engine. In the last months the situation has been worsening and it does not seem to have an end as Chinese authorities struggle to stop the hemorrhage. What’s different from the last crisis of 2008 is the scale of the debt and the fact that no global power driver of the economy is in a healthy situation. This all factors which reflect the massive size of China’s economy in the global markets and its unpredictability… And the critical question for the global economy, however, is how China will come with this?

We are on the verge, some say on the border of a precipice of what can only be described as a rising systemic risk for all global markets. In the last crisis China was not in the boat. Now China is picking (or leading) the boat of debt and other systemic issues.

The Fed and the ECB now hint that banks should prepare for NEGATIVE INTEREST RATES. Will this action undermine the entire world economy in its run for something quiet scary?

The increasingly unstable footing that the world financial markets are standing on is reflected in the follow up of quantitative easing and the follow up widening credit spreads that demonstrate that CONFIDENCE can collapse. And trust is the key element for economy!

Is the solution a global effort to find an unified solution and ASAP? But that obliges global organisations and financial players to start working seriously together and be less divisive. And someone needs to start it NOW. But the solution is not to continue printing more money. With this, during the last week the central banks lost their market credibility… And as proved in history you cannot print fake money if it does not exist. At a certain point we are publishing garbage as money, and someone still needs to pay the real bills.

Should we start looking at Bitcoin as a commodity as so far is not controlled by central banks?… Go back to Gold and precious metals? History repeats itself but the solution is really to start looking at a solution for the global economy that uses reality and not local solutions for global fundamental issues… Special not face the problems as an united front.

Ironically we are still in a time of abundance and the World Bank Forecasts Global Poverty to Fall Below 10% for First Time in history of mankind… As the number of people living in extreme poverty around the world fell to under 10 percent of the global population in 2015. And more, according to World Bank projections released a quarter-century-long sustained reduction in poverty is moving the world closer to the historic goal of ending poverty by 2030.

As ZeroHedge put it recently and looking at the WSJ graphs, it seems that we are on step 8 in WSJ’s doom loop…the step 9 is when things really start to go very, very south for the real economy.

So the question is how can we fix the global financial markets from trading fake money and not let that fake money destroy the real economy and all its good / positive things.

So be careful out there. Safes trades and Investments!

Dinis Guarda is an author, academic, influencer, serial entrepreneur and leader in 4IR, AI, Fintech, digital transformation and Blockchain. With over two decades of experience in international business, C level positions and digital transformation, Dinis has worked with new tech, cryptocurrencies, drive ICOs, regulation, compliance, legal international processes, and has created a bank, and been involved in the inception of some of the top 100 digital currencies.

Dinis has created various companies such as Ztudium tech platform a digital and blockchain startup that created the software Blockimpact (sold to Glance Technologies Inc) and founder and publisher of intelligenthq.com, hedgethink.com, fashionabc.org and tradersdna.com. Dinis is also the co-founder of techabc and citiesabc, a digital transformation platform to empower, guide and index cities through 4IR based technologies like blockchain, AI, IoT, etc.

He has been working with the likes of UN / UNITAR, UNESCO, European Space Agency, Davos WEF, Philips, Saxo Bank, Mastercard, Barclays and governments all over the world.

He has been a guest lecturer at Copenhagen Business School, Group INSEEC/Monaco University, where he coordinates executive Masters and MBAs.

As an author, Dinis Guarda published the book 4IR: AI, Blockchain, FinTech, IoT, Reinventing a Nation in 2019. His upcoming book, titled 4IR Magna Carta Cities ABC: A tech AI blockchain 4IR Smart Cities Data Research Charter of Liberties for our humanity is due to be published in 2020.

He is ranked as one of the most influential people in Blockchain in the world by Right Relevance as well as being listed in Cointelegraph’s Top People In Blockchain and Rise Global’s The Artificial Intelligence Power 100. He was also listed as one of the 100 B2B Thought Leaders and Influencers to Follow in 2020 by Thinkers360.