Last week we saw the expected de-escalation in the Iran – Israel war and a risk on rally ensued.

The Yen had sharp sell off. Firstly, the BoJ kept rates unchanged, and a dovish tone then compounded the fall closing the week through 158.

The dollar ended the week roughly flat with the DXY closing around 106.

In commodity currencies Aussie was the strongest. The AUD had a good week as strong domestic and inflation data buoyed the currency but also renewed optimism for the China recovery story. Data wise strong PMI’s gave optimism for GDP Q2 growth and a good week in Hong Kong stocks gave the positive sentiment and if this turns into a stable trend the AUD should see further upside.

Both Euro and Pound had relatively quieter weeks. The GBP performed well against the JPY and USD while the Euro had little data to spark interest. The ECB is still looking towards the summer before any rate cuts will be considered.

Oil continued its volatility with large intra week swings. The end of the week WTI close 1.9% higher.

Next week the market will be looking at the JPY to see if the collapse continues. We would expect a short terms reversal, but it is where the trend settles.

Data wise it is a busy week with FOMC and Non-Farm Payrolls as May rolls in.

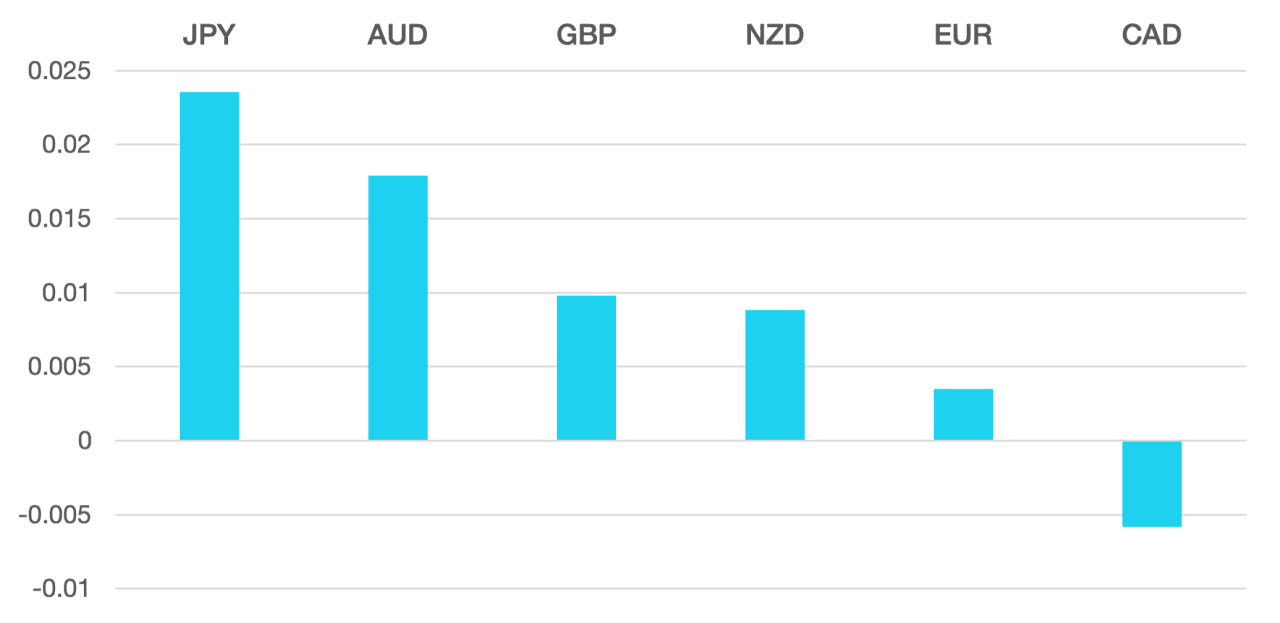

Weekly Majors’ Market Performance

What is Cromwell FX?

Cromwell FX is a quantitative FX manager offering superior risk adjusted returns. The portfolio is the most liquid pairs . The strategy is fully automated and adhere to strict rick management procedures to control leverage and position limits.

The post Yen Collapse; FOMC in Focus first appeared on trademakers.

The post Yen Collapse; FOMC in Focus first appeared on JP Fund Services.

The post Yen Collapse; FOMC in Focus appeared first on JP Fund Services.